PVC: Futures rose first and then suppressed in the afternoon, and transactions showed a reduction in positions, and the spot market rose slightly.

PVC futures analysis: October 30th V2401 contract opening price: 6115, highest price: 6147, lowest price: 6090, position: 859162, settlement price: 6116, yesterday settlement: 6080, up: 36, daily trading volume: 805849 lots, precipitated capital: 3.666 billion, capital outflow: 77.1 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 10.27 |

Price 10.30 |

Rise and fall |

Remarks |

|

North China |

5750-5800 |

5800-5850 |

50/50 |

Send to cash remittance |

|

East China |

5880-5950 |

5950-6020 |

70/70 |

Cash out of the warehouse |

|

South China |

5950-5980 |

6000-6060 |

50/80 |

Cash out of the warehouse |

|

Northeast China |

5700-5900 |

5700-5900 |

0/0 |

Send to cash remittance |

|

Central China |

5850-5900 |

5870-5920 |

20/20 |

Send to cash remittance |

|

Southwest |

5650-5800 |

5650-5800 |

0/0 |

Send to cash remittance |

PVC spot market: mainstream transaction prices in China's PVC market rose slightly at the beginning of the week, but transactions were limited. Compared with the valuation, North China rose 50 yuan / ton, East China 70 yuan / ton, South China 50-80 yuan / ton, Northeast China stable, Central China 20 yuan / ton, and Southwest China stable. Upstream PVC production enterprises ex-factory prices sporadically raised 20-50 yuan / ton, individual radical enterprises raised 100 yuan off-site warehouse quotations, some enterprises wait and see price stability. Futures volatility is higher, and the basis is weaker in some areas, including East China basis offer 01 contract-(130-150), South China 01 contract-(80-130), North 01 contract-(450-550), Southwest 01 contract-(300). Although the spot market price has been raised, and the basis has changed slightly, but the actual part of the small negotiations, relatively high prices are still relatively difficult to close transactions, and the current disk price supply does not have a clear price advantage, the downstream hanging order point is relatively low, the overall transaction is light, the trading atmosphere is slightly poor.

From the futures point of view: & the nbsp; PVC2401 contract was arranged in a narrow range of night trading on Friday, and the fluctuation direction of the overall night trading period is unknown. After the start of early trading, futures began to rise, once maintained a good intraday rise, the highest point of 6147, afternoon prices weakened slightly to give up the increase. 2401 contracts range from 6090 to 6147 throughout the day, with a spread of 57. 01. The contract reduced its position by 15630 hands and has held 859162 positions so far. The 2405 contract closed at 6205, with 110149 positions.

PVC Future Forecast:

Futures: & the operation of the nbsp; PVC2401 contract price has once again reached a recent high of 6147. As we have mentioned in the recent market, we have also mentioned that we have pushed up the high with a small progressive model. In terms of today's trading, the short opening is 22.9% higher than the 21.6% higher, and the flat 25.8% higher than 23.7%, which is more like a round-robin game between short sellers. The reduction of positions in trading tends to rise slightly caused by the flat market, so although there is an upside, it cannot be judged as an improvement in the market at present. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) is basically upward, but the KD line at the daily level has the meaning of narrowing the yellow line. On the whole, the operating pressure level of futures prices is effective in the short term, and take a further look at the performance around 6100.

Spot: & the rise in the nbsp; market comes from the stimulation of policy news. The current highs of the two cities have shown a slightly upward model, but so far in the absence of new stimulus, it is expected that the upside of the two cities may have come to an end. From the perspective of the industrial chain, the current demand weak traders continue to feedback poor shipments, as well as the lack of digestibility of orders, from downstream products enterprises to understand that terminal signing is also rare. Therefore, the persistently high social inventory caused by weak demand has always restricted the fundamentals of PVC. In addition, the remaining variables of fundamentals have led to insufficient prices in the two markets. From the uplink of the common commodity market and the stimulation of the policy port, it is difficult to reverse obviously, so the short-term market no longer has a new positive stimulus, it is expected to face some pressure. But on the other hand, when such weak fundamentals are consensus, there is no significant decline in PVC, so spot prices may still face a small adjustment in the short term as a whole.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 10.27 |

Price 10.30 |

Rate of change |

|

V2401 collection |

6112 |

6095 |

-17 |

|

|

Average spot price in East China |

5915 |

5985 |

70 |

|

|

Average spot price in South China |

5965 |

6030 |

65 |

|

|

PVC2401 basis difference |

-197 |

-110 |

87 |

|

|

V2405 collection |

6214 |

6204 |

-10 |

|

|

V2401-2405 closed |

-102 |

-109 |

-7 |

|

|

PP2401 collection |

7599 |

7615 |

16 |

|

|

Plastic L2401 collection |

8159 |

8169 |

10 |

|

|

V--PP basis difference |

-1487 |

-1520 |

-33 |

|

|

Vmure-L basis difference of plastics |

-2047 |

-2074 |

-27 |

|

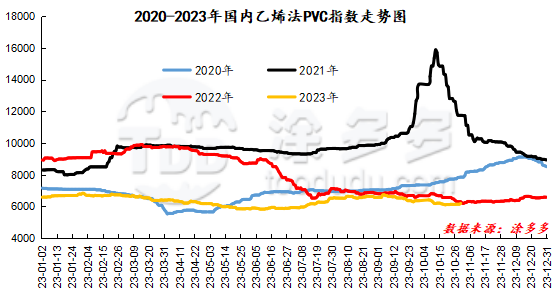

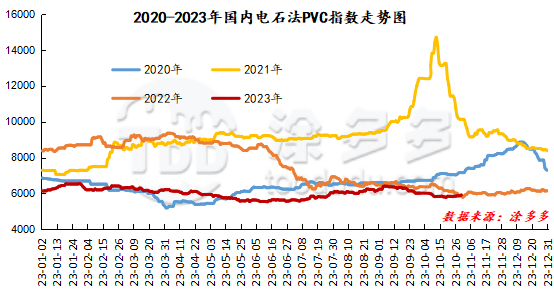

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC was 5916.09 on October 30th, up 48.04, or 0.819%. The ethylene PVC spot index was 6196.13, up 53.57, the range was 0.872%, the calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 280.04.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

10.27 warehouse orders |

10.30 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

351 |

351 |

0 |

|

|

Zhenjiang Middle and far Sea |

351 |

351 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,343 |

1,343 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,374 |

9,374 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,844 |

1,844 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

581 |

581 |

0 |

|

PVC subtotal |

|

30,155 |

30,155 |

0 |

|

Total |

|

30,155 |

30,155 |

0 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.