PVC: Futures returned to the previous range, lightened positions and left the market in advance, and the spot market adjusted within a narrow range

PVC futures analysis: November 15 V2401 contract opening price: 6080, highest price: 6118, lowest price: 6039, position: 748823, settlement price: 6074, yesterday settlement: 6054, up: 20, daily trading volume: 938256 lots, precipitated capital: 3.204 billion, capital outflow: 85.26 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.14 |

Price 11.15 |

Rise and fall |

Remarks |

|

North China |

5780-5810 |

5750-5800 |

-30/-10 |

Send to cash remittance |

|

East China |

5870-5950 |

5870-5970 |

0/20 |

Cash out of the warehouse |

|

South China |

5900-5950 |

5880-5950 |

-20/0 |

Cash out of the warehouse |

|

Northeast China |

5700-5870 |

5650-5870 |

-50/0 |

Send to cash remittance |

|

Central China |

5830-5850 |

5830-5850 |

0/0 |

Send to cash remittance |

|

Southwest |

5700-5800 |

5700-5800 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price adjustment is narrow, and the fluctuation range is small. Compared with the valuation, it fell 10-30 yuan / ton in North China, 20 yuan / ton in East China, 20 yuan / ton in South China, 50 yuan / ton in Northeast China, and stable in Central China and Southwest China. Upstream PVC production enterprises factory prices continue to be stable, the production enterprises are not willing to adjust prices, but the first generation of contracts are also less signed, some businesses wait and see mainly. The futures price is slightly stronger, and the price offered by merchants in the spot market does not change much, and some of them are adjusted slightly. There is no obvious advantage in the offer price in the morning. as the futures rise, some traders cancel the negotiations, and the basis offer is weak. among them, East China 01 contract-(150-200), South China 01 contract-(110-170), North 01 contract-(500-550), Southwest 01 contract-(300), the spot market is still slightly poor, the transaction atmosphere is weak, and the downstream hanging order is mainly low. The spot price advantage disappears after the futures go up.

From the perspective of futures: & the opening price of nbsp; PVC2401 contract is mainly arranged in a narrow range, while the intraday price is slightly weaker. After the start of morning trading, futures prices continued to fluctuate on the basis of night trading, rising slightly at the end of the morning, and continuing to break through the 6100 mark at the end of the afternoon. 2401 contracts fluctuate in the range of 6039-6118 throughout the day, with a spread of 79. 01. The contract increased its position by 23846 hands, with 748823 positions so far. The 2405 contract closed at 6263, with 147828 positions.

PVC Future Forecast:

Futures: & the operation of the futures price of the nbsp; PVC2401 contract continues to rise slightly, and the current volatility range of the futures price returns to the previous state, and the trading continues to reduce positions, of which 22.5% of the short opening is compared with 21.8% more. The corresponding disk level increases by 26.6% compared to 23.8%. The increase in short-range further contributed to the slight rise in futures prices. The technical level shows that the opening of the Bollinger belt (13, 13, 2) is flat, and the KD line and MACD line at the daily level show a slightly golden fork trend. At the close of midday, the main contracts of Chinese futures were floating red in a large area, and PVC also followed the overall commodity sentiment to repair upwards. in the short term, futures prices or early repeats continued to maintain the trend of narrow adjustment and observe the pressure performance in the upper 6150 direction.

Spot aspect: The rise of the two cities is more inclined to be driven by commodity sentiment, and today's commodity sentiment shows a slight upward repair. in the overall macro environment, unless there are more special fundamentals, it is more difficult for a single product to get out of a separate market, and PVC is also affected by this to rise slightly with the overall rise, but the feedback from the spot market is poor, and spot prices do not show obvious improvement, especially in terms of transactions. Downstream products enterprises low-price rigid demand for replenishment, and the current downstream demand is gradually shrinking, businesses in various regions continue to feedback poor shipping rhythm. Real estate data from January to October, national investment in real estate development was 9.5922 trillion yuan, down 9.3% from the same period last year (down 9.1% from January to September). In the outer disk, the price of the international crude oil futures market closed basically stable, and the market weighed the prospect of supply and demand and the impact of US inflation data on its monetary policy. The International Energy Agency (IEA) has raised its forecast for global oil demand growth, but supply concerns caused by the Israeli-Palestinian conflict have been further eased, and US crude oil stocks are expected to rise. On the whole, it is difficult to have more directional fluctuations in the current spot market, which is still dominated by narrow adjustment.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.14 |

