Daily Review of Urea: Manufacturers 'mentality boosts price strength (November 6)

China Urea Price Index:

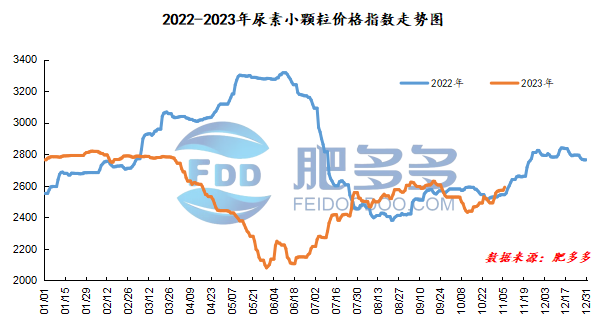

According to Feiduo data, the urea small pellet price index on November 6 was 2,591.50, up 19.55 from last Friday, up 0.76% month-on-month, and up 1.87% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2372, the highest price is 2435, the lowest price is 2357, the settlement price is 2398, and the closing price is 2420. The closing price is 27% higher than the settlement price of the previous trading day, up 1.13% month-on-month. The fluctuation range of the whole day is 2357-2435; the basis of the 01 contract in Shandong is 140; the 01 contract has increased its position by 21743 lots today, and so far, it has held 388968 lots.

Spot market analysis:

Today, China's urea prices continue to be firm and upward, with increases ranging from 10 to 60 yuan/ton. After several consecutive days of rising prices, factories have received a large number of orders, and currently prices are mainly supported.

Specifically, prices in Northeast China rose to 2,590 - 2,650 yuan/ton. Prices in North China rose to 2,410 - 2,630 yuan/ton. Prices in the northwest region rose to 2,570 - 2,580 yuan/ton. Prices in Southwest China are stable at 2,480 - 2,800 yuan/ton. Prices in East China rose to 2,550 - 2,590 yuan/ton. The price of small and medium-sized particles in Central China has risen to 2,540 - 2,680 yuan/ton, and the price of large particles has stabilized at 2,550 - 2,680 yuan/ton. Prices in South China rose to 2,620 - 2,740 yuan/ton.

Market outlook forecast:

In terms of supply, the current daily production of urea is still maintained at a relatively high level. In the later period, gas-head enterprises will gradually enter the maintenance period. It is expected that the utilization rate of urea production capacity will decline, and supply will decline accordingly. On the manufacturer's side, the factory received a large number of orders in the early stage, and some manufacturers began to restrict the order after the orders were fully received. With the support of advance orders, they were optimistic about the price. In terms of the market, the market was boosted by international news such as the Palestinian-Israeli conflict, the India-Pakistan conflict, and Egypt's urea production cut. Urea futures rose strongly, and the emotions once again drove domestic demand to follow up. Quotes in mainstream areas of the market were firm and tested. On the demand side, the current spot price is high, the downstream willingness to reserve is low, and winter reserves have not been launched on a large scale. Judging from the current market reserve demand, the short reserve period is relatively scattered, and it is slow to follow up.

On the whole, manufacturers are supported by orders, market sentiment has been greatly boosted, and supply is expected to shrink in the future. It is expected that the urea market price will fluctuate and consolidate in a short period of time.