PVC: Futures encountered Black Friday, futures prices fell significantly within the intraday market, and spot prices loosened slightly

PVC futures analysis: November 17 V2401 contract opening price: 6137, highest price: 6160, lowest price: 6033, position: 733511, settlement price: 6089, yesterday settlement: 6116, down: 27, daily trading volume: 1064935 lots, precipitated capital: 3.111 billion, capital outflow: 49.46 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.16 |

Price 11.17 |

Rise and fall |

Remarks |

|

North China |

5780-5820 |

5750-5800 |

-30/-20 |

Send to cash remittance |

|

East China |

5900-5970 |

5850-5940 |

-50/-30 |

Cash out of the warehouse |

|

South China |

5900-5980 |

5900-5950 |

0/-30 |

Cash out of the warehouse |

|

Northeast China |

5650-5870 |

5650-5870 |

0/0 |

Send to cash remittance |

|

Central China |

5880-5920 |

5830-5870 |

-50/-50 |

Send to cash remittance |

|

Southwest |

5700-5800 |

5700-5800 |

0/0 |

Send to cash remittance |

PVC spot market: mainstream transaction prices in China's PVC market have loosened slightly and prices have weakened in various regions. Compared with the valuation, it fell by 20-30 yuan / ton in North China, 30-50 yuan / ton in East China, 30 yuan / ton in South China, stable in Northeast China, 50 yuan / ton in Central China and stable in Southwest China. Upstream PVC production enterprises factory prices slightly reduced 20-50 yuan / ton, some maintain a stable price wait-and-see, coinciding with Friday generation contract signing is not much. Futures are weak and downward, and the prices offered by traders in various regions have fallen slightly, and there is basically room for negotiation. After the futures price goes down, the order order is relatively increased, and there is a certain transaction in the low order. The basis of each region has expanded, including East China base offer 01 contract-(150-200-250), South China 01 contract-(130-200), North 01 contract-(500-550), Southwest 01 contract-(350). On the whole, the purchasing enthusiasm of the downstream has not changed greatly, the purchase order for bargain is on the low side, and the trading atmosphere in the spot market is slightly weak.

Futures point of view: PVC2401 contract night opening price is relatively high volatility, but the high price has not been maintained, and then weakened obviously. After the start of morning trading, futures prices fell further, the lowest point is 6033, afternoon prices rebounded slightly to repair, but not strong enough. 2401 contracts range from 6033 to 6160 throughout the day, with a spread of 127. 01 contracts reduced their positions by 2072 positions, and so far they have held 733511 positions. The 2405 contract closed at 6220, with 159370 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC2401 contract futures encountered Black Friday, the intraday decline was obvious, and the short opening of 23.5% was compared with 22.7% more. From the perspective of transaction trend, it is more inclined to short-term operation, and the fluctuation range of futures price is in line with our expectations. At present, the operation of the futures price is framed to run within a relatively narrow range. Relatively small adjustments make the trend line change frequently, especially the KD line at the daily level. The technical level shows that the opening of the Bollinger belt (13, 13, 2) tends to expand, and the futures price runs through the low point of the middle rail and approaches the position of the lower rail. In the short term, the operation of futures prices will continue the current trend, rising and falling dilemma, we still maintain the early judgment, the operation of futures prices to observe the performance in the range of 6000-6150.

Spot aspect: period the operation of the two cities is weak on Friday, the prices of the two cities are weak, there are certain transactions in the spot market low hanging orders, but only maintain rigid demand procurement, downstream products enterprises feedback is not good. For the current PVC spot market sales, the annual average profit is reduced obviously, especially the intermediate merchants feedback that the profit of PVC single product is less, and some merchants open up new chemical categories. From the perspective of chlor-alkali balance, the current two markets of PVC are mature, but when caustic soda futures are listed soon and fluctuate widely, some funds tend to pay more attention to caustic soda products. PVC current fundamentals are still weak, the market continues to outflow funds, the spot market is also lack of a certain degree of activity. In the outer disk, the price of the international crude oil futures market fell nearly 5%, and the US WTI oil price fell to its lowest level since July, as the market worried that the downturn in US economic data might lead to a slowdown in its oil demand, and pessimistic traders even thought that the current oil market was already oversupplied. On the whole, the spot market is still mainly adjusted in a narrow range in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.16 |

