PVC: Strong futures transactions opened more frequently, the volatility became narrower, and the spot market rose slightly

PVC futures analysis: November 6 V2401 contract opening price: 6177, highest price: 6196, lowest price: 6141, position: 790664, settlement price: 6169, yesterday settlement: 6141, up: 28, daily trading volume: 708626 lots, precipitated capital: 3.42 billion, capital outflow: 31.7 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 11.3 |

Price 11.6 |

Rise and fall |

Remarks |

|

North China |

5830-5870 |

5850-5900 |

20/30 |

Send to cash remittance |

|

East China |

5990-6050 |

5990-6050 |

0/0 |

Cash out of the warehouse |

|

South China |

5950-6000 |

5980-6020 |

30/20 |

Cash out of the warehouse |

|

Northeast China |

5700-5920 |

5750-5950 |

50/30 |

Send to cash remittance |

|

Central China |

5900-5920 |

5900-5920 |

0/0 |

Send to cash remittance |

|

Southwest |

5720-5850 |

5750-5900 |

30/50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices began to rise slightly at the beginning of the week, market sentiment slightly improved. From the comparison of valuation: among them, North China rose 20-30 yuan / ton, East China stable, South China 30 yuan / ton, Northeast China 30-50 yuan / ton, Central China stable, Southwest China 30-50 yuan / ton. Upstream production enterprises factory quotation in some areas to maintain a stable wait-and-see, some enterprises tentatively increased by 50-100 yuan / ton. When the futures price is on the strong side, especially in the afternoon, the quotation mentality of the merchants in the spot market has slightly recovered. The offer in the spot market in the afternoon is slightly higher than that of last Friday, but there is resistance to the general high price transaction, and the lower price is the main form of transaction in the downstream. The basis offer has no price advantage and is adjusted slightly, including the basis offer 01 contract in East China-(150-200), and the 01 contract in South China-(100-150). North 01 contract-(500-550), southwest 01 contract-(300). Although the price of the two cities rose slightly in the term, the purchasing enthusiasm in the lower reaches of the spot market is low, the wait-and-see intention is relatively obvious, and the trading atmosphere in the spot market is not good.

Futures point of view: PVC01 contracts last Friday night prices maintain a high volatility trend, the overall night trading is maintained. Futures prices weakened slightly after the start of morning trading on Monday, but did not fall much and then rebounded, and afternoon prices returned to consolidation near the opening price. 2401 the contract fluctuates from 6141 to 6196 throughout the day, with a spread of 550.2401. The contract reduced its position by 8232 positions and has held 790664 positions so far. The 2405 contract closed at 6297, with 121668 positions.

PVC Future Forecast:

Futures: PVC01 contract prices rose slightly again in intraday trading, with 6196 approaching the expected mark of 6200 but did not exceed it. In terms of trading, 23.6% of them opened more than 21.8% in the short term, but the market still showed a slight reduction in positions. The technical level shows that the opening of the three rails of the Bolin belt (13, 13, 2) changes, the middle rail of the lower rail turns upward, and the opening of the upper rail is horizontal. The KD line and MACD line at the daily line level show a golden fork trend, but the recent narrow fluctuation of the futures price makes the two trend lines slightly lose the basis for judgment. At present, due to the lack of fundamental trends, the cultural goods index is OK today, although the PVC has risen slightly, but the pressure above has increased. In the short term, the operation of futures prices will continue to observe the performance of the integer level of 6200.

