Daily Review of Urea: Prices continue to rise and market follow-up slows down (November 8)

China Urea Price Index:

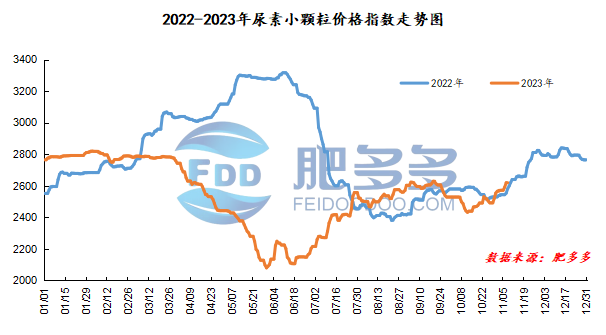

According to calculations from Feiduo data, the urea small pellet price index on November 8 was 2,624.68, up 5.00 from yesterday, up 0.19% month-on-month, and up 1.68% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2400, the highest price is 2423, the lowest price is 2364, the settlement price is 2391, and the closing price is 2396. The closing price is down 52 compared with the settlement price of the previous trading day, down 2.12% month-on-month. The fluctuation range of the whole day is 2364-2423; the basis of the 01 contract in Shandong is 194; the 01 contract has reduced its position by 13044 lots today, and so far, it has held 354606 lots.

Spot market analysis:

Today, China's urea prices continued to increase. As prices continued to rise in recent days, the market follow-up speed began to gradually slow down. Under the tight spot situation of manufacturers, there was no downward trend in today's factory quotations.

Specifically, prices in Northeast China have stabilized at 2,590 - 2,680 yuan/ton. Prices in North China rose to 2,430 - 2,680 yuan/ton. Prices in Northwest China rose to 2,610 - 2,620 yuan/ton. Prices in Southwest China are stable at 2,550 - 2,800 yuan/ton. Prices in East China rose to 2,580 - 2,630 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,560 - 2,730 yuan/ton, and the price of large particles has risen to 2,680 - 2,730 yuan/ton. Prices in South China rose to 2,680 - 2,770 yuan/ton.

Market outlook forecast:

On the supply side, Nissan continues to operate at a high level for a short period of time. This week, corporate inventories have risen slightly. However, with equipment parking and factories successively shipping, corporate inventories remain low, and spot supply in the market is still tight. In terms of manufacturers, manufacturers have received a large number of orders in advance in the early stage. Currently, most processing is being processed in the early stage. Some factories in mainstream regions have stopped collecting. Under the tight spot supply situation, manufacturers 'quotations continue to rise and their mentality is strong. In terms of the market, futures prices have continued to rise in recent days, and market prices have continued to rise. Driven by sentiment, the number of new orders in the market has increased, the focus of transactions has shifted, and the current market atmosphere is improving. On the demand side, China's urea market is still slightly slow to follow up, and the industrial demand market purchases are mostly on-demand. Among them, the demand for urea from Northeast compound fertilizer factories has increased. The agricultural demand market is still in the off-season. A small number of dealers are replenishing goods on dips, and prices are high. Under the influence of most dealers 'reserve demand has slowed down.

On the whole, manufacturers are still waiting, inventories continue to be low, market sentiment continues to hold prices, and urea market prices are expected to continue to fluctuate at a high level in the short term.