PVC: Futures officially entered one million positions, Masukang downward and empty positions were obviously open, and the spot market weakened

PVC futures analysis: October 18 V2401 contract opening price: 5920, highest price: 5968, lowest price: 5864, position: 1004896, settlement price: 5922, yesterday settlement: 5937, down: 15, daily trading volume: 1034116 lots, precipitated capital: 4.131 billion, capital inflow: 74.77 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 10.17 |

Price 10.18 |

Rise and fall |

Remarks |

|

North China |

5710-5750 |

5690-5750 |

-20/0 |

Send to cash remittance |

|

East China |

5790-5870 |

5790-5870 |

0/0 |

Cash out of the warehouse |

|

South China |

5850-5950 |

5850-5930 |

0/-20 |

Cash out of the warehouse |

|

Northeast China |

5750-5900 |

5700-5900 |

-50/0 |

Send to cash remittance |

|

Central China |

5830-5850 |

5820-5830 |

-10/-20 |

Send to cash remittance |

|

Southwest |

5600-5800 |

5600-5750 |

0/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price trend has been divided, can still maintain a stable operation in the morning, spot prices fell slightly in the afternoon. Compared with the valuation, it fell by 20 yuan / ton in North China, 20 yuan / ton in East China, 20 yuan / ton in South China, 50 yuan / ton in Northeast China, 10-20 yuan / ton in Central China and 50 yuan / ton in Southwest China. Upstream PVC production enterprises still continue to wait and see factory prices, individual enterprises began to reduce 50 yuan / ton. The decline in futures futures prices has led to a lack of mentality among spot traders, especially a lower price offer in the afternoon compared with yesterday, but the point price source has an advantage, and the basis offer is partially weaker than yesterday. Among them, East China base offer 01 contract-(50-100-150), South China 01 contract-(0-50-90), North 01 contract-(400-520), Southwest 01 contract-(250). On the whole, even if there is a certain advantage in the spot price, the transaction atmosphere in the spot market is generally on the low side, the downstream purchasing enthusiasm is not high, and the low price is dominated by hanging orders. Ethylene method synchronous downlink quotation, transaction aspect is also light.

From the futures point of view: & the night price of the nbsp; PVC2401 contract opened slightly higher, opened low and went higher, but the upward range was not large. After the start of morning trading, there was a peak of 5968, and then the price began to fluctuate, especially in the afternoon, and the decline did not stop in late trading. 2401 contracts range from 5864 to 5968 throughout the day, with a spread of 104. 01 contracts with an increase of 25861 positions and 1004896 hands so far. The 2405 contract closed at 5989, with 116122 positions.

PVC Future Forecast:

Futures: & the overall performance of nbsp; PVC2401 contract futures is weak. After experiencing the low horizontal trading, today's disk futures once again showed an obvious weakening trend, refreshing the recent low of 5864 became a new low, and the open position increased downside short opening more frequently. In terms of trading, the short opening rate was 26.8% compared with 21.5% higher. The technical level shows that the three tracks of the Bollinger belt (13, 13, 2) are all downward, and the KD lines and MACD lines at the daily level show a dead-fork trend. The disk shows an empty situation, each trend line is obviously weak, and there is a continuous empty force on the disk. In the short term, the operating pressure of the futures price is still large, the continuous increase of positions and short-term opening materials in the short term or further down, there is pressure on the short-term operation of the futures price.

Spot: from the post-holiday spot market continues to operate in a depressed atmosphere, and light transactions in the case of insufficient orders for terminal products enterprises are also faced with the situation of procurement is not active. Today, the two markets weakened again in the afternoon. On the one hand, in view of the hedging policies entered by the pressure of spot sales, on the other hand, at the close of the afternoon, the main Chinese futures contracts were mixed, with coke, coking coal and butadiene rubber (BR) falling by more than 3% and methanol, starch and pulp by more than 2%. PVC also followed the commodity sentiment into a weaker situation. PVC fundamentals in recent calcium carbide prices have been weak downside, insufficient cost support. In addition, the outer plate of Formosa Plastics prices fell sharply yesterday, Taiwan Formosa Plastics PVC11 monthly shipments fell by US $100. In addition, according to today's real estate data, according to the National Bureau of Statistics, from January to September 2023, national investment in real estate development totaled 8.7269 trillion yuan, down 9.1 percent from a year earlier (down 8.8 percent from January to August). On the whole, the operating pressure of the two cities is greater, and the spot market price may still face the test in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 10.17 |

Price 10.18 |

Rate of change |

|

V2401 collection |

5918 |

5872 |

-46 |

|

|

Average spot price in East China |

5830 |

5830 |

0 |

|

|

Average spot price in South China |

5900 |

5890 |

-10 |

|

|

PVC2401 basis difference |

-88 |

-42 |

46 |

|

|

V2405 collection |

6028 |

5989 |

-39 |

|

|

V2401-2405 closed |

-110 |

-117 |

-7 |

|

|

PP2401 collection |

7452 |

7421 |

-31 |

|

|

Plastic L2401 collection |

7998 |

7931 |

-67 |

|

|

V--PP basis difference |

-1534 |

-1549 |

-15 |

|

|

Vmure-L basis difference of plastics |

-2080 |

-2059 |

21 |

|

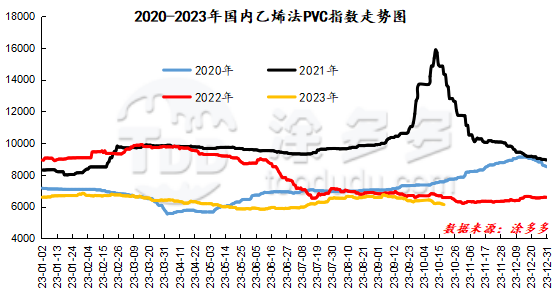

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index fell 9.89, or 0.17%, to 5804.13 on October 18. The ethylene PVC spot index was 6123.42, down 30.23, or 0.491%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 319.29.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

10.17 warehouse orders |

10.18 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

274 |

274 |

0 |

|

|

Zhenjiang Middle and far Sea |

274 |

274 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,292 |

1,343 |

51 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,209 |

9,269 |

60 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,844 |

1,844 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

3,162 |

3,162 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

29,881 |

29,992 |

111 |

|

Total |

|

29,881 |

29,992 |

111 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.