Polyester industry chain: lack of cost support for the decline in production and sales in the polyester market

I. the market trend chart of polyester industry chain

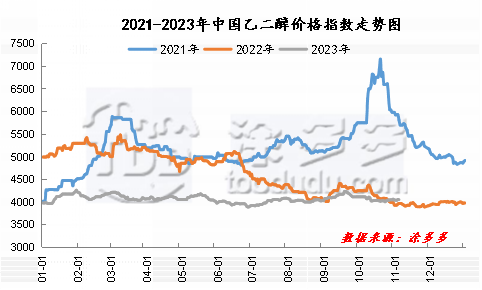

The market price index of ethylene glycol was 4058.57, down 2.12 from the previous working day.

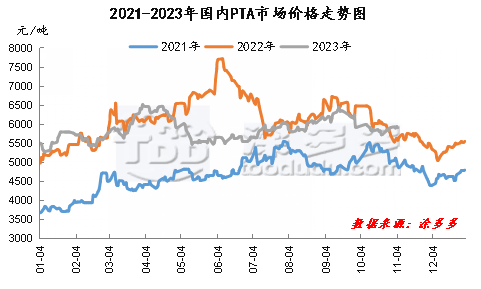

China's PTA market price index was 5910 on Nov. 6, down 30 percent from the previous working day.

On November 6th, the market price of polyester chips was 6800, unchanged from the previous working day. The market price index of polyester bottle chips was 6825, down 50% from the previous working day.

