Phosphate fertilizer daily review: Positive upstream and downstream support high and firm phosphate fertilizer prices (November 1)

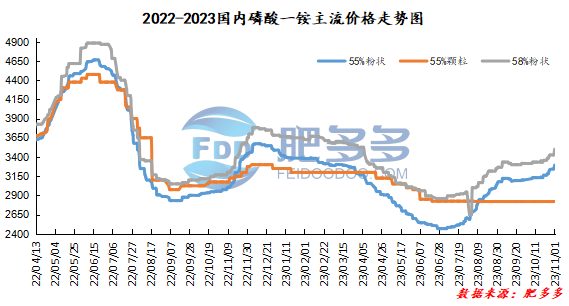

Monoammonium phosphate price index:

According to Feiduo data, on November 1, China's 55% powder index of monoammonium phosphate was 3,293.75, rising; the 55% particle index was 2,820.00, stable; and the 58% powder index was 3,500.00, rising.

Monoammonium phosphate market analysis and forecast:

Today, the market price of monoammonium phosphate in China continues to be high. In terms of factories, factories have a large number of orders, most of which have been issued for more than one month. Currently, they are mainly receiving orders in a limited manner. The factory has a good mentality and many prices. On the supply side, the operating rate of monoammonium continues to remain low, and the market supply is in short supply. In terms of demand, the current market demand is mainly for winter storage, and the demand will still exist in the later period, and most purchases are being followed up. On the whole, the tight supply situation in the monoammonium market continues, and many companies have ready support. The downstream are also replenishing stocks and following up in an orderly manner. It is expected that the market price of monoammonium phosphate will remain at a high level in a short period of time.

Specific market prices in each region are as follows:

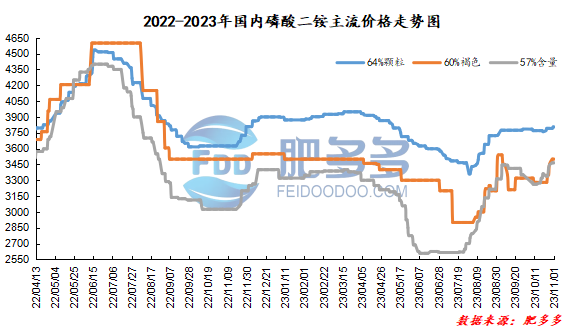

Diammonium phosphate price index:

According to Feiduo data, on November 1, the 64% particle index of China's mainstream diammonium phosphate was 3,805.00, stable; the 60% brown index was 3,500.00, stable; and the 57% content index was 3,465.00, stable.

Diammonium phosphate market analysis and forecast:

Today, the market price of diammonium phosphate in China continues to stabilize and consolidate. In terms of factories, factories continue to execute export orders. Winter storage prices for most factories have not yet been released, and domestic orders have not yet been collected. On the supply side, the diammonium market continues to be scarce and supply is tight. On the demand side, at this stage, there is a lot of market demand that needs to be followed up, downstream traders are taking a cautious wait-and-see attitude, and industries in the winter storage market are just in need of purchasing. In terms of raw materials, the prices of raw materials sulfur and synthetic ammonia fluctuated slightly, and cost support still exists. On the whole, the exports of diammonium plants are ready to be supported, downstream needs are still in place, and high prices of raw materials are firm. It is expected that the price of diammonium phosphate will continue to be stable and consolidated in the short term.

Specific market prices in each region are as follows: