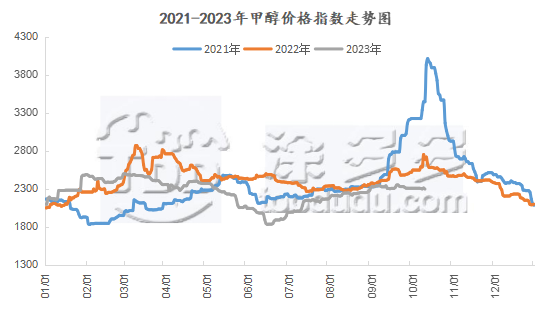

Methanol: Long and short game, methanol market weakness is sorted out

On October 12, the methanol market price index was 2280.94, down 8.49 from yesterday and 0.37% from the previous month.

Outer disk dynamics:

Methanol closed on October 11:

China CFR 280,287 US dollars / ton, up 2 US dollars / ton

European FOB 269-270euros / ton, flat

Us FOB 85-90 cents per gallon, flat

CFR in Southeast Asia is US $356-357 per ton, flat.

Summary of today's prices:

Guanzhong: 2240-2280 (0), North Route: 2070-2130 (- 30), Lunan: 2430 (- 20), Henan: 2320-2330 (- 20), Shanxi: 2200-2300 (0), Port: 2435-2455 (- 25)

Freight:

North Route-Northern Shandong 210-280 (0ax 0), Southern Route-Northern Shandong 240-320 (0ax 0), Shanxi-Northern Shandong 100-160 (- 10max 0), Guanzhong-Southwest Shandong 160-220 (0max 0)

Spot market: today, the methanol market is weak, the spot price is reduced by 10-40 yuan / ton, the futures market rebounds after falling, and the supply in the Chinese market has decreased, but the start of the market is still on the high side, and the demand side recovers less than expected. the downstream replenishment enthusiasm is poor, the market transaction is general. Specifically, the market prices in the main producing areas are mixed, with the price quoted on the northern line of 2070-2130 yuan / ton, the lower end reduced by 30 yuan / ton, local equipment parking and overhauling, the supply is slightly tight, the prices of some enterprises are strong, and traders and downstream often meet bargains to fill the gap. Follow-up attention to the operation of the plant in the field. The market price of consumer land is reduced by 2430 yuan / ton in southern Shandong, 20 yuan / ton in the low end, 2310-2330 yuan / ton in the north of Shandong province, and 20 yuan / ton in the low end. At present, the mindset of workers in the market is different, and there is rigid demand for procurement downstream. Prices in North China have been partially reduced, including 2200-2300 yuan / ton in Shanxi and 2350-2380 yuan / ton in Hebei, which is stable at the low end. at present, the market atmosphere is light and the downstream replenishment atmosphere is general. Prices in southwest China remain stable, of which Yungui quoted 2400-2500 yuan / ton, Sichuan and Chongqing quoted 2350-2460 yuan / ton, low-end stable, the current market negotiations are mediocre, terminal demand is weak, some prices have no market. Quotations in other regions of China have also been adjusted to varying degrees.

Port market: methanol futures fell in the morning and rebounded in the afternoon. Spot and long-term paper goods hold goods to sell, buy every bargain to pick up goods, the basis is strong. The price difference between replacements has narrowed in recent months. The overall transaction is active throughout the day. Taicang main port transaction price: spot transaction: 2435-2470, basis + 25 Universe 35 + 10: 2450-2485, basis + 40 pm 45: 10: 2460-2490, basis + 50 pm 55: 11: 2470-2500, basis + 58 inch 62.

|

Area |

2023/10/12 |

2023/10/11 |

Rise and fall |

|

The whole country |

2280.94 |

2289.43 |

-8.49 |

|

Northwest |

2070-2280 |

2080-2280 |

-10/0 |

|

North China |

2200-2380 |

2200-2400 |

0/-20 |

|

East China |

2435-2520 |

2460-2530 |

-25/-10 |

|

South China |

2430-2510 |

2455-2550 |

-25/-40 |

|

Southwest |

2350-2500 |

2350-2500 |

0/0 |

|

Northeast China |

2100-2450 |

2100-2450 |

0/0 |

|

Shandong |

2310-2430 |

2330-2450 |

-20/-20 |

|

Central China |

2320-2640 |

2340-2640 |

-20/0 |

Future forecast: the recent macro performance is general, the cost support is limited, the Chinese market equipment maintenance and restart, Ningxia Qinghua, Shanghai and Mongolia Energy and other methanol plant parking maintenance, local supply tightening support some enterprises offer strong, Inner Mongolia Shilin 300000 ton plant ignition restart, planned to produce products in the near future, Rongxin Phase I, Hebi coal methanol plant is expected to restart before the end of the month, spot supply is expected to increase China's start-up is still on the high side, coupled with the recent low volatility in the futures market, the mindset of the market operators is weak, and the market trading mood is not high. On the demand side, the demand in the terminal downstream market increases slowly, and the downstream olefin maintains high start-up. However, the overall replenishment mood is general, and the demand has not significantly improved. At present, the inventory of raw materials in some factories downstream is on the high side, and the overall rigid demand is mainly maintained. In the later stage, we also need to pay attention to the start-up of downstream factories and the change of load. At present, the performance of the macro and cost aspects is poor, the futures market remains low and volatile, and the recovery of the demand side is not as expected. Under the long-short game, the market atmosphere is weak, and the cautious wait-and-see mood remains. It is expected that short-term methanol market prices may be weak, and in the later stage, we need to pay close attention to macro policies and crude oil and coal prices.

Recent operation of the device:

|

Name of production enterprise |

Annual capacity; ten thousand tons |

Raw material |

Starting date of maintenance |

Maintenance end date |

Operation of the device |

|

Inner Mongolia Shilin |

30 |

Coal |

2023/7/30 |

2023/10/12 |

Ignition restarting. |

|

Yunnan disintegration |

24 |

Natural gas |

2023/8/12 |

2023/10/19 |

Parking maintenance |

|

Hebi coalification |

60 |

Coal |

2023/9/21 |

2023/10/15 |

Parking maintenance |

|

Inner Mongolia Rongxin Phase I |

90 |

Coal |

2023/10/8 |

2023/10/18 |

Planned maintenance for 10 days |

|

Northwest energy |

30 |

Coal |

2023/10/8 |

To be determined |

Parking maintenance |

|

Yankuang national coke |

25 |

Coke oven gas |

2023/10/10 |

2023/10/17 |

Parking maintenance |

|

Inner Mongolia and Baitai |

10 |

Coke oven gas |

2023/10/9 |

2023/10/16 |

Parking maintenance |

|

Shandong Prosperity |

17 |

Coke oven gas |

2023/10/10 |

To be determined |

Stop the car. |

|

Qinghua, Ningxia |

20 |

Coke oven gas |

2023/10/11 |

2023/10/25 |

Parking maintenance |

|

Shanghai and Mongolia Energy |

40 |

Coke oven gas |

2023/10/11 |

2023/10/17 |

Parking maintenance |

|

Xinjiang Zhongtai |

20 |

Coke oven gas |

2023/10/15 |

2023/10/30 |

Planned maintenance for 2 weeks |