Price 11.15 |

Rate of change |

|

V2401 collection |

6081 |

6112 |

31 |

|

|

Average spot price in East China |

5910 |

5920 |

10 |

|

|

Average spot price in South China |

5925 |

5915 |

-10 |

|

|

PVC2401 basis difference |

-171 |

-192 |

-21 |

|

|

V2405 collection |

6215 |

6263 |

48 |

|

|

V2401-2405 closed |

-134 |

-151 |

-17 |

|

|

PP2401 collection |

7671 |

7733 |

62 |

|

|

Plastic L2401 collection |

8059 |

8161 |

102 |

|

|

V--PP basis difference |

-1590 |

-1621 |

-31 |

|

|

Vmure-L basis difference of plastics |

-1978 |

-2049 |

-71 |

|

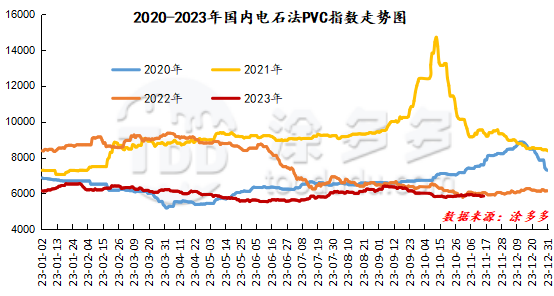

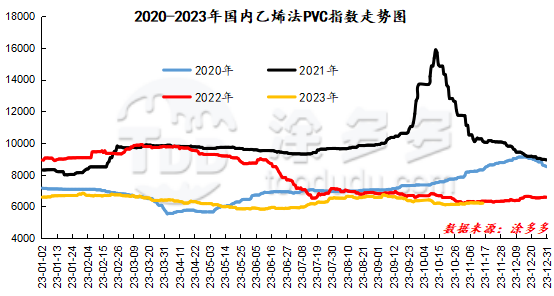

China PVC Index: according to Tuduoduo data, the spot index of China's calcium carbide PVC fell 4.9 or 0.084% to 5853.99 on November 15. The ethylene PVC spot index was 6206.91, down 0.54, with a range of 0.009%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 352.92.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.14 warehouse orders |

11.15 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,383 |

1,383 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

942 |

942 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

417 |

66 |

|

|

Zhenjiang Middle and far Sea |

351 |

417 |

66 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,256 |

3,256 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,150 |

2,690 |

540 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

12,395 |

12,395 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

307 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

Tiantai International Trade (Zhejiang Jianfeng) |

26 |

26 |

0 |

|

Total |

|

37,075 |

37,681 |

606 |

|

|

|

37,075 |

37,681 |

606 |

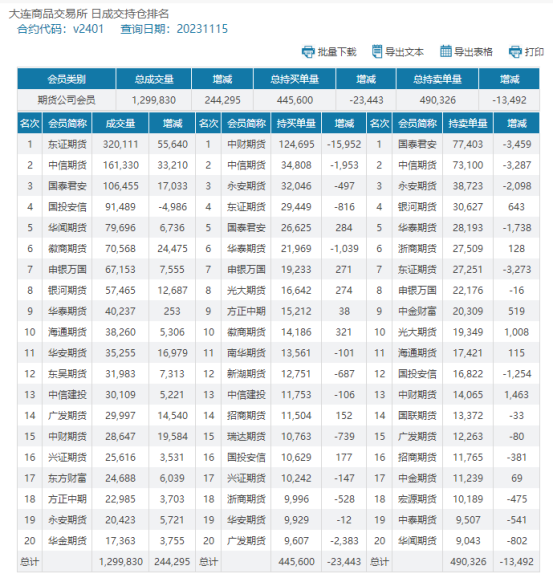

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.