Phosphate fertilizer daily review: Market supply is still tight and phosphate fertilizer prices are stable and sorted out (November 2)

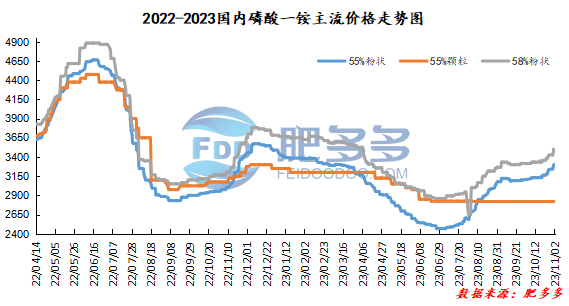

Monoammonium phosphate price index:

According to Feiduo data, on November 2, the 55% powder index of China's monoammonium phosphate was 3,300.00, rising; the 55% particle index was 2,820.00, stable; and the 58% powder index was 3,500.00, stable.

Monoammonium phosphate market analysis and forecast:

Today, the market price of monoammonium phosphate in China continues to be high. On the factory side, the factory continues to suspend receiving orders and quoting, and can be implemented until the end of November or early December. It will continue to support it, its mentality is firm, and the atmosphere of pushing up is strong. On the supply side, the operating rate of monoammonium is still low, the market supply is tight, and sellers are reluctant to sell. In terms of demand, the current market demand is still dominated by winter reserves. There are just demand expectations in Northeast China, North China and East China, and the market will be clear in the later period. On the whole, the monoammonium market has received a large number of orders and is ready for support. Coupled with the small supply, demand still exists. It is expected that the upward trend in the market price of monoammonium phosphate will continue in the short term.

Specific market prices in each region are as follows:

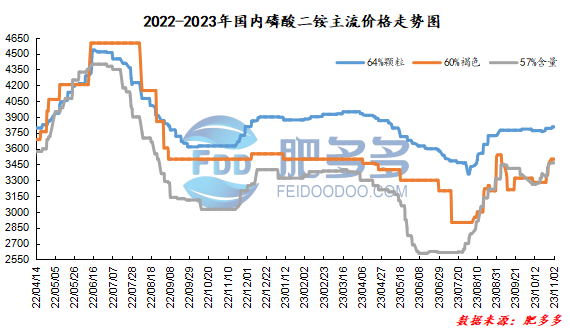

Diammonium phosphate price index:

According to Feiduo data, on November 2, the 64% particle index of China's mainstream diammonium phosphate was 3,805.00, stable; the 60% brown index was 3,500.00, stable; and the 57% content index was 3,465.00, stable.

Diammonium phosphate market analysis and forecast:

Today, the market price of diammonium phosphate in China continues to stabilize and consolidate. In terms of factories, factories continue to execute export orders. Winter storage prices for most factories have not yet been released, and most companies have not yet collected payments. On the supply side, the diammonium market continues to be scarce, and the supply is tight, which is good for the market. On the demand side, the Chinese market of diammonium just needs to follow up slowly, while downstream traders have a wait-and-see attitude. The industry in the winter storage market just needs to purchase and continues to purchase. In terms of raw materials, the prices of raw materials sulfur and synthetic ammonia fluctuated slightly, and costs remained high. On the whole, the export orders of the diammonium factory are supported, the downstream just need to continue to follow up, and the high prices of raw materials are firm. It is expected that the price of diammonium phosphate will remain mainly high in the short term.

Specific market prices in each region are as follows: