Daily Review of Urea: Market fear of heights shows a slight correction in urea prices (November 9)

China Urea Price Index:

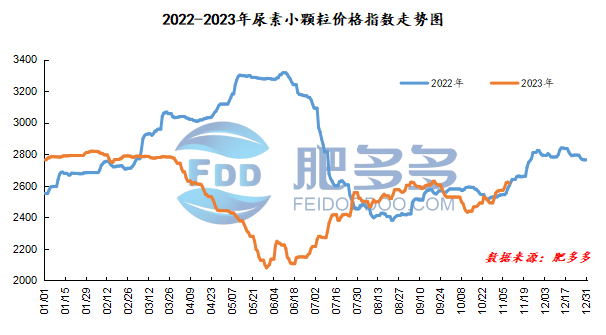

According to Feiduo data, the urea small pellet price index on November 9 was 2,615.14, down 9.55 from yesterday, down 0.36% month-on-month, and up 0.62% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2376, the highest price is 2425, the lowest price is 2350, the settlement price is 2388, and the closing price is 2403. The closing price is up 12 compared with the settlement price of the previous trading day, up 0.50% month-on-month. The fluctuation range of the whole day is 2350-2425; the basis of the 01 contract in Shandong is 147; the 01 contract has reduced its position by 13470 lots today, and so far, it has held 341136 lots.

Spot market analysis:

Today, China's urea prices have been slightly lowered and consolidated. The market trading atmosphere has been relatively weak. The transaction of new orders has not been ideal. Manufacturers have been forced to lower their factory quotations, and traders have reduced prices to sell.

Specifically, prices in Northeast China have stabilized at 2,590 - 2,680 yuan/ton. Prices in North China fell to 2,410 - 2,680 yuan/ton. Prices in the northwest region have stabilized at 2,610 - 2,620 yuan/ton. Prices in Southwest China are stable at 2,550 - 2,800 yuan/ton. Prices in East China fell to 2,540 - 2,620 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,560 - 2,730 yuan/ton, and the price of large particles has stabilized at 2,680 - 2,730 yuan/ton. Prices in South China fell to 2,680 - 2,760 yuan/ton.

Market outlook forecast:

In terms of supply, Nissan continued to be high, and corporate inventories rose slightly at low levels. Subsequent factors such as shrinking supply and slow accumulation of stocks continued to exist, and the supply situation remained tight. In terms of manufacturers, the current supply of manufacturers mainly flows to Jigang and downstream compound fertilizer factories for raw materials procurement. Urea manufacturers in some major producing areas have received better orders and once again accumulated a certain amount of pending orders, further enhancing their confidence in the market. Some manufacturers have issued new orders. Small, forced to cut prices and collect orders when the number of pending orders is reduced. In terms of the market, the market currently has low acceptance of high-priced sources of goods, and the purchase of high-priced raw materials has a tendency to be suspended today. However, with the strong support of manufacturers waiting for about one more week and the low inventory of companies, the market maintains a game state among manufacturers. On the demand side, agricultural demand is currently stagnant, industrial demand is just showing a slight upward trend, and demand's support for the market is still relatively weak.

On the whole, the factory is optimistic about prices under the influence of pending orders and low inventories, but downstream demand for high-priced fertilizers has been suspended and has a wait-and-see attitude. A small number of new orders have been sold in the market. It is expected that the urea market price will fluctuate slightly in a short period of time.