PVC: The futures price broke through the lower track and fell deeply. The intraday increased positions significantly, and the spot low continued to weaken.

PVC futures analysis: September 22nd V2401 contract opening price: 6320, highest price: 6335, lowest price: 6232, position: 831702, settlement price: 6279, yesterday settlement: 6378, down: 99, daily trading volume: 1402690 lots, precipitated capital: 3.67 billion, capital inflow: 119 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 9.21 |

Price 9.22 |

Rise and fall |

Remarks |

|

North China |

6180-6240 |

6080-6150 |

-100/-90 |

Send to cash remittance |

|

East China |

6210-6310 |

6090-6190 |

-120/-120 |

Cash out of the warehouse |

|

South China |

6250-6360 |

6170-6260 |

-80/-100 |

Cash out of the warehouse |

|

Northeast China |

6100-6300 |

6050-6200 |

-50/-100 |

Send to cash remittance |

|

Central China |

6170-6200 |

6080-6120 |

-90/-80 |

Send to cash remittance |

|

Southwest |

6100-6250 |

6050-6200 |

-50/-50 |

Send to cash remittance |

PVC spot market: mainstream transaction prices in China's PVC market continue to weaken and decline again on the basis of yesterday's decline. Compared with the valuation, it fell by 90-100 yuan / ton in North China, 120 yuan / ton in East China, 80-100 yuan / ton in South China, 50-100 yuan / ton in Northeast China, 80-90 yuan / ton in Central China and 50 yuan / ton in Southwest China. Upstream PVC production enterprises most of the factory prices down quotation, the range is concentrated in 50-120 yuan / ton or so, including the simultaneous downward price of off-site warehouse, the other part of the ethylene process enterprises closed. The futures price continued to weaken obviously, and the spot market traders made a sharp drop in the price offer, but after the futures price fell, the point price source price advantage was more obvious, and the basis offer changed little compared with yesterday. Among them, East China basis offer 01 contract-(60-130-150), South China 01 contract-(0-50-100), North 01 contract-(350-400-500), Southwest 01 contract-(250). Based on the low point of the disk, the transaction in some areas has improved, and the product enterprises mainly replenish goods at a low price, and the transaction is better than the early period of the week.

Futures point of view: PVC2401 contract night futures prices continue to decline, intraday prices fell significantly, after the beginning of early trading prices fell to the lowest point 6232, bottomed out and rebounded, afternoon prices basically around the narrow range of 6280-6300. 2401 contracts range from 6232 to 6335 throughout the day, with a spread of 103. 01 contracts with an increase of 27441 positions and 831702 positions so far. The 2405 contract closed at 6363, with 72299 positions.

PVC Future Forecast:

Futures: PVC2401 contract futures prices run on the basis of yesterday, futures prices continue to decline, falling below the 6300 mark, the lowest point hit 6232, intraday trading once showed an obvious short-opening trend, the highest increase Cangyu more than 47000 hands, but in late trading some loose orders fled on the one hand, the futures price rebounded on the one hand, on the other hand, part of the intra-day trading completed profit-taking. The operation of the futures week opened and closed. At first, the futures price rose sharply to above 6500, but the high price fell significantly for two consecutive days only in a short time. The decline is down 400 points from a high of 6632 so far. And the technical level shows that the low point of the futures price quickly breaks through the support level of the lower track and falls further. However, we do not believe that it has effectively fallen further below the 6250 position in the short term, and we will continue to observe the performance of the nearby position.

Spot: spot market feedback as we expected, the downward price below 6300 led to an improvement in transactions, price enquiries are active and there is a certain replenishment sentiment, on the one hand, downstream enterprises face short holidays, futures prices down low point if there is no replenishment or face the National Day price problem, so the spot market transaction after the futures price decline is more active than the high period of the week. On the other hand, the downward fall of futures prices caused some spot traders to have a certain degree of panic, and at present, we think that there are some risks and the basis is not appropriate to consider. PVC fundamentals still do not see a large variable, but the current time node to consider how to leave the pre-festival funds. On the outer disk, oil prices closed lower in volatile trading as new US labor market data provided a reason for the Fed to continue to tighten monetary policy, but Russia announced a ban on refined oil exports to curb the decline in oil prices. On the whole, the spot market may be arranged in a narrow range on the current basis in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 9.21 |

Price 9.22 |

Rate of change |

|

V2401 collection |

6307 |

6303 |

-4 |

|

|

Average spot price in East China |

6260 |

6140 |

-120 |

|

|

Average spot price in South China |

6305 |

6215 |

-90 |

|

|

PVC2401 basis difference |

-47 |

-163 |

-116 |

|

|

V2405 collection |

6359 |

6363 |

4 |

|

|

V2401-2405 closed |

-52 |

-60 |

-8 |

|

|

PP2401 collection |

7876 |

7889 |

13 |

|

|

Plastic L2401 collection |

8273 |

8295 |

22 |

|

|

V--PP basis difference |

-1569 |

-1586 |

-17 |

|

|

Vmure-L basis difference of plastics |

-1966 |

-1992 |

-26 |

|

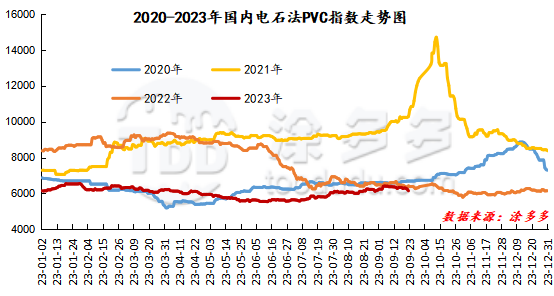

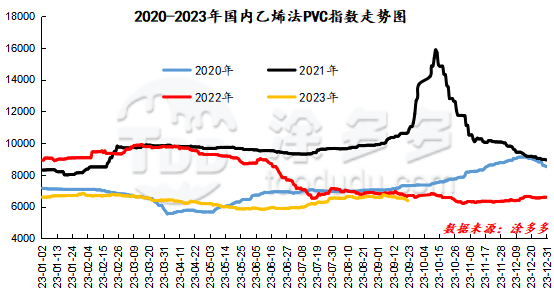

China PVC Index: according to Tudou data, the Chinese calcium carbide PVC spot index fell 94.87, or 1.521%, to 6144.18 on Sept. 22. The ethylene method PVC spot index was 6367.85, down 57.3%, or 0.892%. The calcium carbide method index fell, the ethylene method index dropped, and the ethylene-calcium carbide index spread was 223.67.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

9.21 warehouse receipts |

9.22 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

274 |

274 |

0 |

|

|

Zhenjiang Middle and far Sea |

274 |

274 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,417 |

2,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,392 |

1,392 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,329 |

1,329 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,314 |

9,209 |

-105 |

|

Polyvinyl chloride |

Hangzhou port logistics |

153 |

153 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,781 |

1,781 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,582 |

2,582 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

274 |

274 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang Jiahua |

30 |

30 |

0 |

|

PVC subtotal |

|

29,473 |

29,368 |

-105 |

|

Total |

|

29,473 |

29,368 |

-105 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.