PVC: Futures prices fluctuate within a narrow range at low levels, technical closing lines are unstable, and spot price changes are narrowing

PVC futures analysis: November 28th V2401 contract opening price: 5893, highest price: 5906, lowest price: 5836, position: 760135, settlement price: 5873, yesterday settlement: 5882, down: 9, daily trading volume: 592181 lots, precipitated capital: 3.119 billion, capital outflow: 48.04 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.27 |

Price 11.28 |

Rise and fall |

Remarks |

|

North China |

5650-5720 |

5630-5720 |

-20/0 |

Send to cash remittance |

|

East China |

5710-5830 |

5700-5820 |

-10/-10 |

Cash out of the warehouse |

|

South China |

5750-5860 |

5750-5850 |

0/-10 |

Cash out of the warehouse |

|

Northeast China |

5650-5720 |

5650-5720 |

0/0 |

Send to cash remittance |

|

Central China |

5730-5740 |

5720-5730 |

-10/-10 |

Send to cash remittance |

|

Southwest |

5600-5700 |

5560-5700 |

-40/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices continue to maintain a narrow adjustment, price fluctuations are small. Compared with the valuation, it fell by 20 yuan / ton in North China, 10 yuan / ton in East China, 10 yuan / ton in South China, 10 yuan / ton in Northeast China, 10 yuan / ton in Central China and 40 yuan / ton in Southwest China. Upstream PVC manufacturers factory prices continue to remain stable, although Tuesday is the date of contract signing, but the current generation of merchants do not receive much, especially after the weak operation of futures prices, the willingness to sign orders is weaker and weaker. The price offered by traders in all regions is basically more stable than yesterday, because the futures price has dropped slightly, and the basis offer has a slight advantage, including East China basis offer 01 contract-(50-100-150), South China 01 contract-(20-50-100), North 01 contract-(400), Southwest 01 contract-(250). On the whole, the spot market is calm, the actual transaction negotiations are mainly, the downstream procurement enthusiasm is not high, merchants and downstream enterprises wait and see temporarily, and the trading atmosphere in the spot market is weak.

Futures point of view: PVC2401 contract night market narrow arrangement mainly, futures price fluctuations lack of sufficient direction, after the beginning of early trading, futures prices began to weaken, afternoon lows of 5836, followed by a slight rise in futures prices. 2401 contracts fluctuate from 5836 to 5906 throughout the day, with a price difference of 70,01.The contract has reduced its position by 7646 hands and has held 760135 positions so far. The 2405 contract closed at 6026, with 231640 positions.

PVC Future Forecast:

Futures: PVC2401 contract price after the whole night market narrow finishing, the daytime period again weak, intraday trading open 24.8% compared with 19.7% more open mainly short, 2401 contract before the end of the entrenched by short. At the close of midday, the main contracts of Chinese futures were up and down. Shanghai Nickel rose nearly 4%, Container Index (European Line) rose more than 2%, Urea, rape Oil, Shanghai Silver, Apple, stainless Steel (SS) and Soybean Oil rose more than 1%. In terms of decline, lithium carbonate and soda ash fell by more than 4%, styrene (EB) fell by more than 3%, iron ore and Shanghai tin fell by more than 2%. The rise is basically concentrated in the agricultural sector, as a whole, we still maintain the previous judgment, futures prices may continue to be sorted out in a narrow range, and continue to observe the performance in the range of 5850-5950.