II. Summary of market price of polyester industry chain

|

Product |

Specifications |

Market |

2023.11.6 |

2023.11.3 |

Rise and fall |

Remarks |

|

PTA |

Spot |

East China |

5910 |

5940 |

-30 |

Self-withdrawing tax, yuan / ton |

|

Product |

Specifications |

Market |

2023.11.6 |

2023.11.3 |

Rise and fall |

Remarks |

|

Glycol |

Polyester grade |

East China |

4065 |

4070 |

-5 |

Self-withdrawing tax, yuan / ton |

|

Polyester grade |

South China |

4120 |

4120 |

0 |

Short delivery including tax, yuan / ton |

|

|

Product |

Specifications |

Market |

2023.11.6 |

2023.11.3 |

Rise and fall |

Remarks |

|

Polyester chip |

Semi-light section |

East China |

6800 |

6800 |

0 |

Factory includes tax, yuan / ton |

|

Light slicing |

6850 |

6850 |

0 |

Factory includes tax, yuan / ton |

||

|

Product |

Specifications |

Market |

2023.11.6 |

2023.11.3 |

Rise and fall |

Remarks |

|

Polyester bottle chip |

Aquarius level (IV.=0.8) |

East China |

6825 |

6875 |

-50 |

Factory includes tax, yuan / ton |

|

Oil bottle grade |

6825 |

6875 |

-50 |

Factory includes tax, yuan / ton |

||

|

Hot pot grade |

6825 |

6875 |

-50 |

Factory includes tax, yuan / ton |

||

|

Carbonic acid grade |

6925 |

6975 |

-50 |

Factory includes tax, yuan / ton |

||

|

Aquarius level (IV.=0.8) |

South China |

6825 |

6875 |

-50 |

Factory includes tax, yuan / ton |

|

|

Oil bottle grade |

6825 |

6875 |

-50 |

Factory includes tax, yuan / ton |

||

|

Hot pot grade |

6825 |

6875 |

-50 |

Factory includes tax, yuan / ton |

||

|

Carbonic acid grade |

6925 |

6975 |

-50 |

Factory includes tax, yuan / ton |

||

|

Product |

Specifications |

Market |

2023.11.6 |

2023.11.3 |

Rise and fall |

Remarks |

|

Polyester filament |

Jiangsu and Zhejiang market POY150D/48F |

East China |

7350 |

7350 |

0 |

Factory includes tax, yuan / ton |

|

Jiangsu and Zhejiang market FDY150D/96F |

7950 |

7950 |

0 |

Factory includes tax, yuan / ton |

||

|

Jiangsu and Zhejiang market DTY150D/48F |

8650 |

8650 |

0 |

Factory includes tax, yuan / ton |

||

|

Jiangsu and Zhejiang market POY75D/72F |

7550 |

7550 |

0 |

Factory includes tax, yuan / ton |

||

|

Product |

Specifications |

Market |

2023.11.6 |

2023.11.3 |

Rise and fall |

Remarks |

|

Polyester staple yarn |

Semi-glossy white 1.56: 38 |

Jiangsu Province |

7375 |

7400 |

-25 |

Factory includes tax, yuan / ton |

|

Semi-glossy white 1.56: 38 |

Zhejiang |

7425 |

7450 |

-25 |

Factory includes tax, yuan / ton |

III. Brief introduction of Polyester Industry chain Market

PTA

Today, the spot market of PTA in East China is weak, and we will consult around 5910 yuan / ton. This week and next week, the main port delivery 01 liters of water 30-40 near the deal and negotiations. The international crude oil market fell and depressed, and the PTA futures market fell. Spot basis fluctuates slightly, traders and polyester factories buy mainly in rigid demand, and the market mentality is cautious. It is expected that the short-term market will maintain a narrow adjustment.

Glycol

Today, the market price of ethylene glycol is maintained. The international crude oil market fell, the market atmosphere was general, and the focus of negotiations in the ethylene glycol market adjusted slightly. The quotation in East China revolved around 4065 yuan / ton, down 5 yuan / ton compared with the previous working day. The quotation in South China is around 4120 yuan / ton. Ethylene glycol port inventory continues to accumulate, downstream polyester load remains high, while the procurement mentality is cautious, supply and demand support is limited. Lack of continuous drive in the market, it is expected that the ethylene glycol market will adjust narrowly in the short term.

Polyester chip

Today, the polyester chip market maintains finishing. The PTA market of polyester raw materials is weak, the cost support is insufficient, the offer of polyester chip manufacturers is stable, and the focus of market transaction is adjusted slightly. Downstream demand weakens, market production and sales decline. It is expected that the polyester chip market will maintain the finishing operation in the short term.

Polyester bottle chip

Today, the polyester bottle chip market is in a narrow correction. Polyester raw materials PTA market fell, cost-end pressure, bottle chip manufacturers offer down 50 yuan / ton, market offer tends to low-end; downstream cautious follow-up, market trading atmosphere in general. It is expected that the short-term lactone bottle market may maintain finishing.

Polyester filament

Today's polyester filament market narrow finishing. Polyester raw material PTA market fell, the cost end is weak, polyester filament factory quotation is stable, individual enterprise quotation narrow adjustment, transaction center of gravity fluctuation is not big. The downstream demand is low, and the market production and sales are light. It is expected that the market price of filament will be arranged in a narrow range in the short term.

Polyester staple fiber

Today, the polyester staple market is narrowly weak. The falling cost suppresses the market, and the negotiation price in the staple fiber market pulls back. Downstream cautious wait-and-see-based, market production and marketing is relatively weak. It is expected that the short-term market price of polyester staple fiber will be maintained.

IV. Polyester Raw material Futures Market

PTA: November 6th PTA main 2401 contract opening price: 5934, lowest price: 5830, highest price: 5948, closing price: 5864, settlement price: 5880, down 44, position: 1286957.

Ethylene glycol: November 6th EG main contract 2401 opening price: 4156, lowest price: 4120, highest price: 4164, closing price: 4159, settlement price: 4144, up 36, position: 462801.

V. production and marketing data of polyester market

|

Product |

2023.11.6 |

2023.11.3 |

Rise and fall |

Unit |

|

Polyester chip |

50% |

90% |

-40% |

% |

|

Polyester filament |

35% |

45% |

-10% |

% |

|

Polyester staple fiber |

40% |

75% |

-35% |

% |

VI. Future forecast

The international crude oil market fluctuates at a high level, and the cost promotes the market. with the support of the supply and demand side of the polyester raw material PTA and ethylene glycol market, it is expected that the short-term market will adjust narrowly, the polyester raw material end will support, the polyester market offer will adjust slightly with the cost, the downstream demand is weak, and the market production and marketing is depressed. Short-term polyester market prices are expected to fluctuate within a narrow range. In the later stage, we should pay close attention to the changes of the raw material market and the supply and demand of polyester itself.