PVC: The futures price reduced its position and left the market and rose slightly at the end of the day. This wave of market may end. The spot market range is sorted out.

PVC futures analysis: November 27th V2401 contract opening price: 5910, highest price: 5919, lowest price: 5845, position: 767781, settlement price: 5882, yesterday settlement: 5856, up: 26, daily trading volume: 700874 lots, precipitated capital: 3.167 billion, capital outflow: 179 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.24 |

Price 11.27 |

Rise and fall |

Remarks |

|

North China |

5650-5720 |

5650-5720 |

0/0 |

Send to cash remittance |

|

East China |

5710-5830 |

5710-5830 |

0/0 |

Cash out of the warehouse |

|

South China |

5740-5860 |

5750-5860 |

10/0 |

Cash out of the warehouse |

|

Northeast China |

5650-5720 |

5650-5720 |

0/0 |

Send to cash remittance |

|

Central China |

5710-5730 |

5730-5740 |

20/10 |

Send to cash remittance |

|

Southwest |

5600-5700 |

5600-5700 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price range collation, the overall change is not big. According to the comparison of valuation, North China is temporarily stable, East China is temporarily stable, South China is up 10 yuan / ton, Northeast China is temporarily stable, Central China is up 10-20 yuan / ton, and Southwest China is temporarily stable. Most of the ex-factory prices of upstream PVC production enterprises remain stable, without obvious adjustment, including the quotations of remote warehouses remain unchanged, but there are few contracts signed on Monday. The volatility of the futures market is mainly due to the slight rise in the afternoon futures price, the traders' offer price has not changed much, and the price advantage of the basis offer is not obvious for the time being. Among them, East China base offer 01 contract-(50-100-150), South China 01 contract-(20-50-100), North 01 contract-(400), Southwest 01 contract-(250), the downstream wait-and-see mentality is more obvious, the enthusiasm of product enterprises to take goods has weakened, last week bargain replenishment, so Monday's spot market turnover is poor, procurement enthusiasm decreased.

From a futures point of view: & the opening price of the nbsp; PVC2401 contract was slightly weaker last week, breaking the 5900 mark. After the start of morning trading, the futures price fluctuated on the basis of the night market, the lowest point of 5845 hit bottom and rebounded, and the price rose slightly in the afternoon. 2401 contracts range from 5845 to 5919 throughout the day, with a spread of 74. 01. The contract reduced its position by 42331 positions and has held 767781 positions so far. The 2405 contract closed at 6062, with 219065 positions.

PVC Future Forecast:

Futures: The futures price of PVC2401 contract has been repaired to a certain extent since its low of 5781. On Monday, it rose slightly at the end of the day, and its position showed a certain trend of reducing its position and leaving the market. The continuous reduction of positions last Friday may to a certain extent herald the end of this downward market. With the passage of time, the market of changing positions for months begins to be ushered in. On the one hand, speculative positions in the market of changing positions for months are suggested to participate carefully. The market is divorced from the fundamentals of repetition, and short-dominated 01 contract Jiancang market or support the futures price, and will not go down further. Technical level shows that the Bollinger belt (13, 13, 2) three-track opening is still downward, in the short term to look at the price or continue to collate narrowly, observe the performance of the range of 5850-5950.

Spot aspect: & the reduction of positions on the nbsp; futures market curbed the further decline of the futures price, of which the market was 28.2% flat compared to 24.6% flat, and the depressed market showed signs of ending. The corresponding spot market has stopped falling at the same time, but there are no further signs of pushing up. Whether they are production enterprises or traders and downstream products enterprises, they have a strong wait-and-see mentality. On the one hand, the price is in the process of falling in the early stage. Product enterprises have rigid demand to replenish goods at bargain prices. Therefore, when the market stops falling, the transaction becomes weaker. PVC fundamentals are still not many variables at present, after the midline enters the market of changing positions and changing months, the trend of the prices of the two cities is expected to break away from the fundamentals to form a unique market for changing months. Oil prices have fallen in the outer disk, and the market is expected to maintain the current production reduction agreement at this week's OPEC + meeting. On the whole, the spot market price may continue to be sorted out in a narrow range in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.24 |

