PVC: Futures ended sideways and made a slight breakthrough. 01 significantly reduced positions, and the spot market recovered slightly.

PVC futures analysis: December 15 V2401 contract opening price: 5820, highest price: 5923, lowest price: 5819, position: 370159, settlement price: 5871, yesterday settlement: 5826, up: 45, daily trading volume: 561050 lots, precipitated capital: 1.532 billion, capital outflow: 233 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 12.14 |

Price 12.15 |

Rise and fall |

Remarks |

|

North China |

5580-5650 |

5600-5650 |

20/0 |

Send to cash remittance |

|

East China |

5700-5770 |

5730-5800 |

30/20 |

Cash out of the warehouse |

|

South China |

5750-5820 |

5800-5840 |

50/20 |

Cash out of the warehouse |

|

Northeast China |

5550-5700 |

5550-5750 |

0/50 |

Send to cash remittance |

|

Central China |

5690-5710 |

5690-5710 |

0/0 |

Send to cash remittance |

|

Southwest |

5550-5630 |

5550-5630 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices rose slightly, the reappearance of Red Friday. Compared with the valuation, it rose 20 yuan / ton in North China, 20-30 yuan / ton in East China, 20-50 yuan / ton in South China, 50 yuan / ton in Northeast China, and stable in Central and Southwest China. Upstream PVC production enterprises ex-factory prices sporadically tentatively raised 20-50 yuan / ton, most enterprises still maintain stable prices and actively digest inventory, but there are not many contracts signed on Friday. Futures prices rose slightly, and prices offered by traders in various regions rose slightly compared with yesterday, but there is some room for negotiation, the supply of goods at low prices in the spot market has decreased, and the supply of goods at point prices has no price advantage for the time being. Basis adjustment expanded slightly, including East China basis offer 05 contract-(250-340), South China 05 contract-(150-200), North 05 contract-(530-550), Southwest 05 contract-(260). On the whole, the trading atmosphere in the spot market is not good, there is an appropriate amount of replenishment in the early stage of the downstream, and the actual transaction is rare.

From the perspective of futures: & the night market of the nbsp; PVC2401 contract is arranged in a narrow range, and the fluctuation range of the futures price is small and the direction is unknown. After the start of morning trading, futures prices rose slightly, forming a better upward breakthrough trend, and afternoon prices fluctuated relatively high during the day. 2401 contracts range from 5819 to 5923 throughout the day, with a price difference of 104. 01 contracts reduced their positions by 62902 positions, and so far they have held 370159 positions. The 2405 contract closed at 6058, with 537994 positions.

PVC Future Forecast:

Futures: PVC2401 contract futures transaction, in which the air flat 28.2% compared with the more flat 26.5%, the increase in the short price makes the futures price further up slightly. The trend of the futures price successfully ended the horizontal state of the week, the high point formed an upward trend of small breakthroughs, and the futures price was located between the upper tracks in the Bollinger belt. The technical level shows that the opening of the middle rail in the Bollinger belt (13, 13, 2) is upward, and the KD line and MACD line at the daily level show a golden fork trend. At present, the monthly difference of 01-05 contract is 147 points from the closing price. 05 contract position successfully surpassed 01 contract, but the main force has not changed. Overall, the operation of the futures price in the short term is observed. 01 contract above 5950 and 05 contract 6100 direction pressure.

Spot aspect: In our previous forecast, we also mentioned that from the medium-and long-term point of view of the 05 contract, both the futures market and the spot market should be expected slightly, but the market before the Spring Festival should be treated cautiously. First of all, the accumulation pool caused by the weak demand in the fourth quarter still makes PVC have weak fundamentals, which is also the fundamental reason why futures market funds can not be clearly diverted. Secondly, in the case of the prevalence of spot digestion point prices, hedging policies or constantly intervene in hedging in the case of favorable basis. In terms of information policy, the National Bureau of Statistics: the overall recovery of economic operation There will be no deflation. In answering a reporter's question, it is mentioned that the main expected targets for development for the whole year are expected to be well completed, and the real estate market situation is expected to further improve. In the outer disk, the price of international crude oil futures market rose as the Federal Reserve issued a signal that it might cut interest rates next year, dragging down the dollar, and the International Energy Agency (IEA) raised its forecast for global oil demand growth next year. On the whole, the spot market may continue to adjust slightly.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 12.14 |

