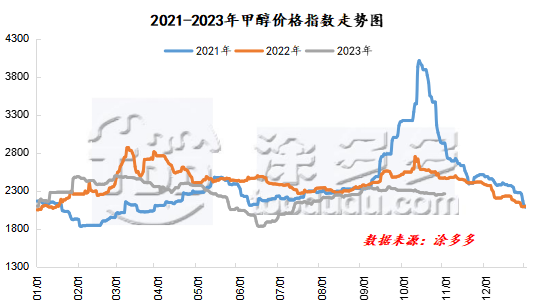

Methanol: Futures rose and fell back. Chinese quotations showed a regional trend

On November 10th, the methanol market price index was 2275.79, up 1.54 from yesterday and 0.07 per cent higher than yesterday.

Outer disk dynamics:

Methanol closed on November 9th:

China CFR 289-290 US dollars / ton, down 1 US dollars / ton

European FOB 347.5-348.5 euros / ton, flat

Us FOB 103-105 cents per gallon, flat

Southeast Asia CFR 349-350USD / ton, flat.

Summary of today's prices:

Guanzhong: 2190-2550 (0), North Route: 2065-2100 (0), Lunan: 2380 (30), Henan: 2280-2300 (0), Shanxi: 2200-2250 (0), Port: 2480-2500 (- 25)

Freight:

North Route-Northern Shandong 200-280 (0ax 0), Southern Route-Northern Shandong 250-290 (0max 0), Shanxi-Northern Shandong 110-170 (0max 0), Guanzhong-Southwest Shandong 140-190 (0max 0)

Spot market: today, methanol futures rose and fell, and the trading atmosphere in the spot market was slightly mediocre. At present, the Chinese market is still in the game stage, and the cautious mood of operators is obvious. Specifically, the market quotations in the main producing areas are adjusted in a narrow range, with today's quotation of 2065-2100 yuan / ton on the north line and 2050-2060 yuan / ton on the south line. Recently, some methanol plants in northwest China are in negative storage and shutdown operations, and the supply in some areas is narrowly tightened. Superimposed with the news of methanol production increment from olefin plants, it is good for the market atmosphere and supports the mentality of operators. Ningxia quotation is running at a high price under the support of low supply, and the manufacturers' price attitude is strong. From the point of view of Shandong, the main consumer area, at present, the inventory of mainstream manufacturers in the region is under a little pressure, and downstream manufacturers mainly need to replenish goods at low prices, and the overall market atmosphere is general. Lunan quoted price of 2380 yuan / ton today, 30 yuan / ton higher than yesterday. Lubei quoted price of 2350-2370 yuan / ton. The market price in central China is adjusted in a narrow range, with Henan quoted price of 2280-2300 yuan / ton and Lianghu quoted price of 2450-2630 yuan / ton. downstream demand has not improved significantly in the short term, maintaining rigid demand for procurement. Quotations in other regions of China have also been adjusted to varying degrees.

Port market: methanol futures fell today. Morning futures are high, unilateral high shipments are active, arbitrage buying orders are cautious, the basis is weaker, and the inter-month spread is widening; in the afternoon, as futures fall, selling decreases and the basis is repaired. The overall transaction throughout the day is not bad. Taicang main port transaction price; spot / 11: 2465-2505, basis 01-25 Maximus 11 :2485-2520, basis 01-15 Maxima 11 :2485-2535, basis 01-5 Universe: 12 transactions :2500-2545, basis 01-10 Universe 17.

|

Area |

2023/11/10 |

2023/11/9 |

Rise and fall |

|

The whole country |

2275.79 |

2274.25 |

1.54 |

|

Northwest |

2050-2250 |

2050-2250 |

0/0 |

|

North China |

2200-2320 |

2200-2300 |

0/20 |

|

East China |

2480-2550 |

2505-2570 |

-25/-20 |

|

South China |

2480-2560 |

2480-2560 |

0/0 |

|

Southwest |

2400-2570 |

2400-2570 |

0/0 |

|

Northeast China |

2350-2480 |

2350-2480 |

0/0 |

|

Shandong |

2350-2350 |

2320-2360 |

30/-10 |

|

Central China |

2280-2630 |

2280-2630 |

0/0 |

Forecast in the future: recently, the start-up of some regional markets in China has declined, the 400000-ton natural gas methanol plant in Lutianhua has been stopped for overhaul, and the 400000-ton methanol plant in Shenmu Phase II of Shaanxi Province has been temporarily shut down on November 9 and is expected to resume in about a week. local supply has been reduced, and recently there has been news of olefin production, under the support of double positive support, the market price shows a regional trend. However, considering that the current downstream demand follow-up is limited and the market transaction volume is not good, generally speaking, the driving force of methanol market price rise may be relatively limited in the short term, but in the later stage, it is necessary to pay close attention to the operation of air head units in southwest China and the start-up of traditional downstream demand affected by seasonal factors.

Recent operation of the device:

|

Name of production enterprise |

Annual capacity; ten thousand tons |

Raw material |

Starting date of maintenance |

Maintenance end date |

Operation of the device |

|

Shaanxi Weihua |

20 |

Coal |

2023/10/9 |

2023/10/30 |

Restarted |

|

Inner Mongolia black cat |

30 |

Coke oven gas |

2023/10/17 |

2023/10/31 |

Restarted |

|

Shanxi Ganyang |

30 |

Coke oven gas |

2023/10/20 |

2023/10/31 |

Restarted |

|

Guizhou Tianfu |

20 |

Coal |

2023/10/29 |

2023/11/8 |

Parking maintenance |

|

Yunnan Pioneer |

50 |

Coal |

2023/10/28 |

2023/11/19 |

Parking maintenance |

|

Yunnan qu coal |

20 |

Coke oven gas |

2023/10/30 |

2023/11/6 |

Parking maintenance |

|

Yulin Yanzhou Mine |

60 |

Coal |

2023/11/2 |

2023/11/5 |

Restarted |

|

Oweigan yuan |

20 |

Coal |

2023/11/1 |

2023/11/10 |

Parking maintenance |

|

Lu Tianhua |

40 |

Natural gas |

2023/11/7 |

To be determined |

Fault impending stop |

|

Shaanxi Shenmu |

40 |

Coal |

2023/11/10 |

2023/11/17 |

Temporary Parking |