PVC: Futures price reduction hit a bottom and rebounded slightly, but the fluctuation range narrowed, and the spot market was repaired sporadically

PVC futures analysis: December 6 V2401 contract opening price: 5671, highest price: 5727, lowest price: 5642, position: 740862, settlement price: 5682, yesterday settlement: 5688, down: 6, daily trading volume: 749562 lots, precipitated capital: 2.965 billion, capital outflow: 76.45 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 12.5 |

Price 12.6 |

Rise and fall |

Remarks |

|

North China |

5530-5600 |

5530-5580 |

0/-20 |

Send to cash remittance |

|

East China |

5550-5650 |

5570-5650 |

20/0 |

Cash out of the warehouse |

|

South China |

5620-5700 |

5670-5750 |

50/50 |

Cash out of the warehouse |

|

Northeast China |

5500-5650 |

5500-5650 |

0/0 |

Send to cash remittance |

|

Central China |

5600-5620 |

5600-5620 |

0/0 |

Send to cash remittance |

|

Southwest |

5450-5600 |

5450-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices rose slightly, the market situation appeared some repair. Comparison of valuation: among them, North China fell by 20 yuan / ton, East China increased by 20 yuan / ton, South China increased by 50 yuan / ton, and Northeast, Central and Southwest regions were stable. The ex-factory prices of upstream PVC production enterprises still have a sporadic drop of 20-50 yuan per ton, and most enterprises remain stable for the time being. Futures price volatility has risen, the spot market traders offer part of the price has been raised compared with yesterday, but the adjustment is smaller. The basis offer has not changed much compared with yesterday, and the price advantage of point price has gradually disappeared after the futures price has gone up, including East China basis offer 01 contract-(50-100-140), South China 01 contract-(0-20-50-90), North 01 contract-(310-350), Southwest 01 contract-(200). After the futures price went up, the spot price advantage declined, the transaction in the spot market became weak, the downstream purchasing enthusiasm was low, and the trading atmosphere in the spot market was weak.

Futures point of view: PVC2401 contract night trading opened higher and then fell back, after the lowest point of 5642 bottomed out to rebound. After the start of morning trading, the futures price began to fluctuate upward, there was a certain rise to repair, and the afternoon price continued to rise slightly to the end. 2401 contracts range from 5642 to 5727 throughout the day, with a spread of 85. 01. The contract has reduced its position by 25268 hands, and has held 740862 positions so far. The 2405 contract closed at 5902, with 351973 positions.

PVC Future Forecast:

Futures: & the operation of the nbsp; PVC2401 contract price continued to refresh the low, 5642 approaching the front low of the main link, but did not effectively fall below. On the contrary, the afternoon futures price showed a small rebound trend of reducing positions leaving the market, reducing positions more than 25000 hands from the transaction trend is more inclined to 01 profits, reduced positions left the market, part of the position 05 contracts. The technical level shows that the Bollinger belt (13, 13, 2) three tracks still open downward, the operating range of the futures price is similar to yesterday's low narrow finishing, but the trend rebounded slightly upward repair, the afternoon cultural goods index also closed higher. On the whole, the rebound caused by reducing positions and leaving the market can not be judged as the rebound of the market. In addition, the market of changing positions and changing months is cautiously involved. It is recommended to wait and see the trend of 05 mainly, and observe the performance of 5750 and 05 contract 5950 points above 01.

Spot: & the trend of nbsp; buying down again rather than buying up prompted light turnover in the spot market today. The slight repair of prices in the two markets did not lead to an improvement in transactions, but most product companies fell into a wait-and-see situation. The current market is not determined by fundamentals, but out of the trend of convergence under the overall commodity mood, as is the case with PVC. The current PVC fundamentals are still not many variables, the current warehouse receipts a total of 41218 hands, equivalent to 206090 tons of spot PVC, market delivery voice gradually. In the outer disk, international oil prices continued to fall due to the disappointing OPEC + production cut decision last week and continuing concerns about oil demand. In addition, the strength of the dollar is also a drag on the oil market. Despite cautious comments from the Fed chairman, the US interest rate market has completely eliminated any possibility of further US interest rate increases. Weak economic data and recent comments from Fed officials, including the chairman, have heightened expectations that the Fed has ended its rate-raising cycle and will start cutting rates as early as March. On the whole, PVC spot market or narrow-band arrangement is the main part in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 12.5 |

Price 12.6 |

Rate of change |

|

V2401 collection |

5671 |

5717 |

46 |

|

|

Average spot price in East China |

5600 |

5610 |

10 |

|

|

Average spot price in South China |

5660 |

5710 |

50 |

|

|

PVC2401 basis difference |

-71 |

-107 |

-36 |

|

|

V2405 collection |

5867 |

5902 |

35 |

|

|

V2401-2405 closed |

-196 |

-185 |

11 |

|

|

PP2401 collection |

7381 |

7419 |

38 |

|

|

Plastic L2401 collection |

7894 |

7964 |

70 |

|

|

V--PP basis difference |

-1710 |

-1702 |

8 |

|

|

Vmure-L basis difference of plastics |

-2223 |

-2247 |

-24 |

|

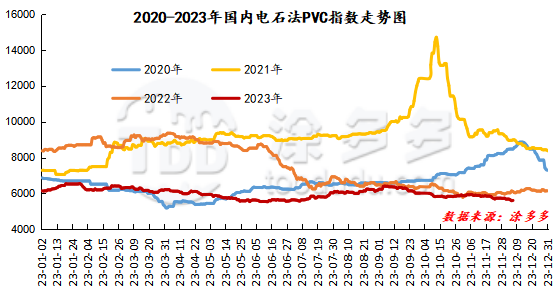

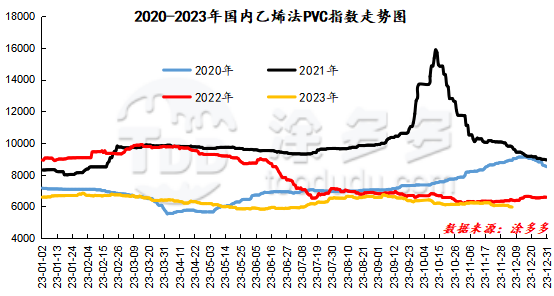

China PVC Index: according to Tudou data, the Chinese calcium carbide PVC spot index rose 11.94, or 0.213%, to 5610.91 on December 6th. The ethylene PVC spot index was 5964.04, down 15.94, with a range of 0.267%. The calcium carbide index rose, the ethylene index decreased, and the ethylene-calcium carbide index spread was 353.13.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

12.5 warehouse orders |

12.6 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,423 |

1,423 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

982 |

982 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

549 |

549 |

0 |

|

|

Zhenjiang Middle and far Sea |

549 |

549 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,356 |

3,436 |

80 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,809 |

2,809 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

14,528 |

15,067 |

539 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

3,184 |

240 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,322 |

180 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

307 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

40,179 |

41,218 |

1,039 |

|

Total |

|

40,179 |

41,218 |

1,039 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.