PVC: Futures prices rebounded and repaired, coinciding with short-term partial departures on Friday, and the spot market rose slightly

PVC futures analysis: November 24th V2401 contract opening price: 5815, highest price: 5911, lowest price: 5813, position: 810111, settlement price: 5856, yesterday settlement: 5819, up: 37, daily trading volume: 686527 lots, precipitated capital: 3.347 billion, capital outflow: 75.08 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.23 |

Price 11.24 |

Rise and fall |

Remarks |

|

North China |

5600-5670 |

5650-5720 |

50/50 |

Send to cash remittance |

|

East China |

5670-5790 |

5710-5830 |

40/40 |

Cash out of the warehouse |

|

South China |

5690-5810 |

5740-5860 |

50/50 |

Cash out of the warehouse |

|

Northeast China |

5600-5720 |

5650-5720 |

50/0 |

Send to cash remittance |

|

Central China |

5680-5700 |

5710-5730 |

30/30 |

Send to cash remittance |

|

Southwest |

5550-5650 |

5600-5700 |

50/50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices rose slightly, prices for partial repair. Compared with the valuation, North China increased by 50 yuan / ton, East China by 40 yuan / ton, South China by 50 yuan / ton, Northeast region by 50 yuan / ton, Central China by 30 yuan / ton, and Southwest China by 50 yuan / ton. Upstream PVC production enterprises mostly maintain stable ex-factory prices, individual enterprises sporadically raised 30 yuan / ton, coinciding with Friday generation contract signing is not much. The spot market price offer has been raised, the futures price rose slightly in the afternoon, the price advantage of the base offer has been relatively weakened, and the point price offer 01 contract and 05 contract coexist. Among them, East China base offer 01 contract-(50-100-150), South China 01 contract-(20-50-100), North 01 contract-(400), Southwest 01 contract-(250), the basis has narrowed and strengthened. On the whole, the purchasing enthusiasm in the lower reaches of the Friday period is not high, the enthusiasm of hanging orders is general, and the trading atmosphere in the spot market is weak.

From the perspective of futures: & the opening price of the nbsp; PVC2401 contract is mainly volatile at night, and rose slightly at the end of the night. After the beginning of morning trading, the futures price was arranged and operated in a narrow range on the basis of night trading, and the price rose again in the afternoon and the upward range was OK in the late afternoon. 2401 the contract fluctuates from 5813 to 5911 throughout the day, with a spread of 98. 01. The contract reduced its position by 30426 hands, and so far it has held 810111 positions. The 2405 contract closed at 6077, with 210858 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices from the low slightly upside repair market, on the one hand coincided with Friday part of the short-term hot money left the market to avoid risk, the market showed a reduction of more than 30, 000 hands rhythm, on the one hand, the futures price since the high so far formed a 300-400 point decline, some short orders profit-taking. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) is still expanding, the KD line at the daily level crosses, and the dead fork trend of the MACD line continues. From the point of view of the current time node, the rebound repair of futures tends to rely on the reduction and departure of short orders, lack of substantial multi-factor support and the introduction of macro-level, and the range of upward materials will not be too large. Observe the performance in the range of 5850-5950.

Spot: futures prices in the two cities rose slightly, but there were few transactions in the spot market on Friday, and some downstream enterprises hung low orders to meet bargain replenishment, so after the futures price rose on Friday, the point price advantage disappeared and the market inquiry activity decreased, fully reflecting the trading trend of buying down but not buying up, but on the whole, the trading in the spot market during the week was still better than that in the early stage. At present, the variables on the supply and demand level of PVC are still generally good, the supply level is temporarily stable, and there are no more hype factors from the perspective of chlor-alkali balance, so it comes from the lack of fundamental direction. In the outer disk, oil prices fell by about 1%, as OPEC's postponement of the ministerial meeting raised expectations that its production cuts may not intensify next year. On the whole, the spot market continues to fluctuate mainly in a narrow range.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.23 |

Price 11.24 |

Rate of change |

|

V2401 collection |

5815 |

5901 |

86 |

|

|

Average spot price in East China |

5730 |

5770 |

40 |

|

|

Average spot price in South China |

5750 |

5800 |

50 |

|

|

PVC2401 basis difference |

-85 |

-131 |

-46 |

|

|

V2405 collection |

6013 |

6077 |

64 |

|

|

V2401-2405 closed |

-198 |

-176 |

22 |

|

|

PP2401 collection |

7424 |

7462 |

38 |

|

|

Plastic L2401 collection |

7854 |

7934 |

80 |

|

|

V--PP basis difference |

-1609 |

-1561 |

48 |

|

|

Vmure-L basis difference of plastics |

-2039 |

-2033 |

6 |

|

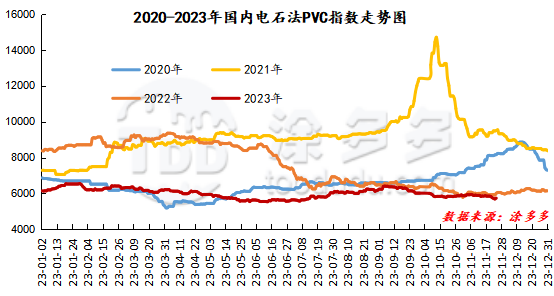

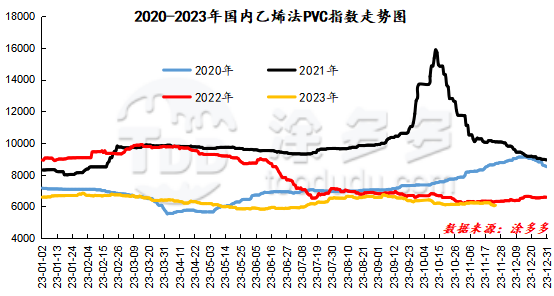

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC rose 43.01, or 0.755%, to 5736.90 on Nov. 24. The ethylene PVC spot index was 6077.02, up 26.32, with a range of 0.435%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 340.12.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.23 warehouse orders |

11.24 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,423 |

1,423 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

982 |

982 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

417 |

417 |

0 |

|

|

Zhenjiang Middle and far Sea |

417 |

417 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,256 |

3,256 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,760 |

2,774 |

14 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

12,922 |

12,922 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

307 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

38,292 |

38,306 |

14 |

|

Total |

|

38,292 |

38,306 |

14 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.