Spot aspect: period the two cities are still low and narrow collation. From the perspective of time, the market of changing positions and changing months began to be ushered in in December, and the fundamentals of the spot market were still few before the end of the 01 contract, so the high inventory and poor spot digestion under the game of supply and demand still restricted the market. On the one hand, the 01 contract will not have a better performance, on the other hand, the difficulty of spot digestion has always made it impossible for merchants to sign orders, and the annual average profit has been reduced. At present, there are differences in the PVC trend of the industrial chain. On the one hand, they think that the prices of the two cities may still test the low range, on the other hand, they think that the weakness of the two cities is a consensus, but they continue to need continuous short suppression and negative factors. Oil prices fell in the outer disk, with Brent crude futures falling below $80 a barrel as the International Energy Agency (IEA) predicted a global oil glut next year. Traders are awaiting the results of the OPEC + meeting to be held later this week. On the whole, the spot market will continue to be low and narrow in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.27 |

Price 11.28 |

Rate of change |

|

V2401 collection |

5893 |

5862 |

-31 |

|

|

Average spot price in East China |

5770 |

5760 |

-10 |

|

|

Average spot price in South China |

5805 |

5800 |

-5 |

|

|

PVC2401 basis difference |

-123 |

-102 |

21 |

|

|

V2405 collection |

6062 |

6062 |

0 |

|

|

V2401-2405 closed |

-169 |

-200 |

-31 |

|

|

PP2401 collection |

7449 |

7418 |

-31 |

|

|

Plastic L2401 collection |

7893 |

7864 |

-29 |

|

|

V--PP basis difference |

-1556 |

-1556 |

0 |

|

|

Vmure-L basis difference of plastics |

-2000 |

-2002 |

-2 |

|

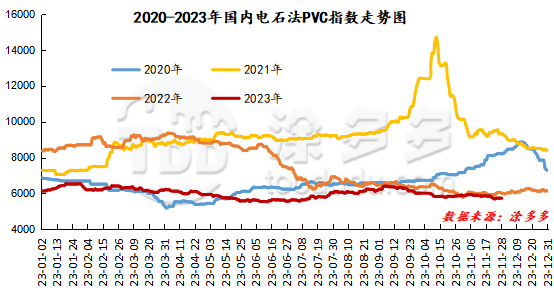

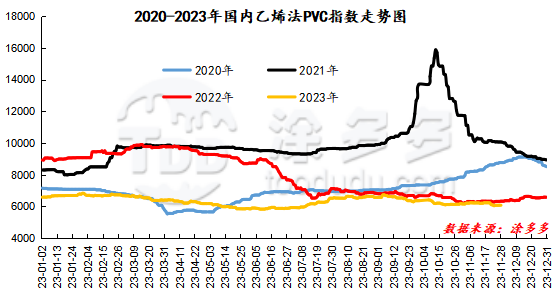

China PVC Index: according to Tuduoduo data, the spot index of China's calcium carbide PVC fell 9.18, or 0.160%, to 5730.67 on Nov. 28. The ethylene method PVC spot index was 6077.02, down 3.09, with a range of 0.051%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 346.35.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.27 warehouse orders |

11.28 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,423 |

1,423 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

982 |

982 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

417 |

417 |

0 |

|

|

Zhenjiang Middle and far Sea |

417 |

417 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,356 |

3,356 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,774 |

2,774 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

13,846 |

13,846 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

307 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

39,330 |

39,330 |

0 |

|

Total |

|

39,330 |

39,330 |

0 |

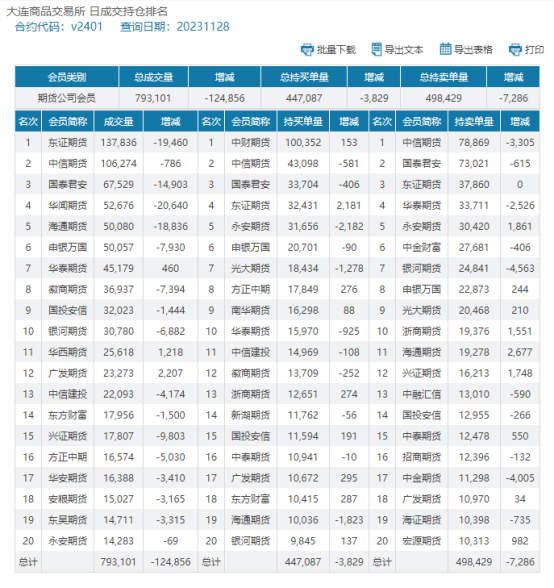

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.