Daily Review of Urea: Affected by export rumors, market inquiries increased today (October 12)

China Urea Price Index:

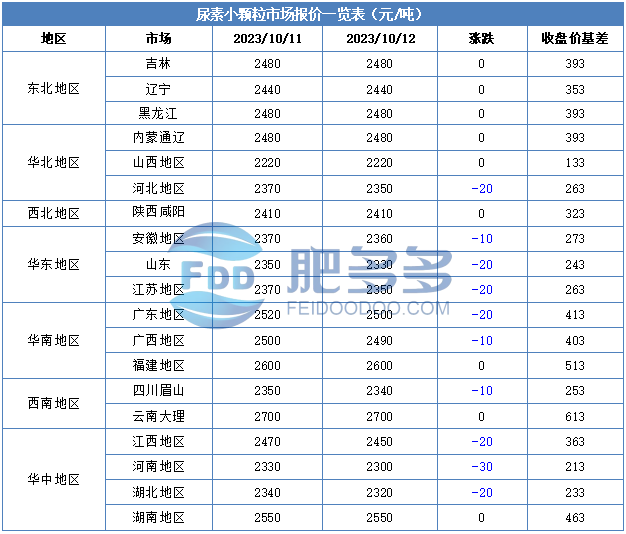

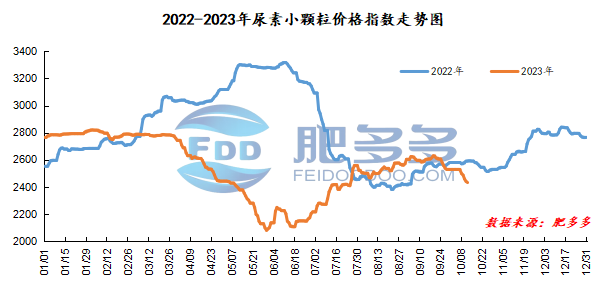

According to Feiduo data, the urea small pellet price index on October 12 was 2,432.09, down 8.64 from yesterday, down 0.35% month-on-month, and down 6.16% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2040, the highest price is 2088, the lowest price is 2011, the settlement price is 2050, and the closing price is 2087. The closing price is up 43 compared with the settlement price of the previous trading day, and the month-on-month increase is 2.10%. The daily fluctuation range is 2011-2088, with a price difference of 77; The 01 contract has increased its position by 12464 lots today, and so far, it has held 326402 lots.

Spot market analysis:

Today, China's urea market prices continued to continue their downward trend, the price downward speed accelerated, and the overall market transaction atmosphere improved slightly, but some wait-and-see mentality still continued.

Specifically, prices in Northeast China have stabilized at 2,420 - 2,490 yuan/ton. Prices in North China have stabilized at 2,220 - 2,490 yuan/ton. Prices in the northwest region are stable at 2,410 - 2,420 yuan/ton. Prices in Southwest China fell to 2,330 - 2,800 yuan/ton. Prices in East China fell to 2,300 - 2,370 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,300 - 2,620 yuan/ton, and the price of large particles stabilized at 2,470 - 2,510 yuan/ton. Prices in South China fell to 2,470 - 2,600 yuan/ton.

Market outlook forecast:

In terms of supply, supply continues to remain high despite the current increase in daily production and continuous restart of maintenance equipment. On the corporate side, some companies still continue to implement orders before the 11th, and the number of orders waiting for them is decreasing day by day. As prices continue to fall in recent days, corporate orders have begun to improve. On the demand side, affected by low prices, downstream purchasing sentiment began to improve, and traders 'demand gradually became apparent, and more replenishment was made at low prices. In terms of exports, news about exports has been circulating in the market recently. India is very involved in bidding for Chinese sources of goods, but the specific situation still requires continued attention in the later stage.

On the whole, the urea market in China is currently affected by export rumors, and a small amount of purchases has occurred. It is expected that the urea market price will remain stable at low prices in a short period of time, and the high price will continue to decline.