PVC: Futures continue to weaken and open obviously. The quarterly market is over and there are deals at low spot prices.

PVC futures analysis: September 14 V2401 contract opening price: 6385, highest price: 6423, lowest price: 6330, position: 781882, settlement price: 6376, yesterday settlement: 6471, down: 95, daily trading volume: 1296112 lots, precipitated capital: 3.5 billion, capital inflow: 50.44 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 9.13 |

Price 9.14 |

Rise and fall |

Remarks |

|

North China |

6230-6300 |

6200-6270 |

-30/-30 |

Send to cash remittance |

|

East China |

6300-6400 |

6210-6300 |

-90/-100 |

Cash out of the warehouse |

|

South China |

6300-6490 |

6280-6400 |

-20/-90 |

Cash out of the warehouse |

|

Northeast China |

6250-6400 |

6250-6400 |

0/0 |

Send to cash remittance |

|

Central China |

6350-6400 |

6250-6400 |

-100/0 |

Send to cash remittance |

|

Southwest |

6150-6300 |

6150-6250 |

0/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices fell slightly, market sentiment has weakened. The factory price of upstream PVC production enterprises is loose, and some enterprises begin to reduce 50-100 yuan / ton, including the simultaneous reduction of prices in different places. The futures market continued to weaken obviously, the overall price of the spot market fell sharply, and each region offered a price without a market, and there were few transactions. However, after the futures price went down, the point price transaction increased. Base offers have strengthened, including East China 01 contract-(50-80-130), South China 01 contract-(50-100) good fans + 10, North 01 contract-(350-500), Southwest 01 contract-(250). The decline in futures prices led to some point price transactions, downstream low prices are mainly pending orders, but most tend to lower prices, although there are transactions but it is difficult to improve.

Futures point of view: PVC2401 contract night price volatility narrowed, but late trading has shown signs of weakness. After the start of morning trading, futures continued to weaken slightly, bottoming out at the lowest point of 6330, but not strong enough. Continue the small-scale concussion until the end in the afternoon. 2401 contracts range from 6330 to 6423 throughout the day, with a spread of 93. 01 contracts with an increase of 10060 positions and 781882 positions so far. The 2405 contract closed at 6444, with 59185 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices continued to decline, but bottomed out after the intraday low of 6330. From the current time node and mood, first of all, the rising market in the third quarter currently has a tendency to end, although it is still in a relatively high range, but the momentum to continue to rise has been insufficient, real estate can not form an effective reversal in a short period of time. On the other hand, the digestion speed of PVC spot is slow, and the entry of hedging empty order always affects the rhythm of the disk and the industrial chain. Futures prices have fallen 302 points since their peak of 6632. The technical level shows that the opening of the Bolin belt (13, 13, 2) is narrowed, and the operation of the futures price begins to enter the range between the middle and lower tracks. Continue to observe the performance in the range of 6300-6450 in the short term.

Spot: & the downward price of nbsp; futures led to some point transactions, but most of the single-point positions are generally low, while the low period of time is relatively short, that is, the rebound, so today's spot market has transactions but it is difficult to show optimism. At present, the fundamental variables of PVC are still insufficient. In mid-September, the start-up load of PVC plant is stable, but the demand continues to be weak, and the monthly performance of real estate data is poor, even in the fourth quarter, it is difficult to usher in a better presentation, so PVC, as a symbol of the real estate sector, still faces greater operating pressure in the fourth quarter in the future. In the short term, there are signs of the end of the upward market, but consider or pre-festival small stock, so for the short-term market or there will not be a deep fall, most of the small shock operation. In the outer disk, international oil prices fell as data released by the US Energy Information Administration showed that US crude oil stocks and refined oil stocks rose last week. In addition, demand concerns caused by global macroeconomic headwinds are a drag on oil prices. On the whole, the spot market of PVC is narrowly arranged in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 9.13 |

Price 9.14 |

Rate of change |

|

V2401 collection |

6385 |

6395 |

10 |

|

|

Average spot price in East China |

6350 |

6255 |

-95 |

|

|

Average spot price in South China |

6395 |

6340 |

-55 |

|

|

PVC2401 basis difference |

-35 |

-140 |

-105 |

|

|

V2405 collection |

6420 |

6444 |

24 |

|

|

V2401-2405 closed |

-35 |

-49 |

-14 |

|

|

PP2401 collection |

7966 |

7957 |

-9 |

|

|

Plastic L2401 collection |

8358 |

8349 |

-9 |

|

|

V--PP basis difference |

-1581 |

-1562 |

19 |

|

|

Vmure-L basis difference of plastics |

-1973 |

-1954 |

19 |

|

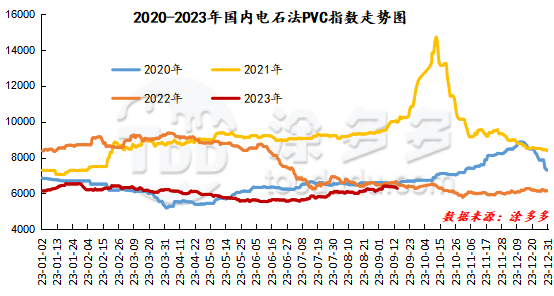

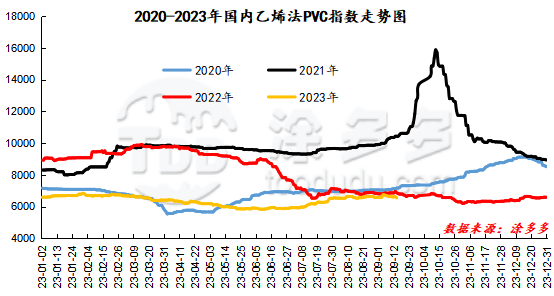

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot index fell 55.08, or 0.87%, to 6277.6 on Sept. 14. The ethylene PVC spot index was 6548.12, down 63.2%, with a range of 0.956%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 270.52.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

9.13 warehouse orders |

9.14 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

843 |

843 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

402 |

402 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

280 |

280 |

0 |

|

|

Zhenjiang Middle and far Sea |

280 |

280 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,417 |

3,417 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,392 |

1,392 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,295 |

1,329 |

34 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

9,177 |

9,592 |

415 |

|

Polyvinyl chloride |

Hangzhou port logistics |

33 |

33 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,181 |

2,181 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,582 |

2,582 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

0 |

-50 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

41 |

274 |

233 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang Jiahua |

30 |

30 |

0 |

|

PVC subtotal |

|

30,405 |

31,037 |

632 |

|

Total |

|

30,405 |

31,037 |

632 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.