Daily Review of Urea: The positive impact of supply reduction under policy control will be small on the market (December 11)

China Urea Price Index:

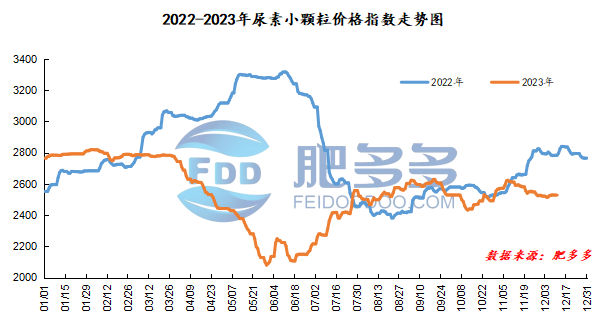

According to Feiduo data, the urea small pellet price index on December 11 was 2,522.86, down 5.45 from last Friday, down 0.22% month-on-month, and down 9.37% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR405 contract is 2244, the highest price is 2278, the lowest price is 2223, the settlement price is 2248, and the closing price is 2240. The closing price is down 38 compared with the settlement price of the previous trading day, down 1.67% month-on-month. The fluctuation range of the whole day is 2223-2278; the basis of the 05 contract in Shandong is 220; the 05 contract has increased its position by 7091 lots today, and so far, it has held 125,000 lots.

Spot market analysis:

Today, China's urea prices were consolidated downward. Most companies 'factory quotations remained stable, and a few companies lowered their receipts. However, the overall price change was small and the market atmosphere was slightly deadlocked.

Specifically, prices in Northeast China have stabilized at 2,500 - 2,530 yuan/ton. Prices in North China have stabilized at 2,350 - 2,540 yuan/ton. Prices in the northwest region are stable at 2,500 - 2,510 yuan/ton. Prices in Southwest China are stable at 2,480 - 2,800 yuan/ton. Prices in East China fell to 2,450 - 2,500 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,450 - 2,650 yuan/ton, and the price of large particles stabilized at 2,580 - 2,660 yuan/ton. Prices in South China fell to 2,620 - 2,660 yuan/ton.

Market outlook forecast:

In terms of factories, most factories currently mainly implement pre-order orders, with average transactions for new orders, little shipping pressure on manufacturers, and little enthusiasm among traders. In the near future, factories still have a small expectation of accumulating stocks and continue to control receiving orders. In terms of the market, under the influence of the news, the overall market atmosphere is weak, manufacturers 'quotations are firm, traders' enthusiasm is weakened, and operators are cautious in trading and have a wait-and-see attitude. On the supply side, as gas companies stop for maintenance, Nissan has dropped within a narrow range. There are still expectations of increasing short-term device maintenance, and the supply side will be tightened one after another. On the demand side, there is still a large gap in the needs of industry and agriculture. In some areas, agricultural needs have been started to prepare fertilizers, and agricultural reserves have increased to cover positions. However, based on the fact that current prices continue to remain high and under policy control, the enthusiasm of downstream purchasing goods has slowed down. The industry is gradually cautious and wait-and-see attitude is gradually rising. Currently, purchasing is carried out at a pace of small quantities multiple times and just following up.

On the whole, although the urea market is currently expected to shrink supply, in response to the policy of ensuring supply and stabilizing prices, prices have remained stable and consolidated, and upward pressure is under pressure. It is expected that the urea market price will continue to operate steadily and in a short period of time.