PVC: Futures turned red in the afternoon, first suppressed and then rose, with long and short positions rotating out of the market, and the spot trend was divided

PVC futures analysis: November 8 V2401 contract opening price: 6096, highest price: 6154, lowest price: 6054, position: 778117, settlement price: 6092, yesterday settlement: 6139, down: 47, daily trading volume: 920231 lots, precipitated capital: 3.347 billion, capital outflow: 37.44 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.7 |

Price 11.8 |

Rise and fall |

Remarks |

|

North China |

5830-5870 |

5800-5840 |

-30/-30 |

Send to cash remittance |

|

East China |

5950-5980 |

5900-5980 |

-50/0 |

Cash out of the warehouse |

|

South China |

5950-6020 |

5920-5970 |

-30/-50 |

Cash out of the warehouse |

|

Northeast China |

5750-5950 |

5750-5950 |

0/0 |

Send to cash remittance |

|

Central China |

5880-5900 |

5850-5880 |

-30/-20 |

Send to cash remittance |

|

Southwest |

5750-5900 |

5700-5850 |

-50/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price trend differentiation, morning session price fell, afternoon rebounded. Compared with the valuation, it fell by 30 yuan / ton in North China, 50 yuan / ton in East China, 30-50 yuan / ton in South China, stable in Northeast China, 20-30 yuan / ton in Central China and 50 yuan / ton in Southwest China. The ex-factory price of upstream PVC production enterprises has been reduced by 30-50 yuan per ton, and some enterprises continue to stabilize prices. The trend of futures prices first suppressed and then rose, and there were differences in the trend of the spot market throughout the day, including a negative drop in prices in the spot market in early trading, and a bad atmosphere, but there was an advantage in the supply of goods at spot prices. Among them, the base difference offer 01 contract in East China-(200), South China 01 contract-(120-170-230), North 01 contract-(500-550), Southwest 01 contract-(300). The actual transaction is mainly at a low price, and the trading atmosphere in the spot market has improved slightly. Afternoon prices rebounded upward, the spot market offers were raised in intraday trading, recovering some of the decline, but the transaction began to fade, and the high price was not good.

Futures point of view: PVC2401 contract night market low and narrow range operation, intraday volatility narrowed. Prices continued to fluctuate after the start of early trading, intraday fluctuations are still lack of direction, prices began to rise in the afternoon, and rose relatively significantly in late trading. 2401 contracts range from 6054 to 6154 throughout the day, with a price difference of 100,01.The contract has reduced its position by 13083 hands and has held 778117 positions so far. The 2405 contract closed at 6275, with 123970 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC2401 contract prices throughout the day after a long period of narrow horizontal trading, late afternoon futures prices rose to recover the previous decline, low futures prices showed a certain more open sentiment, trading opened 23.2% more than empty 21.9%. The recent narrow fluctuation of the futures price makes the overall technical trend lines temporarily lose the basis for judgment, so the trend provided by the technical level is insufficient. At the close of midday, the main contracts of Chinese futures were up and down. Coke coal rose by more than 2%, soda ash, coke, thread, methanol, ferrosilicon and hot coil rose by more than 1%. The trend of the main contract price of PVC also rose at the end of the cultural index. In the short term, the futures price may continue to test the position on the track and observe the performance in the range of 6050-6200.

Spot: spot market transactions after the decline in the early price, there is a certain deal in the low hanging order, but differentiation in the afternoon, the price repair but the inquiry is not good, thus it can be seen that the spot market buy down do not buy up mentality is obvious. From the current supply and demand level, the start-up load of the PVC plant is stable, production enterprises and traders are actively shipping to digest inventory, but the demand side is still slightly weak, various businesses feedback downstream demand continues to be poor, and the current two cities of narrow adjustment make participants lack of direction. On the outer disk, international oil prices fell more than 4 per cent, hitting their lowest level since late July as an increase in OPEC oil exports eased concerns about market tensions and the dollar strengthened. Looking at the spot market in the short term as a whole, there is a lack of direction guidance in both fundamental and macro aspects, resulting in a dilemma between rising and falling prices, and the state of slight adjustment continues.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.7 |

Price 11.8 |

Rate of change |

|

V2401 collection |

6110 |

6144 |

34 |

|

|

Average spot price in East China |

5965 |

5940 |

-25 |

|

|

Average spot price in South China |

5985 |

5945 |

-40 |

|

|

PVC2401 basis difference |

-145 |

-204 |

-59 |

|

|

V2405 collection |

6247 |

6275 |

28 |

|

|

V2401-2405 closed |

-137 |

-131 |

6 |

|

|

PP2401 collection |

7694 |

7710 |

16 |

|

|

Plastic L2401 collection |

8181 |

8202 |

21 |

|

|

V--PP basis difference |

-1584 |

-1566 |

18 |

|

|

Vmure-L basis difference of plastics |

-2071 |

-2058 |

13 |

|

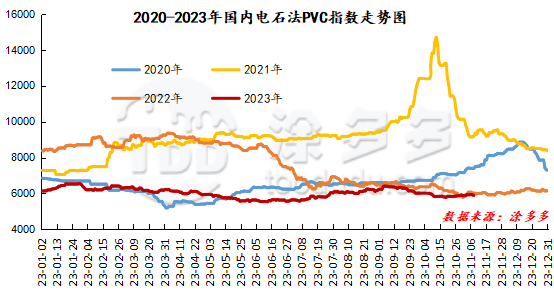

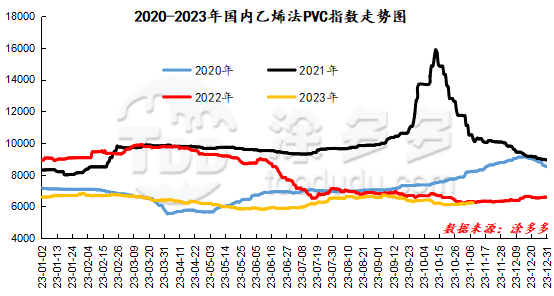

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC fell 30.04, or 0.508%, to 5886.74 on November 8. The ethylene method PVC spot index was 6225.9, down 5.15, with a range of 0.083%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 339.16.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.7 warehouse orders |

11.8 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,143 |

1,143 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

702 |

702 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

351 |

0 |

|

|

Zhenjiang Middle and far Sea |

351 |

351 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,937 |

2,937 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,343 |

1,343 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,350 |

1,350 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

10,607 |

11,185 |

578 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,584 |

2,584 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

32,969 |

33,547 |

578 |

|

Total |

|

32,969 |

33,547 |

578 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.