PVC: Futures short positions have returned strongly, Masukura has fallen below 6 digits, and the spot market has weakened significantly

PVC futures analysis: November 21 V2401 contract opening price: 6025, highest price: 6032, lowest price: 5912, position: 811110, settlement price: 5967, yesterday settlement: 6054, down: 87, daily trading volume: 1046568 lots, precipitated capital: 3.358 billion, capital inflow: 114 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.20 |

Price 11.21 |

Rise and fall |

Remarks |

|

North China |

5730-5770 |

5650-5720 |

-80/-50 |

Send to cash remittance |

|

East China |

5830-5930 |

5750-5870 |

-80/-60 |

Cash out of the warehouse |

|

South China |

5880-5930 |

5780-5880 |

-100/-50 |

Cash out of the warehouse |

|

Northeast China |

5650-5870 |

5650-5820 |

0/-50 |

Send to cash remittance |

|

Central China |

5830-5850 |

5760-5780 |

-70/-70 |

Send to cash remittance |

|

Southwest |

5700-5800 |

5650-5750 |

-50/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices fell more than negative, iterative last Friday continued to weaken. Compared with the valuation, it fell by 50-80 yuan / ton in North China, 60-80 yuan / ton in East China, 50-100 yuan / ton in South China, 50 yuan / ton in Northeast China, 70 yuan / ton in Central China and 50 yuan / ton in Southwest China. The factory prices of upstream PVC production enterprises are mostly reduced by 50 yuan / ton, including simultaneous downward quotations in remote libraries, lower PVC futures shocks, lower price quotations than yesterday, and weak spot market sentiment in various regions. It is difficult for merchants to ship goods at high prices, but the price advantage of basis quotation is more obvious, and the basis of each region has narrowed, among which East China basis offer 01 contract-(100-150-220), South China 01 contract-(110-130-200), North 01 contract-(470-530), Southwest 01 contract-(300), as a whole, after the prices of the two markets have gone down, the point price transaction has increased, and the transaction is mainly concentrated in the interval low price. Downstream bargain replenishment, the spot market trading atmosphere has improved.

Futures point of view: PVC2401 contract night trading opening price is slightly weaker, closed further lower and night trading fell below the prefix 6. Futures prices continued to decline after the start of morning trading, continued to increase positions and fell in intraday trading, and remained weak and low in the afternoon. 2401 contracts fluctuate in the range of 5912-6032 throughout the day, with a spread of 120,001 and an increase of 40409 positions, with 811110 positions so far. The 2405 contract closed at 6108, with 183222 positions.

PVC Future Forecast:

Futures: The futures price of PVC2401 contract began to plummet three times last Friday, and the operating low of today's futures broke through the support level of the lower track, and the downside short sentiment was obvious, in which the short opening of 27.0% was higher than that of 22.6%. The technical level shows that the opening of the third track of the Bollinger belt (13, 13, 2) is enlarged, the lower track turns rapidly down, and the daily KD line and MACD line show a dead-fork trend. And the downward trend of increasing positions for two consecutive days led to a weak disk atmosphere. The fundamentals of PVC are unable to support the price decline in the two markets. On the whole, there is still greater operating pressure on the trend of futures prices in the short term. Observe the performance of the second range 5800-5900, and pay attention to the previous low of 5858.

Spot aspect: overall commodity sentiment is slightly weak, especially chemical varieties, closed at noon, lithium carbonate fell more than 4%, liquefied petroleum gas (LPG), methanol fell more than 3%. PVC plate is a deep downward trend, the spot market prices have fallen across the board, but there is a rigid demand for replenishment in the lower reaches of the low range, mainly concentrated in the low price range. At present, the PVC supply and demand level provides few variables, high inventory and weak demand is a consensus, both manufacturers and merchants report poor shipments, only maintain rigid demand, and some of the generation of merchants have shrinking performance. The monthly export shipping price of Taiwan Formosa Plastics PVC12 rose by US $30, FOB Taiwan price US $730 (FOB), CIF Southeast Asia price US $770 (CFR), CIF Chinese mainland price US $775, CIF India price US $800, but the upward price did not drive current prices in both markets. In the short term, the operation of the spot market may still be low and weak.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.20 |

Price 11.21 |

Rate of change |

|

V2401 collection |

6014 |

5915 |

-99 |

|

|

Average spot price in East China |

5880 |

5810 |

-70 |

|

|

Average spot price in South China |

5905 |

5830 |

-75 |

|

|

PVC2401 basis difference |

-134 |

-105 |

29 |

|

|

V2405 collection |

6199 |

6108 |

-91 |

|

|

V2401-2405 closed |

-185 |

-193 |

-8 |

|

|

PP2401 collection |

7636 |

7516 |

-120 |

|

|

Plastic L2401 collection |

8078 |

7966 |

-112 |

|

|

V--PP basis difference |

-1622 |

-1601 |

21 |

|

|

Vmure-L basis difference of plastics |

-2064 |

-2051 |

13 |

|

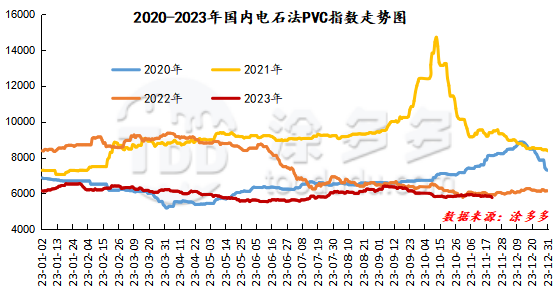

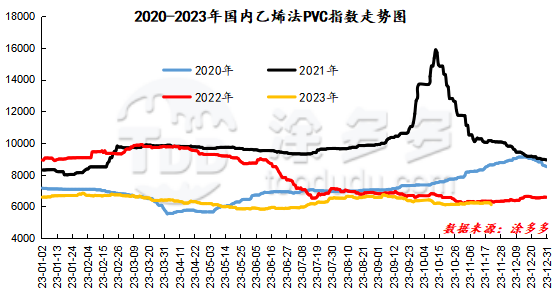

China PVC Index: the spot index of China's calcium carbide PVC fell 65.51, or 1.123%, to 5769.16 on Nov. 21, according to Tudor data. The ethylene PVC spot index was 6115.70, down 107.60, with a range of 1.729%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 346.54.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.20 warehouse orders |

11.21 warehouse receipts |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,383 |

1,383 |

0 |

|

Polyvinyl chloride |

Guangzhou materials |

441 |

441 |

0 |

|

Polyvinyl chloride |

China Central Reserve Nanjing |

942 |

942 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

417 |

417 |

0 |

|

Polyvinyl chloride |

Zhenjiang Middle and far Sea |

417 |

417 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,256 |

3,256 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,690 |

2,690 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

12,462 |

12,922 |

460 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

307 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Zhejiang Jianfeng) |

26 |

0 |

-26 |

|

PVC subtotal |

|

37,748 |

38,182 |

434 |

|

Total |

|

37,748 |

38,182 |

434 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.