PVC: Futures activity has increased more and more, funds have entered the market significantly, and spot stocks have continued to be organized in a narrow range

PVC futures analysis: September 12 V2401 contract opening price: 6465, highest price: 6522, lowest price: 6438, position: 750435, settlement price: 6487, yesterday settlement: 6464, up: 23, daily trading volume: 1152276 lots, precipitated capital: 3.41 billion, capital inflow: 188 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 9.11 |

Price 9.12 |

Rise and fall |

Remarks |

|

North China |

6300-6340 |

6300-6320 |

0/-20 |

Send to cash remittance |

|

East China |

6320-6400 |

6320-6410 |

0/10 |

Cash out of the warehouse |

|

South China |

6360-6490 |

6360-6500 |

0/10 |

Cash out of the warehouse |

|

Northeast China |

6250-6400 |

6250-6400 |

0/0 |

Send to cash remittance |

|

Central China |

6360-6480 |

6360-6480 |

0/0 |

Send to cash remittance |

|

Southwest |

6150-6300 |

6150-6300 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices continue the trend of consolidation, but the transaction is limited. Compared with the valuation, the high-end price in North China fell by 20 yuan / ton, East China increased by 10 yuan / ton, South China increased by 10 yuan / ton, and Northeast, Central and Southwest regions were stable. The ex-factory prices of upstream PVC production enterprises still remain stable and wait-and-see, and very few enterprises in order to promote transaction digestion and inventory slightly reduce 50 yuan / ton, the futures price is arranged horizontally, and the spot market is quoted in the same range, the overall adjustment is not large, basically maintain the price unchanged, a small flexible offer in individual areas, the market price offer and point price offer coexist, but the two ways of transaction is not much, and some of the sources are tight. The spot price is a little higher than the offer. The terminal mainly maintains wait-and-see, and the basis adjustment is limited, including East China basis offer 01 contract-(50-80-130), South China 01 contract-(50-100) good fan + 10, North 01 contract-(350-500), Southwest 01 contract-(250). On the whole, the spot market does not change much.

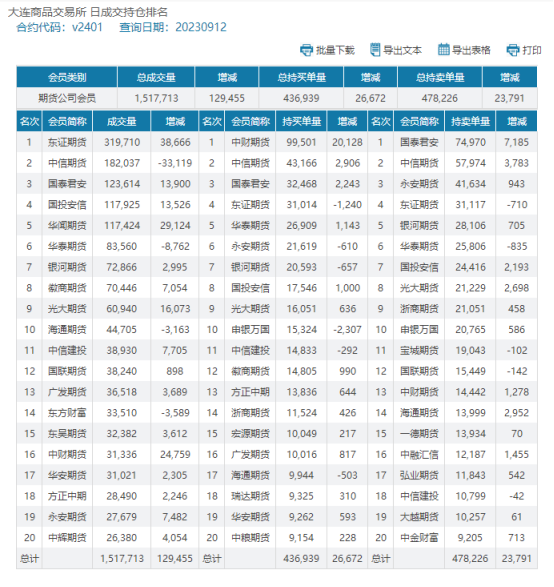

From the perspective of futures: PVC2401 contract opened low and high at night, and the futures price rose obviously from the low level, but the high price was unstable and fell. The price fluctuates mainly after the start of morning trading, and the price change in the afternoon is not obvious. 2401 contracts range from 6438 to 6522 throughout the day, with a spread of 84. 01 contracts with an increase of 37974 positions and 750435 positions so far. The 2405 contract closed at 6532, with 47974 positions.

PVC Future Forecast:

Futures: PVC2401 contract price operation is still relatively high and narrow horizontal trading, but the trading activity increased, the intraday position increased by more than 45000 hands, and some retail investors closed their positions at the end of the day. In terms of transaction, the opening of 25.8% more than the empty order is slightly better than the empty opening of more than 24.8%. Although the futures price has rebounded slightly, it is not strong enough. On the one hand, the high futures price is still suppressed, and the spot can not digest the high level of receiving goods to enter the hedging policy. On the other hand, due to the lack of stimulus from macro and fundamental policies, it is unable to form a sustained high rise, and there is a greater risk of decline over 6500, so there is a large increase in positions in a single day, but the futures price still shows a horizontal state. We still maintain the previous point of view and continue to observe the performance of the horizontal range between 6420 and 6550.

