PVC: The volatility of futures is insufficient, but the open opening is slightly suppressed, and the spot market is organized within a narrow range

PVC futures analysis: September 11 V2401 contract opening price: 6444, highest price: 6502, lowest price: 6428, position: 712461, settlement price: 6464, yesterday settlement: 6477, down: 13, daily trading volume: 1030980 lots, precipitated capital: 3.223 billion, capital inflow: 81.59 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 9.8 |

Price 9.11 |

Rise and fall |

Remarks |

|

North China |

6330-6370 |

6300-6340 |

-30/-30 |

Send to cash remittance |

|

East China |

6350-6380 |

6320-6430 |

-30/50 |

Cash out of the warehouse |

|

South China |

6380-6500 |

6360-6490 |

-20/-10 |

Cash out of the warehouse |

|

Northeast China |

6200-6350 |

6250-6400 |

50/50 |

Send to cash remittance |

|

Central China |

6410-6480 |

6360-6480 |

-50/0 |

Send to cash remittance |

|

Southwest |

6200-6350 |

6150-6300 |

-50/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price is narrow, but the overall spot atmosphere is slightly general. Compared with the valuation, the low-end prices in North China fell by 30 yuan / ton, the low-end prices in East China fell by 30 yuan / ton, the high-end prices rose by 50 yuan / ton, the South China region fell by 10-20 yuan / ton, and the Northeast region rose by 50 yuan / ton. central China fell 50 yuan / ton, southwest fell 50 yuan / ton. The ex-factory prices of upstream PVC production enterprises mostly remained stable, and individual enterprises reduced 20-50 yuan / ton to promote transactions, but it happened to be the first generation of contracts in the spot market on Monday to wait and see, and no volume transactions were seen. The operation of the futures price is strong at first and then weak, the spot market price is mainly arranged in a narrow range, and the market point price and a mouthful price coexist, but there is basically room for negotiation in the transaction part of the price, and the point price supply part has the price advantage after the futures price weakens. Among them, East China base offer 01 contract-(50-80-130), South China 01 contract-(0-100) good powder + 20, North 01 contract-(350-500) Southwest 01 contract-(250). Monday trading atmosphere in the spot market is weak, even if the two quotation methods coexist, but the rigid demand downstream of the spot price is cautious and the single point is generally on the low side.

Futures point of view: & the nbsp; PVC2401 contract hit a low of 6428 at the opening of night trading on Friday and then fluctuated after a small rebound. Prices rose slightly again in early trading on Monday, but the height of the overall intraday operation was insufficient, and prices weakened after reaching a peak in the afternoon. 2401 contracts range from 6428 to 6502 throughout the day, with a spread of 74. 01. The contract increased its position by 14364 hands, and has held 712461 positions so far. The 2405 contract closed at 6509, with 48070 positions.

PVC Future Forecast:

Futures: PVC2401 contract price operation as the title said, the overall volatility is less than 74 points, but in terms of transaction, the short opening of 25.0% is slightly suppressed compared with the opening of 23.2% more. Especially after the futures price weakens again in the afternoon, the market is involved in some short orders. On the one hand, it is still inclined to consider the hedging that the supply of goods in the spot market is not digested smoothly, on the other hand, the early strong market is basically over, and there is no new stimulus. The futures price began to adjust and sort out. The narrowing of the fluctuation of the futures price also makes the closing line anxious at the technical level. The three tracks of the Bollinger belt (13, 13, 2) are vaguely flat, and the low point of the futures price is close to the position of the middle rail again. We still maintain the previous point of view. the operation of the futures price has a further weakening trend, and the performance of the support position near the middle rail 6385 is observed.

Spot aspect: On Monday, for the futures and cash markets, the factors of price stimulus are not enough. First of all, although the operation of the futures price is relatively narrow and slightly suppressed, the overall fluctuation of the futures price is relatively small, on the one hand, because of the lack of external stimulation, the policy factors of speculation in the early period of the current period disappear, on the other hand, the fundamentals of PVC are also lacking, and only some variables appear in the cost port. For example, VCM monomer Taixing Xinpu VCM rose 50% today factory 5600-5650 acceptance (weekly pricing), calcium carbide prices temporarily stable. The time stage has entered the middle of September, the commodities with strong operation in the early stage also began to weaken gradually, and the cultural commodity index also iterated over a continuous narrow period last Friday, the current operation of the two cities in the PVC period is still difficult to get out of the separate market, but it is worth noting that caustic soda futures will be traded on Friday from September 15, and there may be some opportunities for chlor-alkali balance. On the whole, the spot market may still maintain a volatile trend in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

9.8 |

Price 9.11 |

Rate of change |

|

V2401 collection |

6428 |

6462 |

34 |

|

|

Average spot price in East China |

6355 |

6375 |

20 |

|

|

Average spot price in South China |

6440 |

6425 |

-15 |

|

|

PVC2401 basis difference |

-73 |

-87 |

-14 |

|

|

V2405 collection |

6474 |

6509 |

35 |

|

|

V2401-2405 closed |

-46 |

-47 |

-1 |

|

|

PP2401 collection |

7822 |

7865 |

43 |

|

|

Plastic L2401 collection |

8317 |

8354 |

37 |

|

|

V--PP basis difference |

-1394 |

-1403 |

-9 |

|

|

Vmure-L basis difference of plastics |

-1889 |

-1892 |

-3 |

|

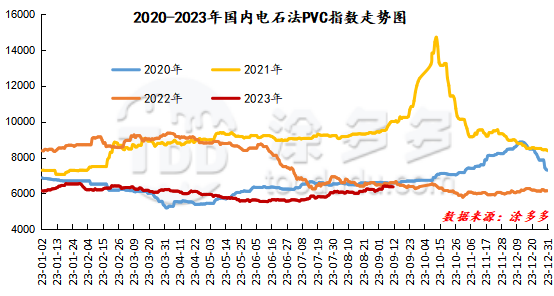

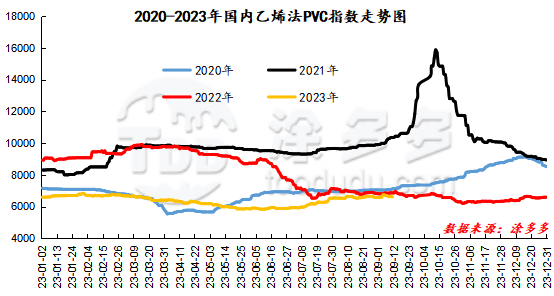

China PVC Index: according to Tudoduo data, the Chinese calcium carbide PVC spot index fell 8.02%, or 0.126%, to 6363.68 on Sept. 11. The ethylene PVC spot index was 6609.9, down 21.92, with a range of 0.331%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 246.22.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

9.8 warehouse orders |

9.11 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

801 |

801 |

0 |

|

|

Guangzhou materials |

441 |

441 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

280 |

280 |

0 |

|

|

Zhenjiang Middle and far Sea |

280 |

280 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,197 |

3,197 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,340 |

1,340 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,205 |

1,205 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

8,639 |

8,672 |

33 |

|

Polyvinyl chloride |

Hangzhou port logistics |

33 |

33 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,591 |

1,591 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,240 |

2,370 |

130 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

170 |

230 |

60 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang Jiahua |

30 |

30 |

0 |

|

PVC subtotal |

|

28,430 |

28,653 |

223 |

|

Total |

|

28,430 |

28,653 |

223 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.