PVC: The futures price wound around the middle track and closed at the negative cross star, significantly reducing positions, and sorting out the spot market range

PVC futures analysis: December 11 V2401 contract opening price: 5845, highest price: 5876, lowest price: 5786, position: 549383, settlement price: 5830, yesterday settlement: 5792, up: 38, daily trading volume: 551330 lots, precipitated capital: 2.242 billion, capital outflow: 150 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 12.8 |

Price 12.11 |

Rise and fall |

Remarks |

|

North China |

5580-5650 |

5610-5650 |

30/0 |

Send to cash remittance |

|

East China |

5680-5760 |

5680-5760 |

0/0 |

Cash out of the warehouse |

|

South China |

5780-5820 |

5780-5820 |

0/0 |

Cash out of the warehouse |

|

Northeast China |

5550-5700 |

5550-5700 |

0/0 |

Send to cash remittance |

|

Central China |

5690-5710 |

5690-5710 |

0/0 |

Send to cash remittance |

|

Southwest |

5550-5680 |

5550-5680 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price range is mainly sorted out, and prices in various regions are adjusted flexibly. Compared with the valuation, North China has increased by 30 yuan per ton, while East China, South China, Northeast, Central China and Southwest China are stable. Upstream PVC production enterprises mostly maintain stable ex-factory prices, individual enterprises slightly increase 50 yuan / ton, the first generation of contracts signed in the first generation of the week not many merchants wait and see. According to the narrow range of futures, the price offer of traders in various regions has changed little compared with last Friday, and the spot market low price has decreased. Both the overall market point price offer and the one-mouth price offer are available, including East China basis offer 05 contract-(210-260-320), South China 05 contract-(150-180), North 05 contract-(530), Southwest 05 contract-(260). Point price supply temporarily has no price advantage and poor shipping, downstream procurement enthusiasm is not high, the early low price period downstream appropriate replenishment, Monday market trading is not active.

From a futures point of view: the nbsp; PVC2401 contract opened slightly higher on Friday night and then gave up gains. Futures prices continued to weaken after the start of early trading on Monday, with a low of 5786 starting to fluctuate. The price rose slightly in the afternoon, but not by much. 2401 contracts range from 5786 to 5876 throughout the day, with a price difference of 90,01.The contract has reduced its position by 36413 hands and has held 549383 positions so far. The 2405 contract closed at 6007, with 401308 positions.

PVC Future Forecast:

Futures: & the operation of the futures price of the nbsp; PVC2401 contract as a whole around the middle track, closed with a negative column cross star, the 2401 contract continued to significantly reduce positions, changing positions for the arrival of the month, but the corresponding 01 reduced positions were not synchronously moved into the 05 contract, part of the funds left the market. Although the operating high point of the futures price formed a certain breakthrough on the basis of last Friday, but it closed at a low level at the end of the day, it can also be seen that the current market is running in the market of reducing positions and leaving the market, lack of certain clear guidance. The technical level shows that the three tracks of the Bollinger belt (13, 13, 2) narrowed, and the rebound formed by the operation of the futures price from the low point led to the emergence of this trend, and the two lines of MACD at the daily level crossed. On the whole, the operation of futures prices may still be relatively narrow in the short term, continue to observe the pressure performance in the direction of 01 contract 5900 and 05 contract 6050.

Spot aspect: early week spot market operation is relatively light, most merchants feedback shipments are not smooth, futures price fluctuations temporarily can not boost the spot market, coupled with the early downstream appropriate replenishment, which also caused the current prices of the two cities in a small rebound in the transaction has weakened. The current supply and demand level variables are still unable to stimulate the prices of the two cities, and the operating rate at the supply level has increased slightly, which further aggravates the pressure of spot digestion in the face of weak demand. There is no obvious volume on the demand side, and the inquiry enthusiasm of the recent export side has also decreased after the price rise. on the whole, the current factors in the two cities are not enough to support the sustained rise in prices. On the outer side, doubts about voluntary production cuts and concerns about future demand have pushed the price of crude oil to a six-month low. On the whole, in the short term, the spot market or the stage range after the rebound began to sort out.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 12.8 |

Price 12.11 |

Rate of change |

|

V2401 collection |

5833 |

5830 |

-3 |

|

|

Average spot price in East China |

5720 |

5720 |

0 |

|

|

Average spot price in South China |

5800 |

5800 |

0 |

|

|

PVC2401 basis difference |

-113 |

-110 |

3 |

|

|

V2405 collection |

6016 |

6007 |

-9 |

|

|

V2401-2405 closed |

-183 |

-177 |

6 |

|

|

PP2401 collection |

7468 |

7484 |

16 |

|

|

Plastic L2401 collection |

8057 |

8018 |

-39 |

|

|

V--PP basis difference |

-1635 |

-1654 |

-19 |

|

|

Vmure-L basis difference of plastics |

-2224 |

-2188 |

36 |

|

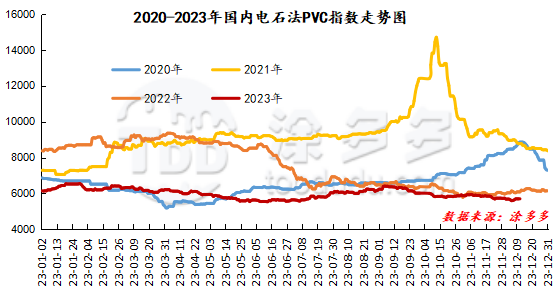

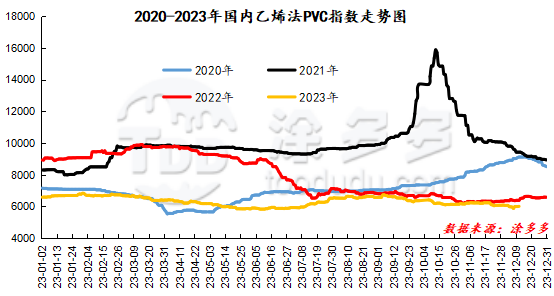

China PVC Index: according to Tudor data, the Chinese calcium carbide PVC spot index rose 3.1, or 0.054%, to 5701.31 on December 11. The ethylene method PVC spot index was 6009.45, up 11.49%, with a range of 0.192%. The calcium carbide method index rose, the ethylene method index rose, and the ethylene-calcium carbide index spread was 308.14.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

12.8 warehouse orders |

12.11 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,892 |

1,892 |

0 |

|

|

Guangzhou materials |

850 |

850 |

0 |

|

|

China Central Reserve Nanjing |

1,042 |

1,042 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

549 |

549 |

0 |

|

|

Zhenjiang Middle and far Sea |

549 |

549 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

4,006 |

4,006 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

2,843 |

2,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,809 |

2,809 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

15,250 |

15,250 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,457 |

3,457 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

360 |

360 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,322 |

3,322 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

487 |

487 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

44,073 |

44,073 |

0 |

|

Total |

|

44,073 |

44,073 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.