PVC: The low and sideways position of futures prices continues, the Bollinger Band opens downward, and the spot continues to adjust within a narrow range

PVC futures analysis: November 29th V2401 contract opening price: 5866, highest price: 2905, lowest price: 5844, position: 749975, settlement price: 5869, yesterday settlement: 5873, down: 4, daily trading volume: 612980 lots, precipitated capital: 3.072 billion, capital outflow: 46.94 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.28 |

Price 11.29 |

Rise and fall |

Remarks |

|

North China |

5630-5720 |

5650-5700 |

20/-20 |

Send to cash remittance |

|

East China |

5700-5820 |

5700-5790 |

0/-30 |

Cash out of the warehouse |

|

South China |

5750-5850 |

5750-5850 |

0/0 |

Cash out of the warehouse |

|

Northeast China |

5650-5720 |

5600-5820 |

-50/100 |

Send to cash remittance |

|

Central China |

5720-5730 |

5720-5730 |

0/0 |

Send to cash remittance |

|

Southwest |

5560-5700 |

5560-5700 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices continue to be arranged in a narrow range, spot market prices do not change much. Compared with the valuation, the low-end prices in North China rose by 20 yuan / ton, the high-end prices fell by 20 yuan / ton, the high-end prices in East China fell by 30 yuan / ton, South China was stable, and the low-end prices in Northeast China fell by 50 yuan / ton. high-end prices rose 100 yuan / ton, and central and southwestern regions were stable. Upstream PVC production enterprises temporarily stable ex-factory prices, individual shipping rhythm of enterprises slightly reduced 20-50 yuan / ton. Futures is still low horizontal trading mainly, the spot market traders in various regions offer is basically stable compared with yesterday, point price and a mouth price offer coexist, but the price advantage of the basis offer is not obvious, the actual transaction negotiation is the main. The basis does not change much, including East China base offer 01 contract-(50-100-150), South China 01 contract-(20-50-100), North 01 contract-(400), Southwest 01 contract-(250). Overall downstream procurement enthusiasm is not high, downstream early bargain replenishment, today most temporary wait-and-see, the spot market trading atmosphere is weak.

Futures point of view: PVC2401 contract night first narrow collation, and then the late price rose, after the start of the morning price from the high down, but the overall decline is not large, mainly in the afternoon at a relatively low level. 2401 the contract fluctuates from 5844 to 5905 throughout the day, with a spread of 61. 01. The contract reduced its position by 10160 hands, and has held 749975 positions so far. The 2405 contract closed at 6025, with 244744 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices continue to be arranged horizontally, the technical level shows that the Bollinger belt (13, 13, 2) three-track opening downward, the daily level of KD line and MACD line still show a dead fork trend. From the overall trend line, the operation of the PVC main contract is still weak, and the short-term futures price is under upward pressure, which comes from the lack of fundamental and macro support, and the 01 contract is still weak in the absence of positive factors. For the current operating trend of the futures price, we believe that the state of the low horizontal position with the passage of time, or ushered in the short position to change the month, 01-09 contract is still large, short-term price operation or continue to narrow mode, continue to observe the performance of the 5850-5950 range.

Spot: this week's spot market feedback is not good, in view of last week's futures prices down, product companies and merchants through low prices for some replenishment, so this week in the horizontal state of the spot market turnover is light, production enterprises also feedback insufficient orders, spot orders low there is a basic quantity but difficult to sell. At present, the supply of PVC is stable, and there are not many fundamental variables. the narrow horizontal trade of the two cities makes the spot market price lack enough fluctuation direction, no matter whether it rises or falls, it lacks the motivation of adjustment, so the overall two cities tend to be stable, especially the spot market price changes little. In the outer disk, oil prices rose 2 per cent as production from Kazakhstan's largest oil field plunged 56 per cent due to offshore storms. Businesses are also watching the OPEC + meeting to be held on Thursday, which is expected to extend the production reduction agreement until next year. On the whole, the spot market may still maintain the trend of narrow arrangement.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.28 |

Price 11.29 |

Rate of change |

|

V2401 collection |

5862 |

5852 |

-10 |

|

|

Average spot price in East China |

5760 |

5745 |

-15 |

|

|

Average spot price in South China |

5800 |

5800 |

0 |

|

|

PVC2401 basis difference |

-102 |

-107 |

-5 |

|

|

V2405 collection |

6062 |

6025 |

-37 |

|

|

V2401-2405 closed |

-200 |

-173 |

27 |

|

|

PP2401 collection |

7418 |

7393 |

-25 |

|

|

Plastic L2401 collection |

7864 |

7869 |

5 |

|

|

V--PP basis difference |

-1556 |

-1541 |

15 |

|

|

Vmure-L basis difference of plastics |

-2002 |

-2017 |

-15 |

|

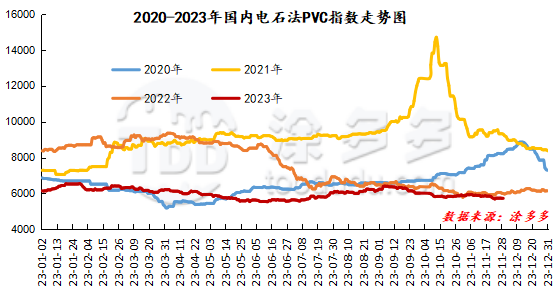

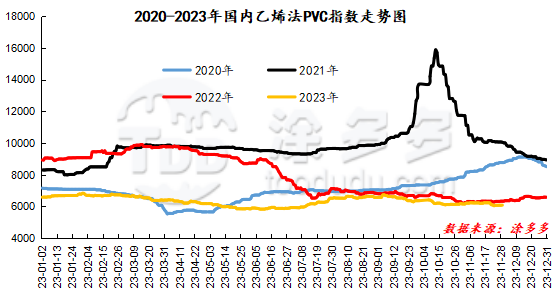

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot Index fell 2.94, or 0.051%, to 5727.73 on November 29th. The PVC spot index of ethylene method was 6085.15, up 8.13%, with a range of 0.134%. The calcium carbide index decreased, the ethylene index increased, and the ethylene-calcium carbide index spread was 357.42.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.28 warehouse orders |

11.29 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,423 |

1,423 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

982 |

982 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

417 |

417 |

0 |

|

|

Zhenjiang Middle and far Sea |

417 |

417 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,356 |

3,356 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,774 |

2,774 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

13,846 |

13,846 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

307 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

39,330 |

39,330 |

0 |

|

Total |

|

39,330 |

39,330 |

0 |

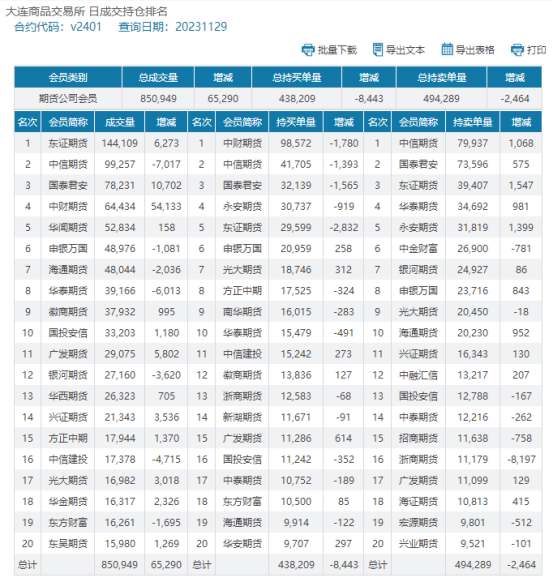

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.