PVC: Review of the strength of futures short positions, the downside risk of increased positions fell below the beginning of 6, and the spot market price was traded

PVC futures analysis: November 13 V2401 contract opening price: 6102, highest price: 6141, lowest price: 6002, position: 799700, settlement price: 6059, yesterday settlement: 6125, down: 66, daily trading volume: 1063629 lots, precipitated capital: 3.365 billion, capital inflow: 64.62 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.10 |

Price 11.13 |

Rise and fall |

Remarks |

|

North China |

5800-5830 |

5730-5780 |

-70/-50 |

Send to cash remittance |

|

East China |

5950-5990 |

5850-5920 |

-100/-70 |

Cash out of the warehouse |

|

South China |

5930-5980 |

5860-5920 |

-70/-60 |

Cash out of the warehouse |

|

Northeast China |

5700-5900 |

5700-5870 |

0/-30 |

Send to cash remittance |

|

Central China |

5830-5880 |

5830-5850 |

0/-30 |

Send to cash remittance |

|

Southwest |

5700-5800 |

5700-5800 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices fell slightly, the atmosphere was slightly bad at the beginning of the week. Compared with the valuation, it fell by 50-70 yuan / ton in North China, 70-100 yuan / ton in East China, 60-70 yuan / ton in South China, 30 yuan / ton in Northeast China, 30 yuan / ton in Central China, and stable in Southwest China. Upstream PVC production enterprise factory price part reduced 50 yuan / ton, some enterprises stable quotation wait-and-see, but Monday session first-generation contract signing is not much. After the weakening of the futures price, the price offer in the spot market decreased obviously compared with last Friday, and there was no real single transaction. After the futures price went down, the price advantage of the basis offer was more obvious, and the basis narrowed slightly. Among them, East China base difference offer 01 contract-(100-150-200), South China 01 contract-(110-150-200), North 01 contract-(500-550), Southwest 01 contract-(300) Downstream products enterprises mainly replenish goods on bargain, and the point price hanging order range is concentrated at 6000-6020 points. There is a certain deal for the order at a low price.

From the perspective of futures: & the night price of nbsp; PVC2401 contract is mainly volatile, and the direction of intraday volatility becomes narrow and unknown. After the start of morning trading on Monday, futures prices declined significantly, intraday prices continued to fall, the lowest point risk fell below the prefix of 6, and afternoon prices continued the trend of low consolidation. 2401 contracts fluctuate in the range of 6002-6141 throughout the day, with a spread of 139. 01 contracts with an increase of 26670 positions and 799700 positions so far. The 2405 contract closed at 6166, with 141176 positions.

PVC Future Forecast:

Futures: The downward range of PVC2401 contract prices is relatively obvious after the start of early trading on Monday. First of all, the volatility of futures prices has changed from the previous narrow situation, and the volatility of futures has expanded. On the other hand, it has changed the state of relative horizontal trading in the past, resulting in a return to the downward trend of short positions. In terms of trading, the price of short opening is 25.5% higher than that of 23.2% higher, and the price of futures increases accordingly, and the futures price shows an obvious downward trend under the joint action of the hatchback. The technical level shows that the opening of the Bollinger belt (13, 13, 2) expands, and the low point of the futures price breaks through the support level of the lower track. In the short term, there is still further weakening pressure on the futures price operation of the market, and the downward trend of breaking the track is to observe the performance of the first target position 5900.

Spot aspect: The operation of the futures market is as we expected, regardless of the support and reasons, the futures price showed a small upward performance of nearly 6200 in the middle and first ten days of November, but in view of the time node and the rhythm dominated by short positions, the futures price will still show a deep downward trend, and the current trend of the two markets is in line with our early forecasts, which also confirms our view on the 01 contract as a whole. Spot market today there are some transactions, rigid demand exists but the spot market to buy down but not buy up, the current PVC fundamentals are weak to become a consensus, and today's calcium carbide cost port calcium carbide appears downward. Under the weak pattern of the two cities, while there is no external force and policy, there is a certain inevitability of price weakening, and the current basis of each region expands. We also mentioned in the previous forecast that we should be vigilant against the expansion of the base differential. expect a deep correction in the prices of the two cities. On the whole, PVC prices in the spot market may still face some operating pressure in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.10 |

Price 11.13 |

Rate of change |

|

V2401 collection |

6100 |

6012 |

-88 |

|

|

Average spot price in East China |

5970 |

5885 |

-85 |

|

|

Average spot price in South China |

5955 |

5890 |

-65 |

|

|

PVC2401 basis difference |

-130 |

-127 |

3 |

|

|

V2405 collection |

6245 |

6166 |

-79 |

|

|

V2401-2405 closed |

-145 |

-154 |

-9 |

|

|

PP2401 collection |

7710 |

7630 |

-80 |

|

|

Plastic L2401 collection |

8162 |

8032 |

-130 |

|

|

V--PP basis difference |

-1610 |

-1618 |

-8 |

|

|

Vmure-L basis difference of plastics |

-2062 |

-2020 |

42 |

|

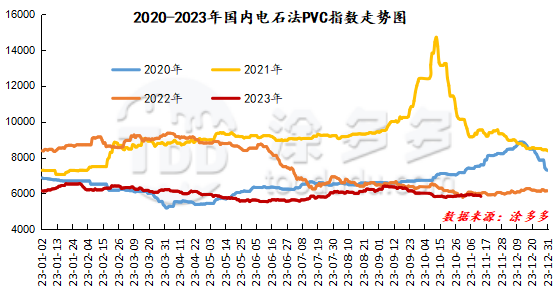

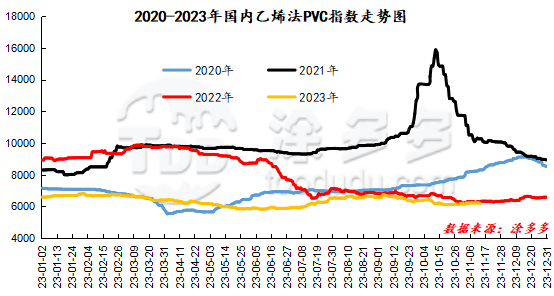

China PVC Index: according to Tuduoduo data, the spot index of China's calcium carbide PVC fell 54.89, or 0.932%, to 5835.43 on November 13. The ethylene method PVC spot index is 6200.76, down 25.01, the range is 0.402%, the calcium carbide method index falls, the ethylene method index drops, the ethylene method-calcium carbide method index price difference is 365.33.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.10 warehouse orders |

11.13 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,143 |

1,383 |

240 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

702 |

942 |

240 |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

351 |

0 |

|

|

Zhenjiang Middle and far Sea |

351 |

351 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,256 |

3,256 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,843 |

1,843 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,150 |

2,150 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

12,133 |

12,395 |

262 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

180 |

180 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

307 |

33 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

Tiantai International Trade (Zhejiang Jianfeng) |

0 |

26 |

26 |

|

Total |

|

36,514 |

37,075 |

561 |

|

|

|

36,514 |

37,075 |

561 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.