Daily review of urea: Market demand weakened, urea prices stabilized and fell slightly (November 30)

China Urea Price Index:

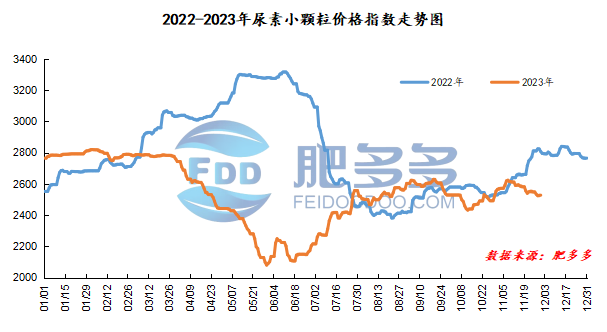

According to Feiduo data, the urea small pellet price index on November 30 was 2,523.77, down 4.09 from yesterday, down 0.16% month-on-month, and down 10.11% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2290, the highest price is 2314, the lowest price is 2266, the settlement price is 2288, and the closing price is 2308. The closing price is down 1 compared with the settlement price of the previous trading day, down 0.04% month-on-month. The fluctuation range of the whole day is 2266-2314; the basis of the 01 contract in Shandong is 142; the 01 contract has reduced its position by 10207 lots today, and so far, it has held 172979 lots.

Spot market analysis:

Today, China's urea prices have been slightly lowered, while corporate prices in various regions have stabilized significantly, and the overall adjustment is small.

Specifically, prices in Northeast China have stabilized at 2,510 - 2,550 yuan/ton. Prices in North China have stabilized at 2,340 - 2,560 yuan/ton. Prices in the northwest region are stable at 2,470 - 2,480 yuan/ton. Prices in Southwest China are stable at 2,480 - 2,800 yuan/ton. Prices in East China have stabilized at 2,440 - 2,490 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,440 - 2,650 yuan/ton, and the price of large particles has stabilized at 2,580 - 2,660 yuan/ton. Prices in South China fell to 2,620 - 2,660 yuan/ton.

Market outlook forecast:

In terms of factories, most manufacturers are currently offering stable and firm prices due to early support, and the number of new orders has decreased significantly compared with the previous two days. In addition, although factories are ready to go, the market flow has decreased, and some companies still have a slight trend of accumulating stocks. It is expected that corporate inventories will gradually increase in the short term. On the supply side, the current operating rate and output of the company remain high. In December, equipment overhauls have increased one after another, and production reductions in gas head units have followed one after another. With positive stimulation, market expectations may improve. In terms of demand, urea is still in the off-season of demand, and the market is preparing for fertilizer on dips. It is just in the process of steadily advancing. After the current round of replenishment, there is a small amount of demand in the agricultural market, but industrial demand still exists. Downstream industries purchase more on dips and have a wait-and-see attitude. The overall market reserve demand has slowed down.

On the whole, the current demand for urea is low, the market is replenished on dips, and with guaranteed supply, it is expected that the urea market price will continue to maintain a large stabilization and small decline in the short term.