Daily Review of Urea: Supply is expected to shrink and the atmosphere for low-price trading is improving (November 28)

China Urea Price Index:

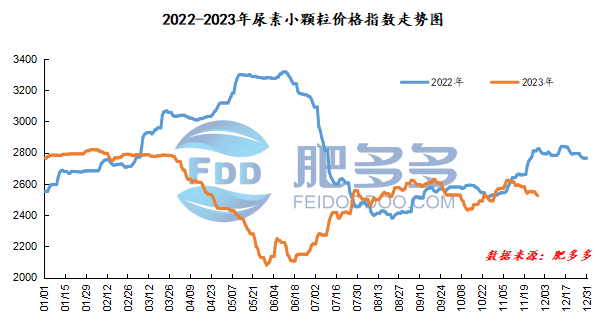

According to Feiduo data, the urea small pellet price index on November 28 was 2,524.23, down 9.68 from yesterday, down 0.38% month-on-month, and down 10.64% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2292, the highest price is 2336, the lowest price is 2287, the settlement price is 2311, and the closing price is 2312. The closing price is up 38 compared with the settlement price of the previous trading day, up 1.67% month-on-month. The fluctuation range of the whole day is 2287-2336; the basis of the 01 contract in Shandong is 118; the 01 contract has reduced its position by 4674 lots today, and so far, it has held 196929 lots.

Spot market analysis:

Today, China's urea prices are mixed, and the overall rise and fall are regionalized. Regions with good market transactions have increased their quotations and controlled orders receiving. Regions with a small number of new orders have received new orders, and prices have been consolidated and operated.

Specifically, prices in Northeast China fell to 2,510 - 2,550 yuan/ton. Prices in North China fell to 2,340 - 2,560 yuan/ton. Prices in Northwest China fell to 2,470 - 2,480 yuan/ton. Prices in Southwest China fell to 2,480 - 2,800 yuan/ton. Prices in East China rose to 2,420 - 2,480 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,420 - 2,650 yuan/ton, and the price of large particles stabilized at 2,580 - 2,660 yuan/ton. Prices in South China fell to 2,620 - 2,650 yuan/ton.

Market outlook forecast:

In terms of factories, some manufacturers currently have better orders when they are low in the early stage and have sufficient orders to prepare. Without obvious sales pressure, companies are accumulating their warehouses and control receiving orders. The current factory quotations are mainly firm; some companies have a small number of transactions have not received new orders and continue to reduce their quotations. Traders just need a small amount. In order to avoid risks, most traders only carry out short-term operations on urea, buy it as you please, and have a wait-and-see mentality. The overall market is in a game between manufacturers. In terms of supply, the company's daily output still remains high. In the later period, there are plans to stop air head units, and air head units have reduced production. In terms of demand, agricultural demand is still in the winter storage period. Due to the long winter storage cycle, the mentality of downstream purchasing and reserves is still mainly wait-and-see. Recently, there is an intention to start short storage, and some traders are waiting to enter the market in a timely manner to pick up goods. The operating rate of the fertilizer market is relatively low, but recently some companies have shown signs of improving their start-up operations, and their ability to consume urea has become stronger. The overall mentality is still mainly wait-and-see.

On the whole, the urea market is currently improving, boosted by the positive expectation of production cuts. Downstream continues to purchase appropriate amounts on dips. It is expected that the urea market price will continue to fluctuate within a short period of time.