Daily Review of Urea: Nissan's slow improvement and market conditions are running firm (September 19)

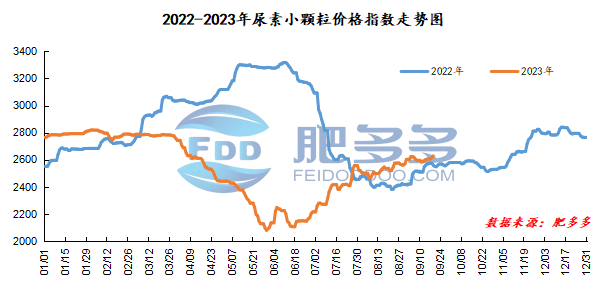

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on September 19 was 2,629.23, up 14.55 from yesterday, up 0.56% month-on-month, and up 2.71% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2280, the highest price is 2294, the lowest price is 2250, the settlement price is 2271, and the closing price is 2266. The closing price is down by 3 compared with the settlement price of the previous trading day, down 0.13% month-on-month. The daily fluctuation range is 2250-2294, and the spread is 44; The 01 contract has reduced its position by 4949 lots today, and so far, it has held 326623 lots.

Spot market analysis:

Today, China's urea market prices continued to be firm. The ex-factory quotations of some companies in mainstream regions increased slightly, and the overall price remained high.

Specifically, prices in Northeast China rose to 2,560 - 2,620 yuan/ton. Prices in North China rose to 2,480 - 2,670 yuan/ton. Prices in the northwest region rose to 2,600 - 2,610 yuan/ton. Prices in Southwest China are stable at 2,450 - 2,800 yuan/ton. Prices in East China have stabilized at 2,640 - 2,700 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,560 - 2,730 yuan/ton, and the price of large particles has stabilized at 2,620 - 2,630 yuan/ton. Prices in South China rose to 2,640 - 2,770 yuan/ton.

Market outlook forecast:

In terms of supply, Nissan continues to improve slowly, and overall supply is still tight. In terms of enterprises, there is currently sufficient volume to be shipped. Some manufacturers have begun to advance orders during the National Day holiday, and new orders are gradually being followed up. On the demand side, agriculture is currently in the final stage of autumn fertilizer production, and there is still a demand gap for downstream compound fertilizers for raw material urea; industry is slowly following up on demand, and overall demand support has weakened.

On the whole, the current market supply and demand relationship is in a relatively balanced state. Therefore, it is expected that the spot price of urea in the short term will mainly be large, stable and minor. Specific attention still needs to be paid to the impact of exports on changes in market sentiment.