Spot aspect: The slight uptick in futures prices in the two cities did not lead to an improvement in transactions at the beginning of the week, from which we can judge that the current supply and demand fundamentals are weak, and poor downstream demand leads to poor shipping rhythm. therefore, even if there is a small rise in the market, it will not lead to an overall improvement in the spot market, and the small increase in futures prices is not conducive to the shipment of the spot market. On the one hand, after production tentatively increases the ex-factory price. Most of the first generation merchants are not enough to follow up, and even if new orders are signed, most of them will be considered to cooperate with the sale of hedging policies, given the demand constraints. However, the current narrow adjustment of futures prices has relatively lengthened the front of spot sales. Under the current time node, the northern demand has gradually begun to shrink, and the start-up of product enterprises is low, so the weak demand is still the current consensus. In the outer disk, international oil prices weakened and fell for the second week in a row as supply concerns caused by tensions in the Middle East eased. On the whole, although the spot market continues to operate slightly stronger in the short term, the sales pressure still exists.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 11.3 |

Price 11.6 |

Rate of change |

|

V2401 collection |

6173 |

6180 |

7 |

|

|

Average spot price in East China |

6020 |

6020 |

0 |

|

|

Average spot price in South China |

5975 |

6000 |

25 |

|

|

PVC2401 basis difference |

-153 |

-160 |

-7 |

|

|

V2405 collection |

6284 |

6297 |

13 |

|

|

V2401-2405 closed |

-111 |

-117 |

-6 |

|

|

PP2401 collection |

7695 |

7729 |

34 |

|

|

Plastic L2401 collection |

8235 |

8229 |

-6 |

|

|

V--PP basis difference |

-1522 |

-1549 |

-27 |

|

|

Vmure-L basis difference of plastics |

-2062 |

-2049 |

13 |

|

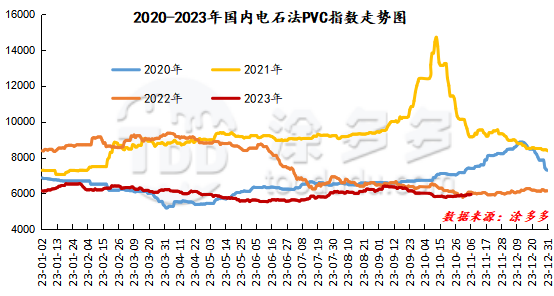

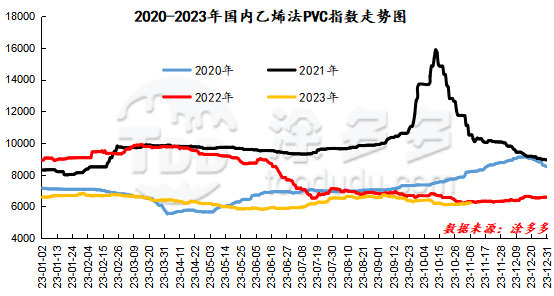

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot Index rose 16.73, or 0.282%, to 5944.14 on November 6. The ethylene PVC spot index was 6233.36, up 20.88, with a range of 0.336%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 289.22.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

11.3 warehouse orders |

11.6 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

351 |

0 |

|

|

Zhenjiang Middle and far Sea |

351 |

351 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,343 |

1,343 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,350 |

1,350 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,474 |

10,444 |

970 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,584 |

2,584 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

31,016 |

31,986 |

970 |

|

Total |

|

31,016 |

31,986 |

970 |

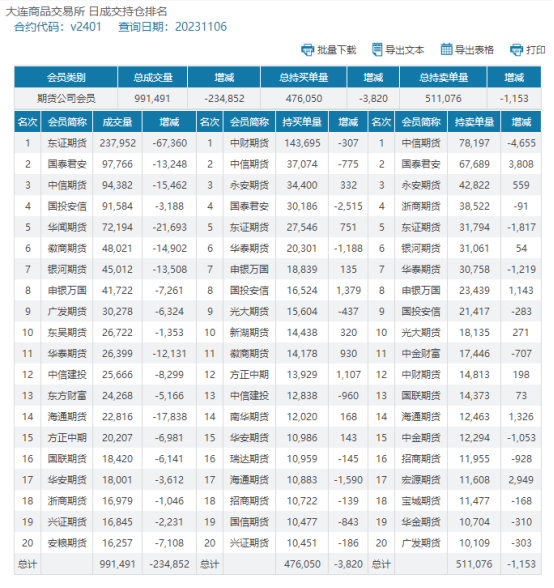

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.

Original: Pei Zhongxue