PVC: Futures gapped lower and opened below the beginning of 6, significantly increased positions by 70,000 lots, and the spot weakened on the first day of opening

PVC futures analysis: October 9 V2401 contract opening price: 6033, highest price: 6095, lowest price: 5995, position: 874522, settlement price: 6048, yesterday settlement: 6148, down: 100, daily trading volume: 741132 lots, precipitated capital: 4.203 billion, capital inflow: 252 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 10.8 |

Price 10.9 |

Rise and fall |

Remarks |

|

North China |

5950-5980 |

5870-5920 |

-80/-60 |

Send to cash remittance |

|

East China |

5950-6000 |

5900-5990 |

-50/-10 |

Cash out of the warehouse |

|

South China |

5990-6100 |

5970-6070 |

-20/-30 |

Cash out of the warehouse |

|

Northeast China |

5900-6050 |

5900-6000 |

0/-50 |

Send to cash remittance |

|

Central China |

5920-5950 |

5870-5900 |

-50/-50 |

Send to cash remittance |

|

Southwest |

5850-6000 |

5800-5950 |

-50/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices declined in various regions, and market prices fell on the first day of trading. Compared with the valuation, it fell by 60-80 yuan / ton in North China, 10-50 yuan / ton in East China, 20-30 yuan / ton in South China, 50 yuan / ton in Northeast China, 50 yuan / ton in Central China and 50 yuan / ton in Southwest China. Upstream PVC production enterprise factory price part of the reduction of 50-100 yuan / ton, including off-site warehouse prices synchronous downward, but some enterprises do not report stable prices wait and see. The trend of futures dived downwards as expected, and the price offer of traders in various regions of the spot market was lowered, while the higher offer did not have the advantage of a single small negotiation, and most of the point-price shipments after the futures price went down. among them, East China base offer 01 contract-(50-100-150), South China 01 contract-(0-50-100), North 01 contract-(400-450), Southwest 01 contract-(250). On the whole, today's transaction is OK, there is procurement enthusiasm in the lower reaches of the point price, and there is a rigid demand for replenishment at every low price.

From the futures point of view: & the nbsp; PVC2401 contract opened low on the first day of trading, and then the futures price slightly repaired the upside but was not strong enough. The high price only returned to the low level after 6095, and the afternoon price continued to fall below the 6000 mark. 2401 contracts range from 5995 to 6095 throughout the day, with a spread of 100,001 and an increase of 69610 positions, with 874522 hands held so far. The 2405 contract closed at 6099, with 89677 positions.

PVC Future Forecast:

Futures: PVC2401 contract price operation jump low open, the futures price weakened obviously, and the intraday significantly increased Cangyu more than 70, 000 hands closed part of the late trading. In terms of transaction, the empty opening of 30.4% compared with 24.8% is absolutely suppressed, showing a negative column and a longer upper shadow line, which highlights more partial air force. The technical level shows that the opening of the Bolin belt (13,13,2) diverges, the opening of the lower rail in the middle rail of the Bolin belt is obvious downward, the upper rail is flat to the opening, and the daily KD line and MACD line tend to expand. At the close of midday trading, most of the main Chinese futures contracts fell, with crude oil futures leading the decline. On the whole, the short-term of the PVC main contract will still show a glued finishing trend, and continue to observe the performance of a hundred points above and below the six-word prefix.

Spot aspect: The sharp decline of crude oil during the holiday period showed a negative trend of trading on the first day of trading, and PVC also followed the market with a clear jump and low opening, and the intraday price further fell, the spot market mentality fell further, but the spot market mentality was negative, but the spot price was OK, the rigid demand of downstream products enterprises was still there, and there was a certain speculative price psychology under the current price, some chose the disk to enter the multi-order, and part of the spot price was low to replenish the stock. The current PVC fundamentals, supply and demand level is stable and little change, but the recent decline in calcium carbide prices, coupled with the weakening of crude oil, the lack of cost port support. In addition, at present, there is no clear policy stimulus at the macro level, so commodities have traded the outer disk after the festival, but from the current time node in October, there is still a certain expectation of repair for Chinese goods in the middle line, but the high point may be difficult to surpass the previous high. there is still some pressure in the long term. In the short term, spot market prices may still face the situation of low shock consolidation.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 9.28 |

Price 10.9 |

Rate of change |

|

V2401 collection |

6137 |

6008 |

-129 |

|

|

Average spot price in East China |

6030 |

5945 |

-85 |

|

|

Average spot price in South China |

6100 |

6020 |

-80 |

|

|

PVC2401 basis difference |

-107 |

-63 |

44 |

|

|

V2405 collection |

6192 |

6099 |

-93 |

|

|

V2401-2405 closed |

-55 |

-91 |

-36 |

|

|

PP2401 collection |

7746 |

7586 |

-160 |

|

|

Plastic L2401 collection |

8247 |

8125 |

-122 |

|

|

V--PP basis difference |

-1609 |

-1578 |

31 |

|

|

Vmure-L basis difference of plastics |

-2110 |

-2117 |

-7 |

|

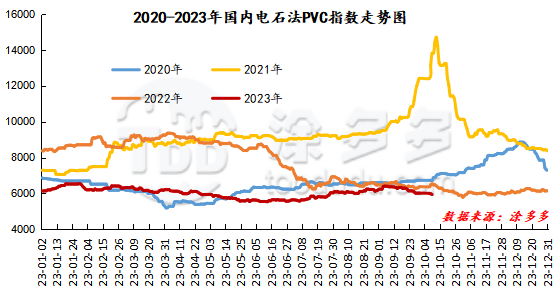

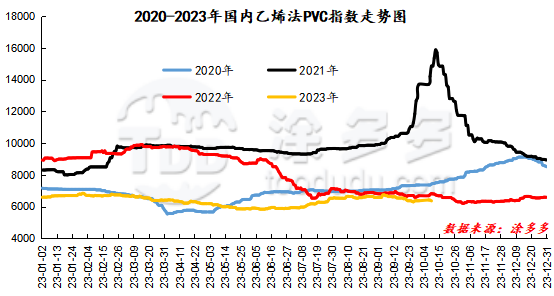

China PVC Index: according to Tuduoduo data, the spot index of China's calcium carbide PVC fell 41.12, or 0.688%, to 5937.85 on October 9. The ethylene PVC spot index was 6357.97, down 45.27, or 0.707%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 420.12.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

9.28 warehouse orders |

10.9 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

274 |

274 |

0 |

|

|

Zhenjiang Middle and far Sea |

274 |

274 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,292 |

1,292 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

8,705 |

8,944 |

239 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,781 |

1,844 |

63 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,582 |

2,582 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

28,734 |

29,036 |

302 |

|

Total |

|

28,734 |

29,036 |

302 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.