Spot aspect: futures price continuous horizontal finishing, first of all, the current low point of the futures price can not stimulate the improvement of the point price transaction, the terminal real order multi-low hanging order rigid demand procurement, on the other hand, there are many real order negotiations in the spot offer. The current stimulus at the macro level and policy level is beginning to dissipate, and factors from fundamentals do not provide more direction of volatility. Therefore, futures prices have been trading horizontally at relatively high levels since they fell from their highs, and there is a lack of adequate guidance for price fluctuations in the two cities. However, we believe that under the current time node, there are still some risk considerations in the medium and long term of the two cities. On the outer plate, Brent crude futures prices were basically flat and remained above $90 a barrel, boosted by production cuts in Saudi Arabia and Russia. Oil prices reached this level for the first time in 10 months after Saudi Arabia and Russia announced a new round of production cuts last week. Saudi Arabia and Russia announced last week that they would extend voluntary supply cuts to the end of the year, totaling 1.3 million barrels a day. Supply cuts have overshadowed continuing concerns about China's economic activity. Overall, the spot market may continue to fluctuate within a narrow range in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

Price 9.11 |

Price 9.12 |

Rate of change |

|

V2401 collection |

6462 |

6492 |

30 |

|

|

Average spot price in East China |

6375 |

6365 |

-10 |

|

|

Average spot price in South China |

6425 |

6430 |

5 |

|

|

PVC2401 basis difference |

-87 |

-127 |

-40 |

|

|

V2405 collection |

6509 |

6532 |

23 |

|

|

V2401-2405 closed |

-47 |

-40 |

7 |

|

|

PP2401 collection |

7865 |

7985 |

120 |

|

|

Plastic L2401 collection |

8354 |

8402 |

48 |

|

|

V--PP basis difference |

-1403 |

-1493 |

-90 |

|

|

Vmure-L basis difference of plastics |

-1892 |

-1910 |

-18 |

|

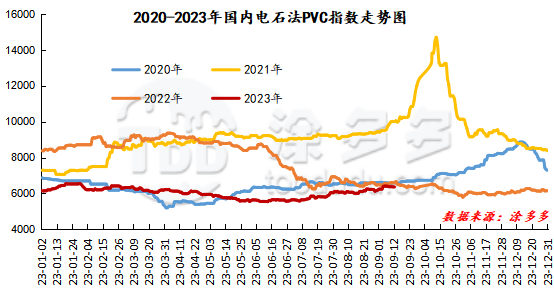

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index fell 3.96, or 0.062%, to 6359.72 on September 12. The PVC spot index of ethylene method was 6615.05, up 5.15%, with a range of 0.078%. The calcium carbide index decreased, the ethylene index increased, and the ethylene-calcium carbide index spread was 255.33.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

9.11 warehouse orders |

9.12 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

801 |

843 |

42 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

360 |

402 |

42 |

|

Polyvinyl chloride |

Cosco sea logistics |

280 |

280 |

0 |

|

|

Zhenjiang Middle and far Sea |

280 |

280 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,197 |

3,417 |

220 |

|

Polyvinyl chloride |

Peak supply chain |

1,340 |

1,340 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,205 |

1,295 |

90 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

8,672 |

9,057 |

385 |

|

Polyvinyl chloride |

Hangzhou port logistics |

33 |

33 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,591 |

2,181 |

590 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,370 |

2,582 |

212 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

230 |

230 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang Jiahua |

30 |

30 |

0 |

|

PVC subtotal |

|

28,653 |

30,192 |

1,539 |

|

Total |

|

28,653 |

30,192 |

1,539 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.