Price 11.17 |

Rate of change |

|

V2401 collection |

6137 |

6058 |

-79 |

|

|

Average spot price in East China |

5935 |

5895 |

-40 |

|

|

Average spot price in South China |

5940 |

5925 |

-15 |

|

|

PVC2401 basis difference |

-202 |

-163 |

39 |

|

|

V2405 collection |

6285 |

6220 |

-65 |

|

|

V2401-2405 closed |

-148 |

-162 |

-14 |

|

|

PP2401 collection |

7751 |

7705 |

-46 |

|

|

Plastic L2401 collection |

8186 |

8161 |

-25 |

|

|

V--PP basis difference |

-1614 |

-1647 |

-33 |

|

|

Vmure-L basis difference of plastics |

-2049 |

-2103 |

-54 |

|

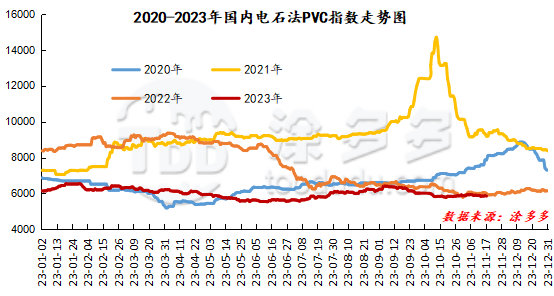

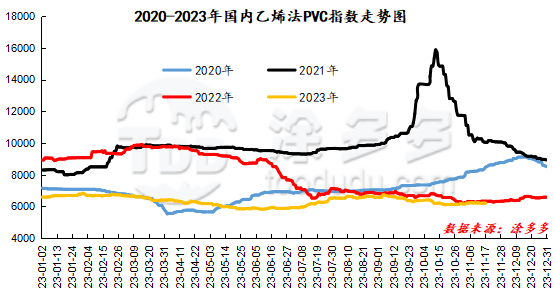

China PVC Index: according to Tuduoduo data, the spot index of China's calcium carbide PVC fell 26.57, or 0.452%, to 5849.96 on November 17. The ethylene PVC spot index was 6211.93, down 3.6, with a range of 0.058%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 361.97.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.16 warehouse orders |

11.17 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,383 |

1,383 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

942 |

942 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

417 |

417 |

0 |

|

|

Zhenjiang Middle and far Sea |

417 |

417 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,256 |

3,256 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,690 |

2,690 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

12,395 |

12,462 |

67 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

307 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

Tiantai International Trade (Zhejiang Jianfeng) |

26 |

26 |

0 |

|

Total |

|

37,681 |

37,748 |

67 |

|

|

|

37,681 |

37,748 |

67 |

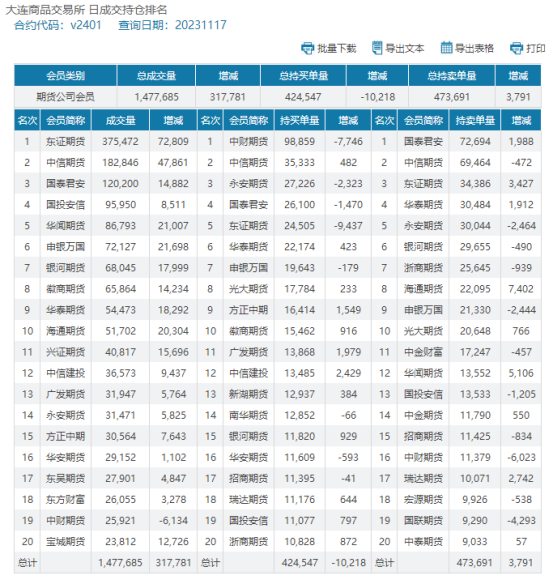

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.