Daily Review of Urea: Urea prices rise again and the market is in a stalemate (November 15)

China Urea Price Index:

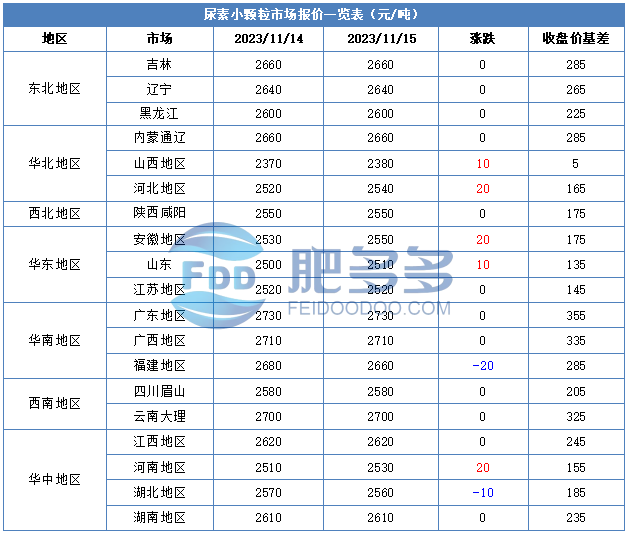

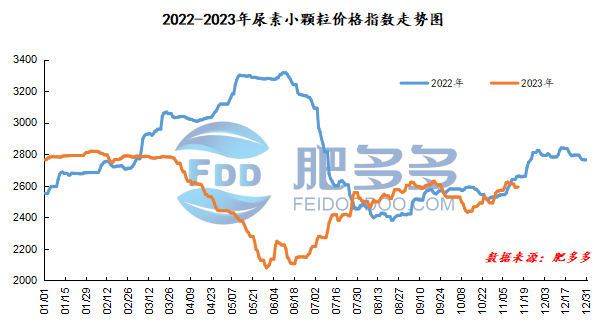

According to Feiduo data, the urea small pellet price index on November 15 was 2,595.14, up 2.27 from yesterday, up 0.09% month-on-month, and down 2.56% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract: 2374, the highest price: 2388, the lowest price: 2344, the settlement price: 2368, the closing price: 2375. The closing price is stable compared with the settlement price of the previous trading day, with a fluctuation range of 2344-2388 throughout the day; the basis of the 01 contract in Shandong is 135; the 01 contract has reduced its position by 13878 lots today, and has held 291975 lots so far.

Spot market analysis:

Today, China's urea prices continue to increase slightly. Most manufacturers have better orders and are currently more willing to support prices and have increased their factory quotations.

Specifically, prices in Northeast China have stabilized at 2,590 - 2,660 yuan/ton. Prices in North China rose to 2,380 - 2,680 yuan/ton. Prices in the northwest region are stable at 2,550 - 2,560 yuan/ton. Prices in Southwest China are stable at 2,550 - 2,800 yuan/ton. Prices in East China rose to 2,490 - 2,550 yuan/ton. The price of small and medium-sized particles in Central China has risen to 2,520 - 2,660 yuan/ton, and the price of large particles has stabilized at 2,610 - 2,730 yuan/ton. Prices in South China fell to 2,660 - 2,740 yuan/ton.

Market outlook forecast:

In terms of supply, some enterprises have recently overhauled their equipment and stopped gas-head urea production, resulting in a slight decrease in the current market supply, but it is still at a high level in the same period, and the supply is relatively sufficient. In terms of manufacturers, the transactions of low-quoted upstream factories have improved, and their factory quotations have been slightly increased. However, the transactions of enterprises with higher previous quotations have been worse. There are many low market transactions, and prices are operating firmly. On the market side, futures prices have fallen as the exchange abolished futures fee margins. Currently, downstream purchasing willingness has been lowered again, waiting for low-priced goods to emerge in the market. On the demand side, agricultural demand for winter storage is slowly following up and has a wait-and-see attitude; industrial compound fertilizer companies have low inventories and high demand for urea. They are currently actively purchasing in the market and seeking more low-level replenishment.

On the whole, the policy stabilization of prices has led to an increase in wait-and-see sentiment in downstream urea procurement. However, manufacturers still have the willingness to accumulate stocks despite low inventories. The overall market atmosphere is deadlocked. It is expected that the urea market price will continue to fluctuate slightly in the short term.