PVC: Futures are arranged sideways at low positions, running high points are relatively small, and the spot part is slightly stronger. Please choose an application

PVC futures analysis: October 13 V2401 contract opening price: 5975, highest price: 5985, lowest price: 5923, position: 947484, settlement price: 5952, yesterday settlement: 5939, up: 13, daily trading volume: 774683 lots, precipitated capital: 3.95 billion, capital inflow: 24.59 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 10.12 |

Price 10.13 |

Rise and fall |

Remarks |

|

North China |

5730-5800 |

5730-5800 |

0/0 |

Send to cash remittance |

|

East China |

5780-5910 |

5800-5910 |

20/0 |

Cash out of the warehouse |

|

South China |

5860-5950 |

5870-5950 |

10/0 |

Cash out of the warehouse |

|

Northeast China |

5750-5950 |

5750-5950 |

0/0 |

Send to cash remittance |

|

Central China |

5830-5850 |

5830-5850 |

0/0 |

Send to cash remittance |

|

Southwest |

5650-5850 |

5650-5850 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices rose slightly in some areas, the spot market slightly stronger. The comparison of valuation shows that North China is stable, East China is up 20 yuan / ton, South China is 10 yuan / ton, and Northeast, Central China and Southwest China are stable. The ex-factory prices of upstream PVC production enterprises basically remained stable, individual ethylene production enterprises slightly increased by 50 yuan / ton, but there were few contracts signed on Friday. The futures market fluctuated in a narrow range, and the offers of traders in some areas of the spot market increased slightly, while those in some areas continued to sort out mainly, and it was difficult to close the deal with a high offer. The basis offer has not changed much compared with yesterday, and the point price supply still has a price advantage, including East China basis offer 01 contract-(50-100-130), South China 01 contract-(0-50), North 01 contract-(380-400-490), Southwest 01 contract-(250). On the whole, the individual supply in the spot market is slightly tight and the price is slightly higher, but the downstream purchasing enthusiasm is not high, and most enterprises have a strong wait-and-see intention.

Futures point of view: PVC2401 contract night trading high opened low, intraday futures prices from a high of 5985 showed a certain weakening trend. Prices rose slightly after the start of morning trading, but the highs did not exceed the night highs, and afternoon prices were narrowly sorted out to the end. 2401 contracts range from 5923 to 5985 throughout the day, with a price spread of 62. 01 contracts with an increase of 7950 positions and 947484 positions so far. The 2405 contract closed at 6063, with 108757 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices have been trading horizontally for three consecutive days since the low, but the high has slightly advanced, and the market has still slightly increased its positions during the Friday session, with 25.4% short opening versus 22.6% more trading. At present, the position of the disk is high, the technical level shows that the Bollinger belt (13, 13, 2) three tracks are still open downward, the slight advance of the futures price makes the KD line at the daily level to cross first, but the trend of MACD dead fork is still large. At present, the guidance from fundamentals, policies and commodity sentiment is insufficient, so in the short term, we may judge the operation of futures prices or continue to advance slightly, making the high point further rise, but the pressure above is greater. Observe the performance of the pressure in 6000.

Spot: & the low horizontal trend of nbsp; futures does not guide the spot market, the performance of the spot market is poor on Friday, the feedback from traders in all regions is mainly light, the downstream products enterprises have a strong wait-and-see mentality, and the pick-up activity is not high. At present, in terms of PVC fundamentals, the starting load of chlor-alkali production units is stable, although the current price is downward, but it is not enough to make production enterprises reduce the load, but the weakness of demand is a consensus, and high inventory under the game of supply and demand is also normal. Recently, the export side has not heard of a better inquiry, the order price improved in the early part of the week and weakened in the later period, and the overall de-treasury of domestic trade is not ideal. In the outer disk, prices in the international crude oil futures market were mixed, while US benchmark WTI oil prices continued to close lower, as official data confirmed a higher-than-expected surge in US crude oil inventories last week and an unexpected rebound in US inflation, which meant that the Federal Reserve would maintain high interest rates for a longer period of time, driving the dollar stronger. On the whole, the spot market still continues to face the trend of low and narrow arrangement.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 10.12 |

Price 10.13 |

Rate of change |

|

V2401 collection |

5968 |

5955 |

-13 |

|

|

Average spot price in East China |

5845 |

5855 |

10 |

|

|

Average spot price in South China |

5905 |

5910 |

5 |

|

|

PVC2401 basis difference |

-123 |

-100 |

23 |

|

|

V2405 collection |

6067 |

6063 |

-4 |

|

|

V2401-2405 closed |

-99 |

-108 |

-9 |

|

|

PP2401 collection |

7462 |

7473 |

11 |

|

|

Plastic L2401 collection |

8037 |

8021 |

-16 |

|

|

V--PP basis difference |

-1494 |

-1518 |

-24 |

|

|

Vmure-L basis difference of plastics |

-2069 |

-2066 |

3 |

|

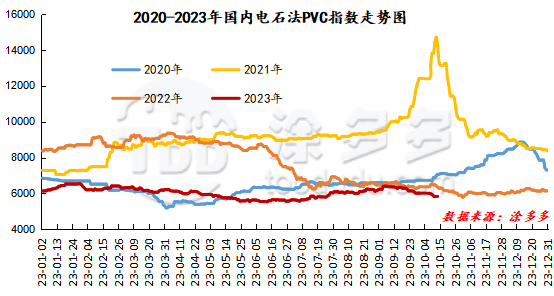

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC rose 4.09, or 0.07%, to 5836.95 on October 13. The ethylene method PVC spot index is 6211.83, up 24.1%, the range is 0.389%, the calcium carbide method index rises, the ethylene method index rises, the ethylene method-calcium carbide method index price difference is 374.88.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

10.12 warehouse orders |

10.13 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

274 |

274 |

0 |

|

|

Zhenjiang Middle and far Sea |

274 |

274 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,292 |

1,292 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,124 |

9,124 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,844 |

1,844 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,562 |

3,162 |

600 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

29,196 |

29,796 |

600 |

|

Total |

|

29,196 |

29,796 |

600 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.