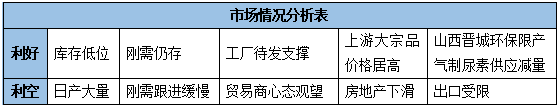

Analysis of factors influencing recent urea market price changes

Introduction: over the past month, urea prices continue to rise, what are the reasons? A brief analysis of the market situation is needed.

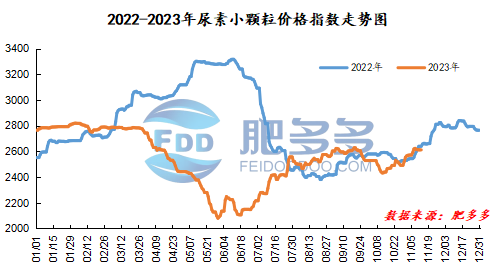

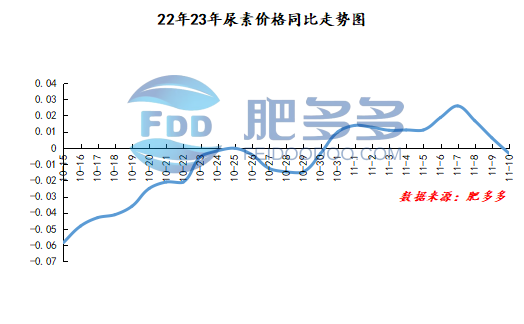

Introduction: since mid-October, the trend of urea price has increased steadily, and the price index has risen sharply and slightly, climbing all the way up, reaching a peak of 2624.68 yuan / ton on November 8, an increase of 1.68 percent over the same period last year. Why is the price trend of urea so strong? is it a change in supply or a significant increase in demand?

Market Overview:

Supply and demand:

On the supply side, the daily output of urea is still between 175 and 180000 tons, which is about 30, 000 tons higher than the same period last year, and the high supply is still there. In the next two months, the new production capacity will enter a vacuum period. Due to the maintenance of some plants, production restrictions on environmental protection and production restrictions in the airhead urea plant after November, the supply margin is weakening.

On the demand side, the overall demand activity of the market is not high, compound fertilizer is in the off-season of production, and the industry is mainly used on demand. The recent price rise slows down, fluctuates slightly in stability, and there are still expectations in the medium term. In agriculture, the demand for reserve procurement is dominant in the off-season. Although there are signs of delay in the procurement of light storage in the near future, under the requirement of the rigid procurement bottom line of 50% of the standard scale of reserve in the third month, the market procurement demand is still there one after another. in addition to light storage procurement, the follow-up of reserve demand in the northeast market can not be ignored. at present, procurement in the northeast market is mainly large particles, small and medium-sized particles on demand procurement. In terms of industry, starting from November, compound fertilizer enterprises will enter the peak season of high-nitrogen compound fertilizer production, and the demand for raw material urea procurement by compound fertilizer enterprises will rise month-on-month in the fourth quarter. It is expected that the demand for urea will increase when the operating rate continues to rise.

Upstream and downstream:

Factory order pressure relief, the mentality of more price, waiting for hair support, factory quotation homeopathic upward. Traders have a small amount of rigid demand, their mentality is more cautious and wait-and-see, and their willingness to purchase is not strong, and they are currently in a state of game among manufacturers. In contrast, the prices of crude oil, coal and natural gas remain high in the upstream, delaying the time that urea should fall in September, and the decline is limited under the support of costs; in addition, affected by the decline in real estate, the demand for urea for melamine in the lower reaches has declined, including the price of urea for vehicles related to housing construction.

In terms of policy:

Affected by the attribute of urea as an agricultural product, the rise of its price is easily regulated by national policies. Among them, affected by the production limit of environmental protection policy in Jincheng, Shanxi Province, urea supply fell in the fourth quarter. Relevant documents show that coal chemical enterprises such as Jinneng holding equipment Manufacturing Group, Orchid Kechuang, and Tianze Group will adopt a certain degree of production limitation. the overall production limit is 43%. In addition, under the influence of a large number of urea exports this year, China's supply has been reduced, and China's urea market reserves have to be postponed. In order to ensure China's supply, most enterprises have issued export suspension statements and guaranteed supply initiatives, and under policy constraints, the price rise has slowed down. Secondly, the fourth quarter will enter China's natural gas limit stage, gas-to-urea enterprises will be affected, gas-to-urea supply will be reduced, disturbing the supply side.

For export:

The policy of ensuring supply and stabilizing prices has put pressure on urea exports. at present, the export inspection cycle has increased from 30 working days to 60 working days, and the export policy has been tightened. Port inventory still has early export orders, the shipping date is from November to December, but under the situation of tighter legal inspection, the number of new export orders is expected to decrease in the future. In terms of label printing, the number of tenders in October reached 1.63 million tons, and the possibility of further bidding has not been ruled out, and the uncertainty of specific export policies in the follow-up still needs continuous attention.

On the international front:

A survey shows that the global purchase of nitrogen fertilizer this year is higher than the same period in previous years, the increase of global fertilizer use. In terms of printing, the logo was printed on October 25, but under the situation of export restrictions, China participated in a small amount, most manufacturers suffered a blow to the bullish mentality, and prices fell slightly. In overseas markets, on October 29, Egypt announced that it would weaken urea production due to a shortage of natural gas. The supply of urea in Egypt decreased, raising the international market price, and the Chinese market price also rose synchronously.