China's urea exports are restricted, international prices fluctuate widely

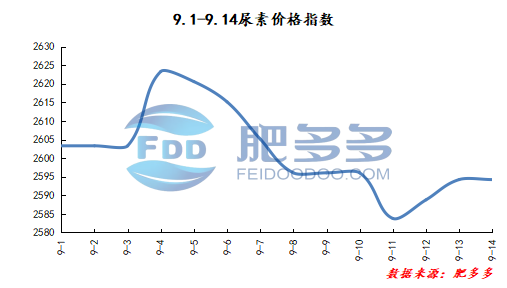

introduction: affected by international urea exports, China exports a large amount of urea abroad, resulting in a shortage of urea supply in China, and urea prices are rising all the way. In order to maintain the price stability of China's urea market and ensure the supply of China's urea market, some major urea exporters have stopped signing new urea export agreements, urea exports are restricted, and international urea prices are raised as a whole. This week, the situation of China's urea export tends to be clear, international urea prices return to rationality, and prices start to decline.

introduction: as the spot market of urea in China remains high in the off-season recently, printing exports aggravate the shortage of supply in China. Some companies issued the proposal of guarantee in autumn on August 31st and continued to issue the proposal on September 2nd, advocating that enterprises should operate rationally and avoid following the trend of speculation, so as to maintain a good price environment in the urea market and promote the healthy and sustainable development of the industry.

Market Overview: in August, India issued a new round of urea non-quantitative import bidding news, the bidding price was higher than the ex-factory price of Shandong at that time, there was export profit. As exporters continue to restock, spot prices continue to rise. Although there is a demand for fertilizer for winter wheat this month, the fear of heights in the lower reaches is becoming more and more obvious, and the purchasing enthusiasm is weakening. China's demand market begins to resist the high price, and the market actually makes a small number of transactions. In terms of policy, news from the market that the port legal inspection is restricted interferes with China's urea export. in enterprises, a number of enterprises have lowered their ex-factory quotations and issued a guarantee proposal, mentioning that they will give priority to the supply of the Chinese market and partially reduce exports.

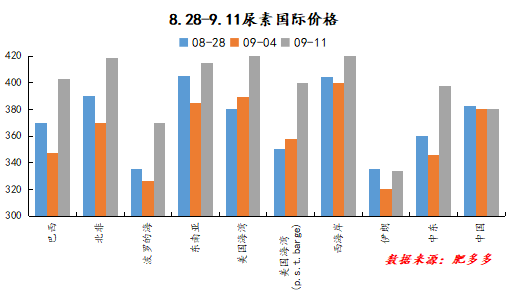

international influence: China is the world's largest exporter of urea production. Once China restricts the export of urea, it is likely to lead to a shortage of urea supply in the major importing countries, which in turn leads to fluctuations in international urea prices. As soon as the news came out on September 5th, international supply was affected, and the FOB prices of various countries changed from a previous decline to a rise this week. Among them, the highest increase in FOB prices at ports such as Brazil, North Africa, the Baltic Sea, Southeast Asia, the West Coast, Iran and the Middle East ranges from 45 to 120 US dollars per ton.

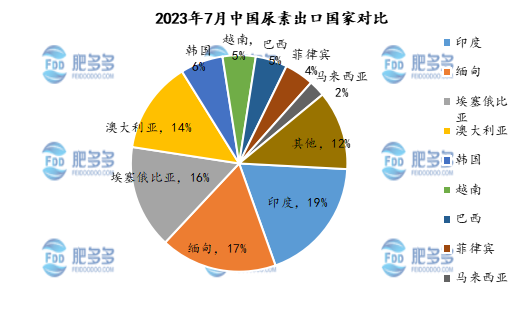

Analysis of exporting countries: once China restricts urea exports, many countries that rely on Chinese urea imports will be affected. From the proportion of urea exports in July, India, Myanmar, Ethiopia, Australia, South Korea, Vietnam, Brazil, the Philippines, Malaysia and other countries accounted for most of the exports. The implementation of export controls on urea undoubtedly has an impact on these countries. Among them, South Korea's automotive urea is highly dependent on Chinese exports, and the government attaches great importance to it. South Korea's Ministry of Finance told the media on Sept. 8 that diplomatic channels confirmed that the Chinese government had not adopted export controls on agricultural urea, Yonhap news agency reported.

Market Analysis:

enterprises, at present, some enterprises are still implementing pre-harvest, urea product orders are abundant, new orders are small.

& in terms of nbsp; supply, the inventory of urea enterprises is currently 245800 tons, which is maintained at a low level. Some enterprises have stopped for maintenance, and the utilization rate of capacity has dropped to 74.79%, and the supply of goods has been reduced. However, some enterprises have expected to put in new capacity since mid-late September, and it is expected that daily output may pick up in the later period.

& in terms of nbsp; demand, China's higher-than-expected exports and compound fertilizer enterprises focus on starting production and replenishment of raw materials, which together support the demand in the off-season period, and China's demand increases, but due to the impact of current high prices, a small number of low-cost purchases downstream, the overall procurement atmosphere is cautious.

future forecast: although the price of urea has declined, the price is still high, downstream buyers are looking for low replenishment, and the market trading atmosphere is slightly higher. In addition, if strict legal inspection becomes a reality, the export benefit of the new round of Indian bidding for China's urea market will be greatly reduced, coupled with the late commissioning of new units and the resumption of early parking units, urea production is expected to increase in the later stage, and market prices are slightly adjusted.