PVC: The futures price fell deeply, a short trend took shape, and the spot continued to fall.

PVC futures analysis: December 4 V2401 contract opening price: 5853, highest price: 5864, lowest price: 5707, position: 765244, settlement price: 5770, yesterday settlement: 5826, down: 56, daily trading volume: 768723 lots, precipitated capital: 3.064 billion, capital inflow: 53.91 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 12.1 |

Price 12.4 |

Rise and fall |

Remarks |

|

North China |

5610-5690 |

5580-5640 |

-30/-50 |

Send to cash remittance |

|

East China |

5610-5720 |

5600-5700 |

-10/-20 |

Cash out of the warehouse |

|

South China |

5740-5800 |

5700-5770 |

-40/-30 |

Cash out of the warehouse |

|

Northeast China |

5550-5750 |

5500-5700 |

-50/-50 |

Send to cash remittance |

|

Central China |

5700-5710 |

5630-5650 |

-70/-60 |

Send to cash remittance |

|

Southwest |

5560-5700 |

5500-5650 |

-60/-50 |

Send to cash remittance |

PVC spot market: mainstream transaction prices in China's PVC market began to weaken at the beginning of the week, with prices falling slightly in all regions. Compared with the valuation, it fell by 30-50 yuan / ton in North China, 10-20 yuan / ton in East China, 30-40 yuan / ton in South China, 50 yuan / ton in Northeast China, 60-70 yuan / ton in Central China and 50-60 yuan / ton in Southwest China. The ex-factory price of upstream PVC production enterprises is generally reduced by 20-50 yuan / ton, and that of individual ethylene enterprises by 100 yuan / ton. The futures price fluctuates downwards, the trader's price offer is lower than last Friday, the basis offer is stronger than last Friday, and the supply advantage of point price is relatively obvious. among them, 01 contract in East China-(50-100-150) or 05 contract-(230-340), South China 01 contract-(0-20-50-100) good fan + 40, North 01 contract-(350-430) or 05 contract-(530-570) Southwest 01 contract-(250). Although the two kinds of contract quotations exist at the same time, the downstream mentality is cautious and the overall order is on the low side, part of the intention to purchase forward pre-sale sources, and the trading atmosphere in the spot market is slightly general.

Futures perspective: & the nbsp; PVC2401 contract began to fall when trading opened on Friday night, and the futures price continued to fluctuate, weakening and falling below the 5800 mark. Futures prices continued to decline after the start of morning trading, followed by low consolidation, and afternoon prices closed further lower. 2401 contracts fluctuate in the range of 5707-5864 throughout the day, with a spread of 157. 01 contracts with an increase of 29322 positions and 765272 positions so far. The 2405 contract closed at 5906, with 306420 positions.

PVC Future Forecast:

Futures: & the operation of the futures price of the nbsp; PVC2401 contract first approaches the lower position of the Bollinger belt (13, 13, 2), showing a recent new low, and then the futures price shows a downward trend of increasing positions, and the short trend is obvious. 01 contract still presents a short-dominated outcome. Entering the month-to-month shift in December, the current 01-05 contract has a large monthly difference, which is not conducive to the long position shift, but is more conducive to short positions. And in the case of no external stimulation under the current time node, it is difficult for PVC to have a good performance on the basis of weak fundamentals, so most of the short trades are traded, of which 25.7% are open compared with 23.6% more. As a whole, the operation of the futures price may still be under pressure in the short term, and observe the position 5700 and the front low position of the main link.

Spot aspect: & the downward bias of nbsp; futures prices also leads to a weak spot market atmosphere. In the case of closely linked terms, the downward trend of futures prices has greatly affected the confidence of the spot market. It coincides with the decline in spot prices at the beginning of the week that did not lead to an improvement in transactions. On the contrary, the downstream hanging order points are generally low and mediocre. The short mood further aggravates the difficulty of spot digestion, production enterprises do not meet the volume of signing orders at the same time, weak demand has always restricted the two cities, and under the current time node, 01 contract as a short contract is still dominated by shorts, followed by obvious seasonal off-season characteristics of the spot market. Oil prices fell in the outer disk, and traders were sceptical about OPEC +'s decision to cut production further in the first quarter of next year. Fed officials are increasingly convinced that they do not need to fight inflation by raising interest rates further, but they are not ready to announce an end to the rate hike. On the whole, it is difficult to change the weak situation of PVC spot market in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 12.1 |

Price 12.4 |

Rate of change |

|

V2401 collection |

5842 |

5719 |

-123 |

|

|

Average spot price in East China |

5665 |

5650 |

-15 |

|

|

Average spot price in South China |

5770 |

5735 |

-35 |

|

|

PVC2401 basis difference |

-177 |

-69 |

108 |

|

|

V2405 collection |

6015 |

5906 |

-109 |

|

|

V2401-2405 closed |

-173 |

-187 |

-14 |

|

|

PP2401 collection |

7442 |

7360 |

-82 |

|

|

Plastic L2401 collection |

7932 |

7856 |

-76 |

|

|

V--PP basis difference |

-1600 |

-1641 |

-41 |

|

|

Vmure-L basis difference of plastics |

-2090 |

-2137 |

-47 |

|

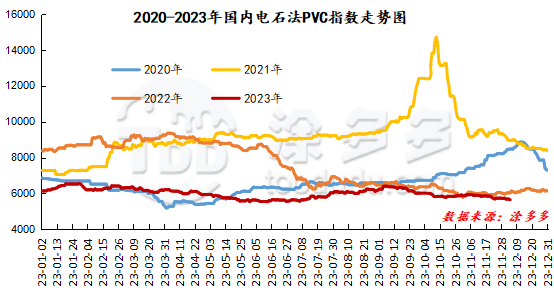

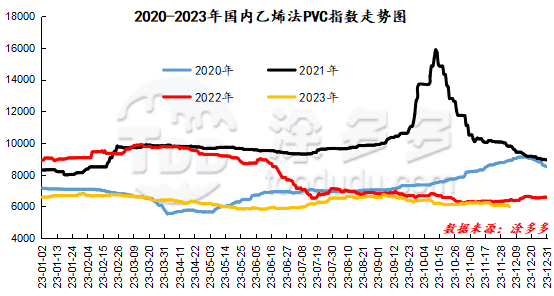

China PVC Index: according to Tuduo data, the China calcium Carbide PVC spot Index fell 36.46, or 0.641%, to 5649.45 on December 4. The ethylene PVC spot index was 5989.21, down 79.85, with a range of 1.316%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 339.76.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

12.1 warehouse order volume |

12.4 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,423 |

1,423 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

982 |

982 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

549 |

549 |

0 |

|

|

Zhenjiang Middle and far Sea |

549 |

549 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,356 |

3,356 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,774 |

2,809 |

35 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

13,846 |

13,846 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

307 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

39,462 |

39,497 |

35 |

|

Total |

|

39,462 |

39,497 |

35 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.