Daily Review of Urea: Policies to ensure supply and stabilize prices, manufacturers 'quotations are lowered and consolidated (November 20)

China Urea Price Index:

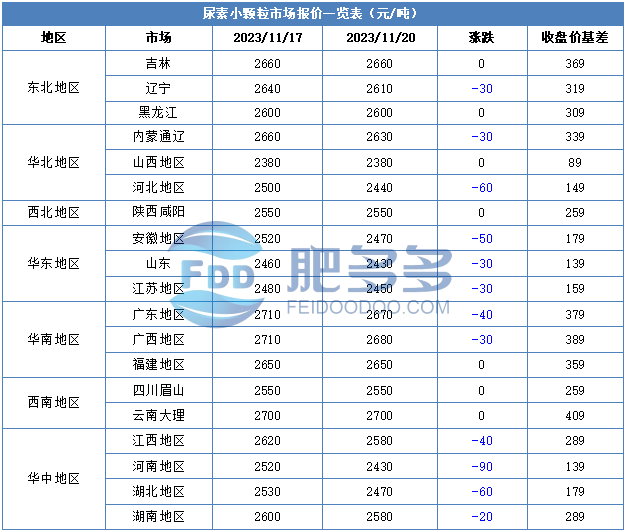

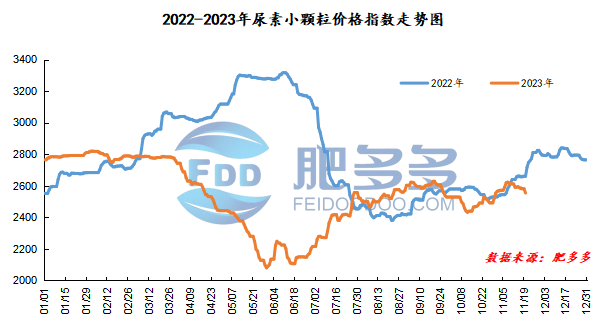

According to Feiduo data, the urea small pellet price index on November 20 was 2,554.68, down 26.82 from last Friday, down 1.04% month-on-month, and down 3.99% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2265, the highest price is 2304, the lowest price is 2250, the settlement price is 2276, and the closing price is 2291. The closing price is down 25 compared with the settlement price of the previous trading day, down 1.08% month-on-month. The daily fluctuation range is 2250-2304; the basis of the 01 contract in Shandong is 139; the 01 contract has reduced its position by 5973 lots today, and so far, it has held 255554 lots.

Spot market analysis:

Today, China's urea prices are consolidating downward. Affected by policy news, the market trading atmosphere is dull and many places are in a wait-and-see state. Manufacturers are forced to lower their factory quotations. Currently, prices are deadlocked and weak.

Specifically, prices in Northeast China fell to 2,590 - 2,640 yuan/ton. Prices in North China fell to 2,370 - 2,650 yuan/ton. Prices in the northwest region are stable at 2,550 - 2,560 yuan/ton. Prices in Southwest China are stable at 2,550 - 2,800 yuan/ton. Prices in East China fell to 2,410 - 2,470 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,430 - 2,640 yuan/ton, and the price of large particles fell to 2,560 - 2,700 yuan/ton. Prices in South China fell to 2,650 - 2,700 yuan/ton.

Market outlook forecast:

On the supply side, some companies have begun to increase production or resume production, and new production capacity has been released one after another. In addition, the existing production capacity in the market continues to maintain high start-up operations. Currently, corporate inventories have increased slightly and the supply side is relatively loose. In terms of the market, twelve fertilizer companies jointly proposed to ensure supply and stabilize prices, and spot prices were under pressure. In addition, in response to the supply guarantee work, the Nitrogen Fertilizer Association requires urea gas head companies not to stop production in winter and spring unless there are special circumstances, and to increase production as much as possible to ensure supply in the Chinese market. It is expected that supply in the Chinese market will continue to be high. On the demand side, affected by ensuring supply and stabilizing prices, orders were generally completed, and most operators held a wait-and-see attitude and waited for a further decline in urea prices. In terms of agricultural demand, winter reserves and short reserves are still in the process of continuous advancement. Industrial demand is expected to grow with the recovery of economic recovery, and market demand is expected to increase steadily.

On the whole, the urea market is currently affected by policies, its mood is unstable, and there is no good price support. It is expected that the urea market price will be weak and consolidated in a short period of time.