PVC: Opportunities for long and short futures have decreased, funds have flocked to the two bases, and spot prices continue to adjust within a narrow range

PVC futures analysis: November 10 V2401 contract opening price: 6130, highest price: 6175, lowest price: 6082, position: 113030, settlement price: 3125, yesterday settlement: 6139, down: 15, daily trading volume: 1074042 lots, precipitated capital: 3.301 billion, capital inflow: 22.82 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.9 |

Price 11.10 |

Rise and fall |

Remarks |

|

North China |

5810-5840 |

5800-5830 |

-10/-10 |

Send to cash remittance |

|

East China |

5950-5990 |

5950-5990 |

0/0 |

Cash out of the warehouse |

|

South China |

5950-6000 |

5930-5980 |

-20/-20 |

Cash out of the warehouse |

|

Northeast China |

5750-5950 |

5700-5900 |

-50/-50 |

Send to cash remittance |

|

Central China |

5880-5900 |

5830-5880 |

-50/-20 |

Send to cash remittance |

|

Southwest |

5700-5850 |

5700-5800 |

0/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices continue to adjust in a narrow range, the spot market operating atmosphere is not good. Compared with the valuation, it fell by 10 yuan / ton in North China, 20 yuan / ton in East China, 20 yuan / ton in South China, 50 yuan / ton in Northeast China, 20-50 yuan / ton in Central China and 50 yuan / ton in southwest China. Most of the ex-factory prices of upstream PVC production enterprises remain stable, but there are few contracts signed on Friday. Futures rose first and then fell. Afternoon prices weakened. The quotation prices of traders in various regions diverged, and some of them increased slightly in the morning, but there were few real transactions in the high offer. In the afternoon, with the weakening of futures, the offer of one price gradually decreased, and the overall price changes throughout the day were mainly arranged in a narrow range. The base offer has no obvious advantage for the time being, including 01 contract in East China-(200), 01 contract in South China-(120-170-230), 01 contract in North China-(500-550), 01 contract in Southwest China-(350). The purchasing enthusiasm in the lower reaches is low and the trading atmosphere in the spot market is weak.

From a futures point of view: PVC2401 contracts weakened significantly at the start of the night trading, but bottomed out at a low of 6082. After the start of morning trading, futures continued to rise, and then the high price did not remain weaker, and afternoon prices continued to fall slightly. 2401 contracts range from 6082 to 6175 throughout the day, with a spread of 93. 01 contracts with an increase of 9725 positions and 773030 positions so far. The 2405 contract closed at 6245, with 135096 positions.

PVC Future Forecast:

Futures: PVC futures: the operation of PVC2401 contract prices continues to be sideways, long-short participation has been reduced, the recent funds have been leaving the market, disk positions continue to decline, although there is a small increase in positions in today's market, but the trend of futures prices is insufficient, narrow adjustment of the market makes opportunities reduced. From the point of view of related products, the fluctuation of soda ash and caustic soda increased recently. The main contract of Chinese futures was mixed at midday close. Soda ash rose by more than 10%, glass by more than 3%, caustic soda, liquefied petroleum gas (LPG), lithium carbonate, iron ore and coke by more than 2%. Overall, in the short term, it comes from the lack of fundamentals and policies, and the market price may continue to run in the range of 6050-6200.

Spot aspect: the fluctuation range of the current futures market operation is relatively narrow, the spot market price adjustment is also insufficient, mostly in a small range, although there are daily adjustments, but the boost to the transaction is limited, after the futures price runs to a low level, there is a part of the point price rigid demand transaction, but can not form a better PVC digestion. And the factors available in the spot market are reduced, the level of supply and demand is not good, and there is a dilemma between rising and falling prices in the two markets. On the outer disk, international oil prices rose slightly after a sell-off earlier this week, possibly because low prices attracted some bargain-hunting investors. Earlier this week, demand concerns and war risk premiums receded, triggering a sell-off in the oil market. For the current spot market in the stabilized market, production enterprises and traders have sales pressure, a small adjustment of prices is not conducive to stimulate speculative demand, so the spot market may continue to adjust slightly in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.9 |

Price 11.10 |

Rate of change |

|

V2401 collection |

6135 |

6100 |

-35 |

|

|

Average spot price in East China |

5970 |

5970 |

0 |

|

|

Average spot price in South China |

5975 |

5955 |

-20 |

|

|

PVC2401 basis difference |

-165 |

-130 |

35 |

|

|

V2405 collection |

6271 |

6245 |

-26 |

|

|

V2401-2405 closed |

-136 |

-145 |

-9 |

|

|

PP2401 collection |

7722 |

7710 |

-12 |

|

|

Plastic L2401 collection |

8169 |

8162 |

-7 |

|

|

V--PP basis difference |

-1587 |

-1610 |

-23 |

|

|

Vmure-L basis difference of plastics |

-2034 |

-2062 |

-28 |

|

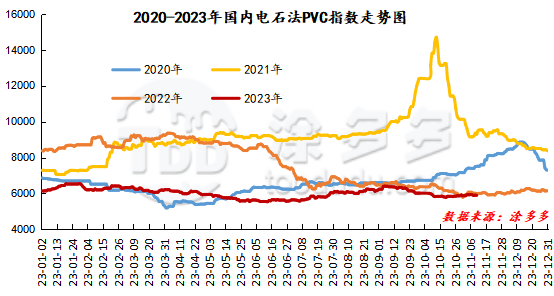

China PVC Index: the spot index of China's calcium carbide PVC fell 16.10, or 0.273%, to 5890.32 on Nov. 10, according to Tudor data. The ethylene PVC spot index was 6225.77, up 2.96, with a range of 0.048%, while the calcium carbide index fell, the ethylene index rose slightly, and the ethylene-calcium carbide index spread was 335.45.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.9 warehouse orders |

11.10 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,143 |

1,143 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

702 |

702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

351 |

0 |

|

|

Zhenjiang Middle and far Sea |

351 |

351 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,256 |

3,256 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,343 |

1,843 |

500 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,420 |

2,150 |

730 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

11,753 |

12,133 |

380 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,944 |

2,944 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

180 |

60 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,142 |

3,142 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

34,844 |

36,514 |

1,670 |

|

Total |

|

34,844 |

36,514 |

1,670 |

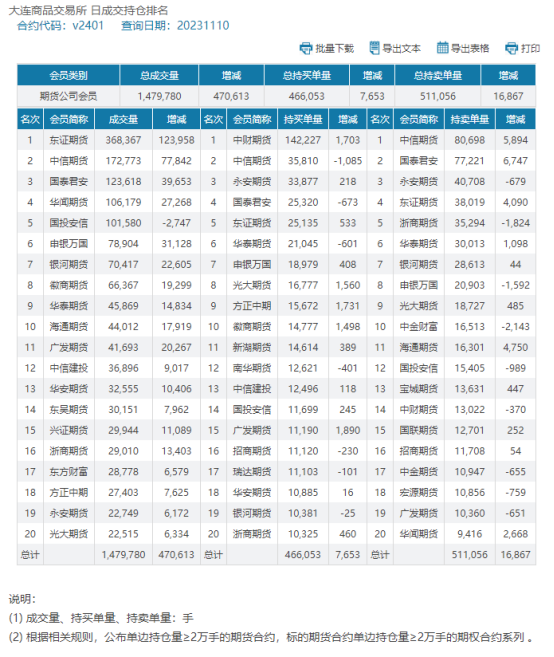

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.