PVC: Futures experienced minor repairs after a deep decline, hot money reduced its position in the short term, and spot prices adjusted slightly

PVC futures analysis: November 14 V2401 contract opening price: 6017, highest price: 6085, lowest price: 6012, position: 772669, settlement price: 6054, yesterday settlement: 6059, down: 5, daily trading volume: 758430 lots, precipitated capital: 3.289 billion, capital outflow: 76.44 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.13 |

Price 11.14 |

Rise and fall |

Remarks |

|

North China |

5730-5780 |

5780-5810 |

50/30 |

Send to cash remittance |

|

East China |

5850-5920 |

5870-5950 |

20/30 |

Cash out of the warehouse |

|

South China |

5860-5920 |

5900-5950 |

40/30 |

Cash out of the warehouse |

|

Northeast China |

5700-5870 |

5700-5870 |

0/0 |

Send to cash remittance |

|

Central China |

5830-5850 |

5830-5850 |

0/0 |

Send to cash remittance |

|

Southwest |

5700-5800 |

5700-5800 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices slightly upward repair, but less efforts. Compared with the valuation, North China rose 30-50 yuan / ton, East China increased 20-30 yuan / ton, South China increased 30-40 yuan / ton, and Northeast, Central and Southwest regions were stable. The ex-factory price of upstream PVC production enterprises is mainly stable, and there is no obvious adjustment trend. Futures prices from the low slightly upward repair, the range is not large, the price of traders in various regions increased yesterday, but the transaction is still concentrated within the low price range. In the spot market, both the spot price and the spot price coexist, and some of the bases are slightly weaker, including East China basis offer 01 contract-(150-170-200), South China 01 contract-(110-150-200), North 01 contract-(500-550), Southwest 01 contract-(300), downstream purchasing enthusiasm weakens, some small orders for bargains are mainly purchased, and the point of view is generally low, and the trading atmosphere in the spot market is weak. Turnover in the overall spot market is limited.

From the perspective of futures: & the opening price of the nbsp; PVC2401 contract is low and narrow in the night trading, and it rose slightly in the late trading. Futures prices continued to rise after the start of early trading, but the upward strength was insufficient, and the upward did not break through the integer barrier, and afternoon prices fluctuated relatively high during the day. 2401 contracts range from 6012 to 6085 throughout the day, with a spread of 73. 01 contracts with an increase of 27031 positions and 772669 positions so far. The 2405 contract closed at 6215, with 142892 positions.

PVC Future Forecast:

Futures: The futures price of the PVC2401 contract fell deeply on Monday, and the trend of the futures price today has been slightly repaired, but the low point of the futures price still touches the lower track of the Bollinger belt. The technical level shows that the opening of the Bollinger belt (13, 13, 2) still has a downward trend, but the distance between the three tracks is narrowing, and the recent trend of relatively narrow adjustment still makes the trend lines at the technical level lack sufficient guidance. In particular, the two trends of the KD line at the daily line level appear alternately, but the distance between the two lines of MACD gradually narrows. Although the futures price shows a small repair, we still believe that the current time node bears still have enough room to carry out, we continue to maintain the early judgment of the operation of the price there is still a certain risk, but the short-term continues to observe the performance of the low 6.

Spot aspect: spot market presents buy down do not buy up the current operation has become a trend, after today's futures price slightly upside repair, downstream products enterprises inquiry enthusiasm is weakened, the actual order transaction is still low hanging order. Judging from this characteristic, the consensus of the overall industrial chain is that the supply of goods in the current spot market is still not digested smoothly, and there are varying degrees of sales pressure on both production enterprises and traders. Especially in the face of off-season and late Spring Festival accumulation expectations, the current period of signing and pre-sale is becoming more and more obvious. At present, the rising power of the PVC market mainly depends on the pull of the macro level and the policy level, and the weak fundamentals have always become shackles. Therefore, even if the short-term uplink pressure is also greater, but the current two cities of the downward part of the industrial chain that the same will not appear deep downside. In the short term, the spot market may still continue the trend of narrow consolidation, but when the basis is too large, the delivery of 01 contracts and the generation of warehouse receipts are gradually put on the agenda.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.13 |

Price 11.14 |

Rate of change |

|

V2401 collection |

6012 |

6081 |

69 |

|

|

Average spot price in East China |

5885 |

5910 |

25 |

|

|

Average spot price in South China |

5890 |

5925 |

35 |

|

|

PVC2401 basis difference |

-127 |

-171 |

-44 |

|

|

V2405 collection |

6166 |

6215 |

49 |

|

|

V2401-2405 closed |

-154 |

-134 |

20 |

|

|

PP2401 collection |

7630 |

7671 |

41 |

|

|

Plastic L2401 collection |

8032 |

8059 |

27 |

|

|

V--PP basis difference |

-1618 |

-1590 |

28 |

|

|

Vmure-L basis difference of plastics |

-2020 |

-1978 |

42 |

|

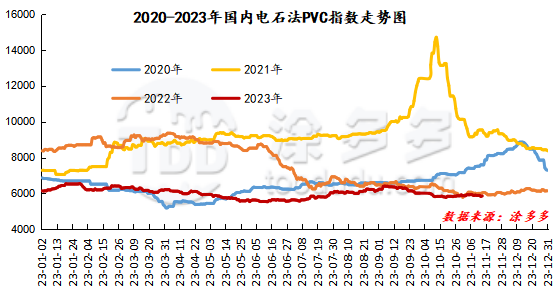

China PVC Index: according to Tudor data, the spot index of China's calcium carbide PVC rose 23.46, or 0.402%, to 5858.89 on Nov. 14. The ethylene method PVC spot index is 6207.45, up 6.69, the range is 0.108%, the calcium carbide method index rises, the ethylene method index rises, the ethylene method-calcium carbide method index price difference is 348.56.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.13 warehouse orders |

11.14 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,383 |

- |

- |

|

|

Guangzhou materials |

441 |

- |

- |

|

|

China Central Reserve Nanjing |

942 |

- |

- |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

- |

- |

|

|

Zhenjiang Middle and far Sea |

351 |

- |

- |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,256 |

- |

- |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

- |

- |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,150 |

- |

- |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

12,395 |

- |

- |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

- |

- |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

- |

- |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

- |

- |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

- |

- |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

- |

- |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

- |

- |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

- |

- |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

- |

- |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

- |

- |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

- |

- |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

- |

- |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

- |

- |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

- |

- |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

- |

- |

|

Polyvinyl chloride |

Sinotrans East China |

307 |

- |

- |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

- |

- |

|

PVC subtotal |

Tiantai International Trade (Zhejiang Jianfeng) |

26 |

- |

- |

|

Total |

|

37,075 |

- |

- |

|

|

|

37,075 |

- |

- |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.