Daily review of urea: Supply is expected to shrink, urea prices increase slightly (December 5)

China Urea Price Index:

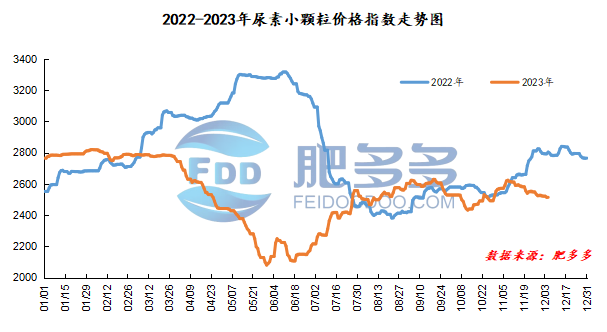

According to Feiduo data, the urea small pellet price index on December 5 was 2,518.32, up 4.23 from yesterday, up 0.17% month-on-month, and down 10.19% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2301, the highest price is 2429, the lowest price is 2295, the settlement price is 2380, and the closing price is 2387. The closing price is up 76 compared with the settlement price of the previous trading day, and the month-on-month increase is 3.29%. The fluctuation range of the whole day is 2295-2429; the basis of the 01 contract in Shandong is 63; the 01 contract has increased its position by 9037 lots today, and so far, it has held 139840 lots.

Spot market analysis:

Today, China's urea prices rose slightly, and prices in most factories remained stable. Some factories were affected by the production reduction of gas head equipment and emotional fluctuations, and prices rose slightly.

Specifically, prices in Northeast China fell to 2,500 - 2,530 yuan/ton. Prices in North China fell to 2,330 - 2,540 yuan/ton. Prices in Northwest China rose to 2,500 - 2,510 yuan/ton. Prices in Southwest China are stable at 2,480 - 2,800 yuan/ton. Prices in East China rose to 2,430 - 2,480 yuan/ton. The price of small and medium-sized particles in Central China has risen to 2,440 - 2,650 yuan/ton, and the price of large particles has stabilized at 2,580 - 2,660 yuan/ton. Prices in South China have stabilized to 2,610 - 2,660 yuan/ton.

Market outlook forecast:

In terms of factories, new orders have increased in the process of processing advance orders in the early stage today. The transactions of low-end new orders by mainstream regional companies have increased significantly. Factory orders have improved, and they intend to slightly increase their ex-factory quotations. On the market side, the transaction of new orders in the market has improved. Affected by the expected reduction in supply and the positive factors of downward starts, the market trading atmosphere has begun to improve, and more downstream markets have entered the market at low prices to get goods. On the supply side, many gas companies will stop their vehicles one after another this month. Some devices have parking plans. Nissan has expectations for a decline. The decline in start-ups has simultaneously boosted market purchasing sentiment. In terms of demand, the current market demand for bargain-hunting purchases has increased, and more of them enter the market to obtain goods and reserve. Some agricultural demand areas have the intention of making inquiries and purchasing; industrial needs are also purchasing appropriate amounts on bargain-hunting, and purchasing goods at more low prices, resulting in a better market trading atmosphere.

On the whole, under the influence of expected supply reduction in the urea market, new orders have been followed up one after another, and the atmosphere is improving. It is expected that the urea market price will remain stable and consolidated in a short period of time, and the overall range of ups and downs will not be too large.