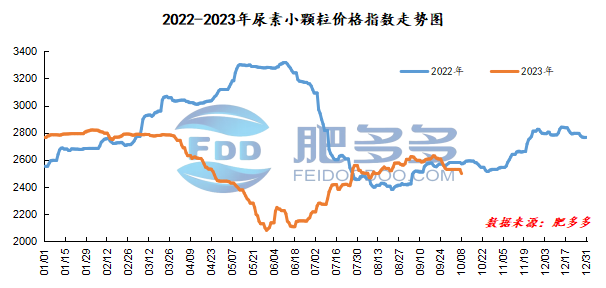

Daily Review of Urea: The market just needs to gradually weaken, prices continue to consolidate downward (October 8)

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on October 8 was 2,498.18, down 24.82 from yesterday, down 0.98% month-on-month, and down 2.81% year-on-year.

Spot market analysis:

Today, China's urea market prices continue to be consolidated downward. Currently, the downstream is not willing to replenish the current company's ex-factory quotations. They often wait for the market to replenish the company when low prices appear, but the company has no choice but to continue to adjust the quotation downward.

Specifically, prices in Northeast China have been lowered to 2,510 - 2,560 yuan/ton. Prices in North China have been lowered to 2,280 - 2,520 yuan/ton. Prices in Northwest China have been lowered to 2,450 - 2,460 yuan/ton. Prices in Southwest China have been lowered to 2,350 - 2,800 yuan/ton. Prices in East China fell to 2,400 - 2,450 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,390 - 2,660 yuan/ton, and the price of large particles stabilized at 2,470 - 2,510 yuan/ton. Prices in South China fell to 2,540 - 2,650 yuan/ton.

Market outlook forecast:

In terms of supply, Nissan is still in a state of gradual recovery, market supply is guaranteed, and the overall situation remains relatively sufficient. On the enterprise side, enterprises continue to implement pre-holiday orders, and the overall volume to be sent is gradually decreasing. Coupled with the current market situation, the pressure on enterprises to collect orders still exists. On the demand side, demand is gradually weakening, and downstream enthusiasm for purchasing goods is still low. They wait for low prices to buy and wait and see. In terms of exports, China's export supervision continues to remain tight and exports remain restricted. In terms of printing and bidding, China's participation in this round of Indian bidding is not high and has little impact on spot quotations. The actual export situation remains to be seen.

On the whole, there is currently no good news in China's urea market to stimulate price changes. It is expected that the urea market price will continue to maintain a gradual decline in the short term.