Daily Review of Urea: Prices continue to fall and downstream mentality waits and sees (October 11)

China Urea Price Index:

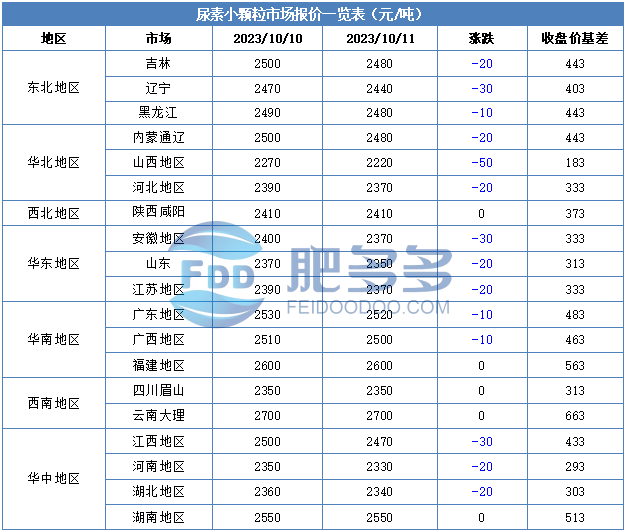

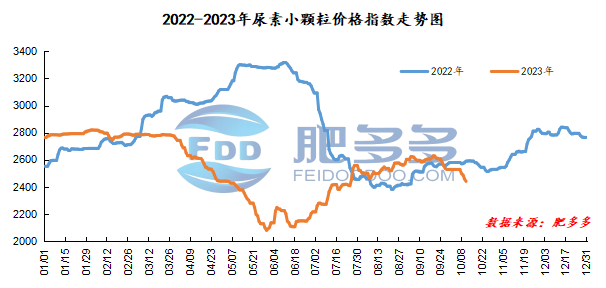

According to Feiduo data, the urea small pellet price index on October 11 was 2,440.73, down 17.59 from yesterday, down 0.72% month-on-month, and down 5.75% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2056, the highest price is 2078, the lowest price is 2015, the settlement price is 2044, and the closing price is 2037. The closing price is down 36 compared with the settlement price of the previous trading day, down 1.74% month-on-month. The daily fluctuation range is 2015 - 2078, and the price difference is 63; the 01 contract has increased its position by 6798 lots today, and so far, it has held 313938 lots.

Spot market analysis:

Today, China's urea market prices continue to decline. As the waiting list gradually decreases, companies have lowered their factory quotations in order to receive new orders.

Specifically, prices in Northeast China have been lowered to 2,420 - 2,490 yuan/ton. Prices in North China fell to 2,220 - 2,490 yuan/ton. Prices in the northwest region are stable at 2,410 - 2,420 yuan/ton. Prices in Southwest China are stable at 2,350 - 2,800 yuan/ton. Prices in East China fell to 2,310 - 2,380 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,320 - 2,620 yuan/ton, and the price of large particles stabilized at 2,470 - 2,510 yuan/ton. Prices in South China fell to 2,490 - 2,600 yuan/ton.

Market outlook forecast:

In terms of supply, the current market supply is sufficient, and the maintenance equipment is still in the process of being restored one after another. On the enterprise side, some enterprises still continue to implement pre-holiday orders and gradually reduce the number of orders to be issued. At present, enterprises have average orders, and their ex-factory quotations have been lowered in order to relieve the pressure on outbound delivery. On the demand side, market demand continues to be sluggish, downstream continues to maintain a wait-and-see attitude, and the wait-and-see atmosphere has intensified. In terms of cost, the price of synthetic ammonia continued to decline today, the price of Q5500 thermal coal in the port fell at a high level, and the mining price of some anthracite lump coal was lowered. Cost support has weakened, but overall prices remain high. Downstream melamine prices are generally stable.

On the whole, there is still some room for downside in the urea market price in China, so it is expected that the urea market price will continue to maintain a downward trend in a short period of time.