Daily Review of Urea: Market conditions are operating firmly under the influence of negative news (December 7)

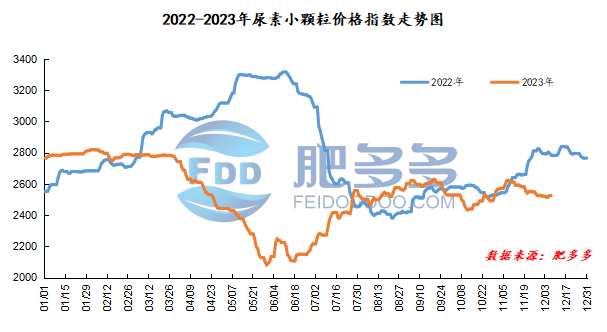

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on December 7 was 2,530.14, up 4.55 from yesterday, up 0.18% month-on-month, and down 9.12% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2432, the highest price is 2447, the lowest price is 2362, the settlement price is 2409, and the closing price is 2377. The closing price is down 40% compared with the settlement price of the previous trading day, down 1.65% month-on-month. The fluctuation range of the whole day is 2362-2447; the basis of the 01 contract in Shandong is 103; the 01 contract has reduced its position by 26813 lots today, and so far, it has held 113427 lots.

Spot market analysis:

Today, China's urea prices have increased slightly. The overall increase by companies with price increases has been relatively small. The prices of most companies have remained stable. Currently, due to the news, market procurement has been slightly deadlocked.

Specifically, prices in Northeast China have stabilized at 2,500 - 2,530 yuan/ton. Prices in North China rose to 2,350 - 2,540 yuan/ton. Prices in the northwest region are stable at 2,500 - 2,510 yuan/ton. Prices in Southwest China are stable at 2,480 - 2,800 yuan/ton. Prices in East China rose to 2,460 - 2,500 yuan/ton. The price of small and medium-sized particles in Central China has risen to 2,470 - 2,650 yuan/ton, and the price of large particles has stabilized at 2,580 - 2,660 yuan/ton. Prices in South China rose to 2,620 - 2,690 yuan/ton.

Market outlook forecast:

In terms of factories, factory quotations are mostly stable and operate, mainly issuing advance orders in the early stage. Currently, the overall advance orders in the market are maintained at about one week; a few companies are affected by downstream short-term follow-up, and prices have increased slightly. However, in terms of the current situation, prices are expected to be stable and stable. Small and medium-sized consolidation operation. On the market side, due to the negative news, market inquiries have dropped compared with the previous two days, and the overall atmosphere has turned cautious and wait-and-see. In terms of supply, the units have been stopped for maintenance one after another this week. Among them, the coal head units of Shanxi Lanhua and Yangmei Fengxi have been stopped, and the supply has been relatively reduced. In the later period, some units are still stopped one after another, and the specific parking time needs to be continuously paid attention to. On the demand side, farmers need more winter storage and make up for orders on demand, and have a wait-and-see attitude; in terms of industrial demand, the downstream compound fertilizer market trend is flat. Under cost pressure, the enthusiasm for picking up goods is not high, and most of them are still wait-and-see.

On the whole, the transaction of new orders in the urea market has cooled down, downstream purchasing sentiment has been affected by the news, and trading has been flat. It is expected that the urea market price will stabilize and consolidate in a short period of time.