Price 11.27 |

Rate of change |

|

V2401 collection |

5901 |

5893 |

-8 |

|

|

Average spot price in East China |

5770 |

5770 |

0 |

|

|

Average spot price in South China |

5800 |

5805 |

5 |

|

|

PVC2401 basis difference |

-131 |

-123 |

8 |

|

|

V2405 collection |

6077 |

6062 |

-15 |

|

|

V2401-2405 closed |

-176 |

-169 |

7 |

|

|

PP2401 collection |

7462 |

7449 |

-13 |

|

|

Plastic L2401 collection |

7934 |

7893 |

-41 |

|

|

V--PP basis difference |

-1561 |

-1556 |

5 |

|

|

Vmure-L basis difference of plastics |

-2033 |

-2000 |

33 |

|

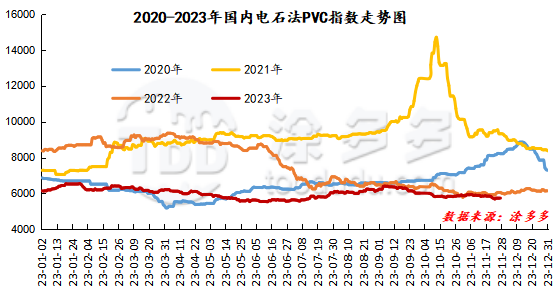

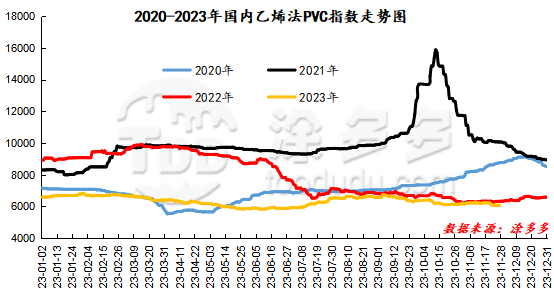

China PVC Index: according to Tudor data, the spot index of China's calcium carbide PVC rose 2.95, or 0.051%, to 5739.85 on November 27th. The ethylene method PVC spot index is 6080.11, up 3.09, the range is 0.051%, the calcium carbide method index rises, the ethylene method index rises, the ethylene method-calcium carbide method index price difference is 340.26.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.24 warehouse orders |

11.27 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,423 |

1,423 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

982 |

982 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

417 |

417 |

0 |

|

|

Zhenjiang Middle and far Sea |

417 |

417 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,256 |

3,356 |

100 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,774 |

2,774 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

12,922 |

13,846 |

924 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

307 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

38,306 |

39,330 |

1,024 |

|

Total |

|

38,306 |

39,330 |

1,024 |

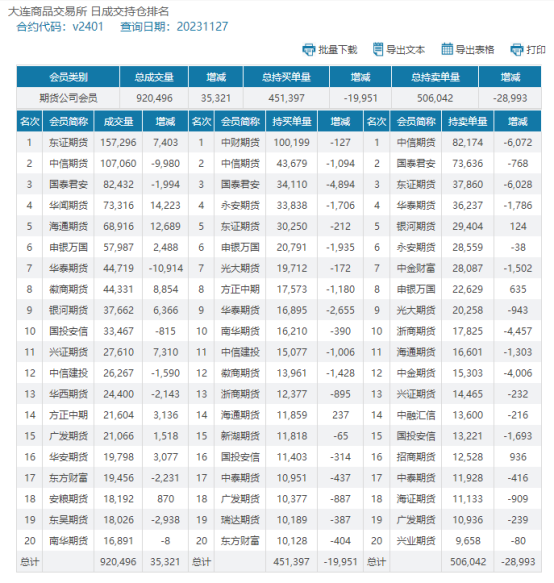

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.