Daily review of urea: Plant production is expected to be reduced and prices are operating firmly (December 4)

China Urea Price Index:

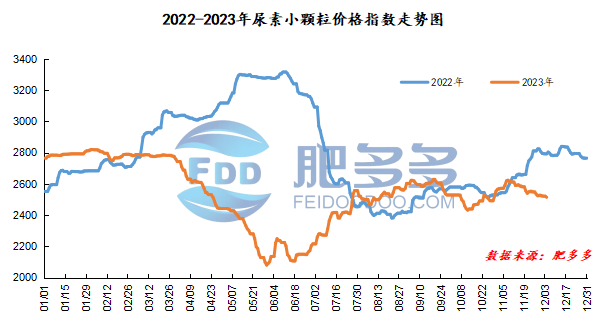

According to Feiduo data, the urea small pellet price index on December 4 was 2,514.09, down 7.41 from last Friday, down 0.29% month-on-month, and down 9.97% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2335, the highest price is 2344, the lowest price is 2289, the settlement price is 2311, and the closing price is 2301. The closing price is down 22 compared with the settlement price of the previous trading day, down 0.95% month-on-month. The fluctuation range of the whole day is 2289-2344; the basis of the 01 contract in Shandong is 119; the 01 contract has reduced its position by 16821 lots today, and so far, it has held 130819 lots.

Spot market analysis:

Today, China's urea prices have been consolidated downward, with the overall reduction being small. Most companies have normal equipment production. With low inventories, prices are mostly stable; some companies have average new orders and lowered their quotations slightly.

Specifically, prices in Northeast China fell to 2,500 - 2,540 yuan/ton. Prices in North China fell to 2,320 - 2,550 yuan/ton. Prices in Northwest China fell to 2,460 - 2,470 yuan/ton. Prices in Southwest China are stable at 2,480 - 2,800 yuan/ton. Prices in East China fell to 2,410 - 2,470 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,430 - 2,650 yuan/ton, and the price of large particles stabilized at 2,580 - 2,660 yuan/ton. Prices in South China fell to 2,610 - 2,660 yuan/ton.

Market outlook forecast:

In terms of factories, the transaction of new orders from factories was flat, and prices continued to decline slightly. With the support of some preparations, prices remained stable. On the market side, the market sentiment is not good, high-priced transactions are still weak, operators are not enthusiastic about buying, the market has insufficient sustainability to follow up, and the price trend is slightly deadlocked. On the supply side, the number of equipment failures and overhauls in enterprises has increased in the past two days. The industry's Nissan trend has declined and output has fallen, which has formed a certain positive support for the market. In terms of inventory, corporate inventories are gradually forming a trend of accumulating inventory. At present, corporate equipment maintenance has increased, and the trend of accumulating inventory has narrowed. On the demand side, agricultural demand has been slow to follow up, and more wait and see purchases; industrial demand has been affected by the increase in compound fertilizer start-ups and increased demand. There is an intention to replenish goods in the downstream, but resistance to high-priced purchases still exists, and the actual transaction price is low.

On the whole, the current urea market demand is flat and the enthusiasm for purchasing is low. However, under the expectation of a reduction in supply, prices are mostly firm and stable. It is expected that the urea market price will continue to stabilize and consolidate in the short term.