PVC: Futures prices encountered Black Friday, but hit bottom in the afternoon and rebounded, and the spot market weakened slightly

PVC futures analysis: December 1st V2401 contract opening price: 5890, highest price: 5895, lowest price: 5755, position: 735950, settlement price: 5826, yesterday settlement: 5879, down: 53, daily trading volume: 1060918 lots, precipitated capital: 3.01 billion, capital outflow: 10.93 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.30 |

Price 12.1 |

Rise and fall |

Remarks |

|

North China |

5650-5700 |

5610-5690 |

-40/-10 |

Send to cash remittance |

|

East China |

5710-5800 |

5610-5720 |

-100/-80 |

Cash out of the warehouse |

|

South China |

5780-5860 |

5740-5800 |

-40/-60 |

Cash out of the warehouse |

|

Northeast China |

5600-5820 |

5550-5750 |

-50/-70 |

Send to cash remittance |

|

Central China |

5720-5730 |

5700-5710 |

-20/-20 |

Send to cash remittance |

|

Southwest |

5560-5700 |

5560-5700 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price down mainly, afternoon partial repair. Compared with the valuation, it fell by 10-40 yuan / ton in North China, 80-100 yuan / ton in East China, 40-60 yuan / ton in South China, 50-70 yuan / ton in Northeast China, 20 yuan / ton in Central China, and stable in Southwest China. Upstream PVC production enterprise factory price part of the slight reduction of 30-50 yuan / ton, some enterprises maintain wait-and-see. The volatility of futures weakened in the morning, and the price offer of traders in various regions was lower than that of yesterday, and it was difficult for the high offer to have an actual transaction, and the price advantage of point price appeared after the futures price went down. The basis offer is stronger than yesterday, including East China 01 contract-(50-100-160), South China 01 contract-(20-50-100) good fan + 30, North 01 contract-(360-430), Southwest 01 contract-(250). Lower point price downstream order enthusiasm increased, some began to order 05 contract, point price transaction is OK, part of the intention to purchase long-term pre-sale sources, the overall trading atmosphere in the spot market has slightly improved.

From the perspective of futures: & the nbsp; PVC2401 contract fell at the beginning of the night trading, and the price trend did not turn to speak of. After the start of morning trading, futures prices continued to decline, and the market continued to increase its positions substantially. Afternoon prices hit bottom and rebounded, and positions declined rapidly. 2401 contracts fluctuate in the range of 5755-5895 throughout the day, with a price difference of 140,01.01 contracts with an increase of 3346 positions and 735950 positions so far. The 2405 contract closed at 6015, with 275291 positions.

PVC Future Forecast:

Futures: & the operation of the futures price of the nbsp; PVC2401 contract showed a reversal, the morning market showed an obvious downward trend, and the position increased significantly, at one time, the position increased by more than 60, 000 hands, but the price bottomed out in the afternoon, and the rapid withdrawal of the short order led to the price upward. on the one hand, the profit taking of the low short order formed a certain stampede, which led to the low position rising rapidly. On the other hand, there are many single resistance to the sharp changes in the disk. The technical level shows that the opening of the three tracks of the Bolin belt (13,13,2) is obvious downward, and the KD line and MACD line at the daily level show a dead-forked trend. The low point of the futures price quickly approaches the support level of the lower rail of the Bollinger belt, but the time is short. On the whole, futures prices may continue the trend of low and narrow consolidation in the short term.

Spot aspect: & the trend of nbsp; futures is taken by surprise. First of all, the rapid decline brings quotation pressure to production enterprises and spot merchants in the morning, and prices decline slightly one after another, but in view of the increased enthusiasm of the market not to buy up and low prices, product enterprises have an appropriate amount of replenishment, changing the light situation in the week, so although prices in the two markets are expected to decline on Friday, the transaction has improved slightly. In the afternoon, as futures prices rose, some merchants began to tentatively repair low prices. Today, the trend of the overall cultural goods index is similar to that of PVC, and it is difficult for PVC to get out of a separate market under the common commodity mood. And PVC does not have unique fundamentals, high inventory and slow supply digestion always restrict the disk. On the outer disk, oil prices fell more than 2 per cent as OPEC + decided to cut production in the first quarter of next year, but by a lower-than-expected amount. Look at the spot market as a whole or re-extend the situation of pre-low consolidation.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.30 |

Price 12.1 |

Rate of change |

|

V2401 collection |

5890 |

5842 |

-48 |

|

|

Average spot price in East China |

5755 |

5665 |

-90 |

|

|

Average spot price in South China |

5820 |

5770 |

-50 |

|

|

PVC2401 basis difference |

-135 |

-177 |

-42 |

|

|

V2405 collection |

6073 |

6015 |

-58 |

|

|

V2401-2405 closed |

-183 |

-173 |

10 |

|

|

PP2401 collection |

7476 |

7442 |

-34 |

|

|

Plastic L2401 collection |

7968 |

7932 |

-36 |

|

|

V--PP basis difference |

-1586 |

-1600 |

-14 |

|

|

Vmure-L basis difference of plastics |

-2078 |

-2090 |

-12 |

|

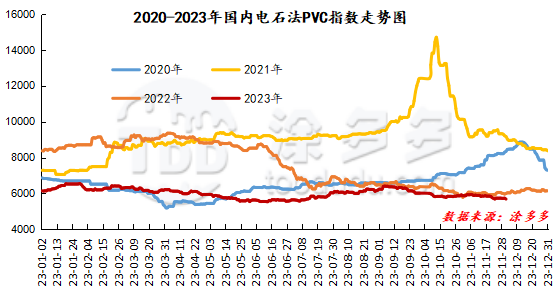

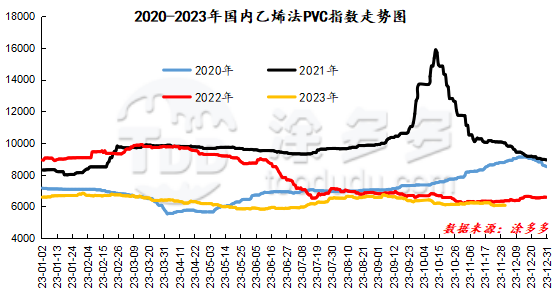

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 49.22, or 0.858%, to 5685.91 on December 1. The ethylene PVC spot index was 6069.06, down 16.09, or 0.264%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 383.15.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.30 warehouse orders |

12.1 warehouse order volume |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,423 |

1,423 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

982 |

982 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

417 |

549 |

132 |

|

|

Zhenjiang Middle and far Sea |

417 |

549 |

132 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,356 |

3,356 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,774 |

2,774 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

13,846 |

13,846 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

307 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

39,330 |

39,462 |

132 |

|

Total |

|

39,330 |

39,462 |

132 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.