Price 12.15 |

Rate of change |

|

V2401 collection |

5820 |

5911 |

91 |

|

|

Average spot price in East China |

5735 |

5765 |

30 |

|

|

Average spot price in South China |

5785 |

5820 |

35 |

|

|

PVC2401 basis difference |

-85 |

-146 |

-61 |

|

|

V2405 collection |

5982 |

6058 |

76 |

|

|

V2401-2405 closed |

-162 |

-147 |

15 |

|

|

PP2401 collection |

7459 |

7496 |

37 |

|

|

Plastic L2401 collection |

8052 |

8103 |

51 |

|

|

V--PP basis difference |

-1639 |

-1585 |

54 |

|

|

Vmure-L basis difference of plastics |

-2232 |

-2192 |

40 |

|

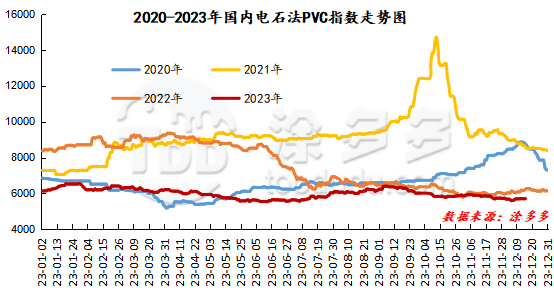

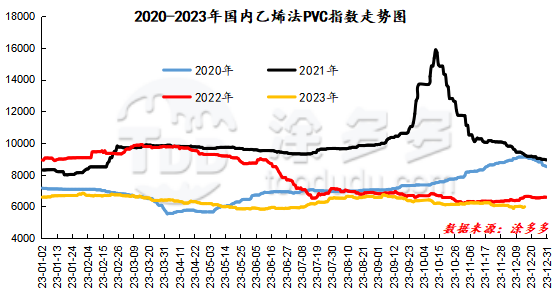

China PVC Index: according to Tudor data, the spot index of China's calcium carbide PVC rose 20.28, or 0.356%, to 5717.42 on December 15. The PVC spot index of ethylene method was 5984.53, up 48.2%, with a range of 0.812%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 267.11.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

12.12 warehouse orders |

12.15 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,892 |

1,892 |

0 |

|

|

Guangzhou materials |

850 |

850 |

0 |

|

|

China Central Reserve Nanjing |

1,042 |

1,042 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

584 |

584 |

0 |

|

|

Zhenjiang Middle and far Sea |

584 |

584 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,806 |

4,806 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,813 |

2,813 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,967 |

3,087 |

120 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

18,405 |

18,405 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,457 |

3,595 |

138 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

470 |

470 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,322 |

3,322 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

487 |

487 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

48,301 |

48,559 |

258 |

|

Total |

|

48,301 |

48,559 |

258 |

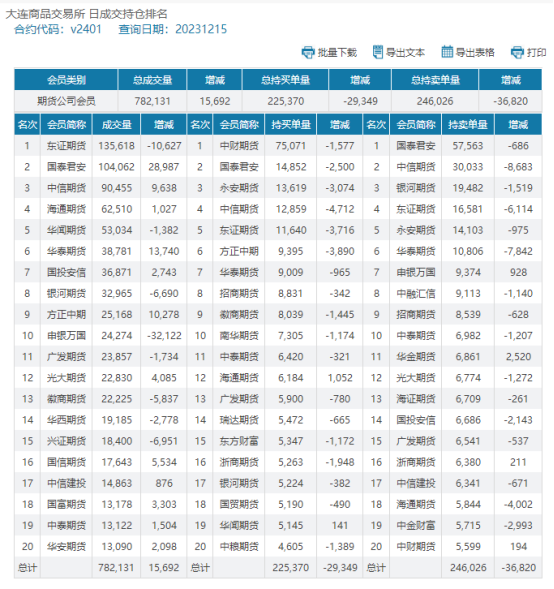

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.