Daily review of urea: Resistance to high prices is gradually rising and the market trading atmosphere is weak (September 11)

China Urea Price Index:

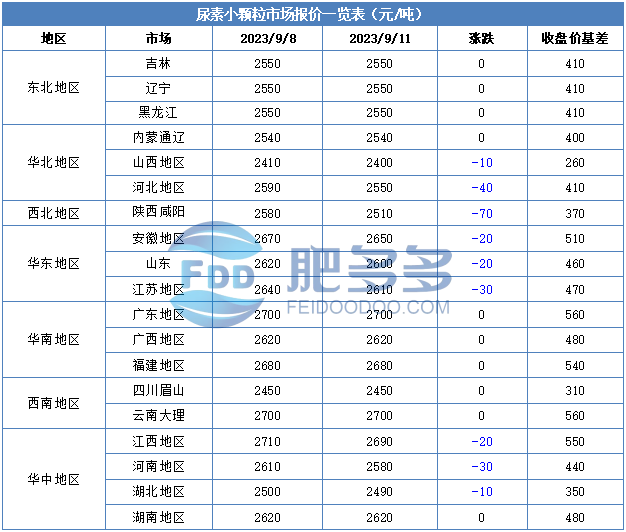

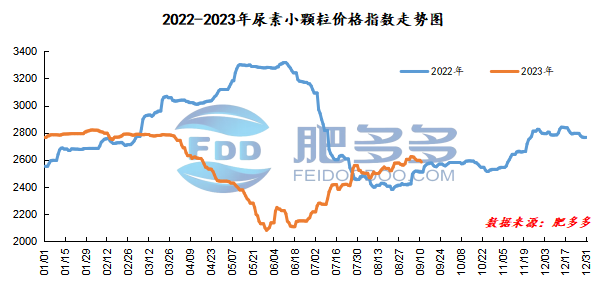

According to Feiduo data, the urea small pellet price index on September 11 was 2,583.77, down 12.27 from last Friday, down 0.47% month-on-month, and up 2.95% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR2401 contract is 2122, the highest price is 2164, the lowest price is 2116, the settlement price is 2139, and the closing price is 2140. The closing price is 35% higher than the settlement price of the previous trading day, and the month-on-month increase is 1.66%. The daily fluctuation range is 2116-2164, and the price difference is 48; the 01 contract has increased its positions by 1471 lots today, and so far, it has held 322585 lots.

Spot market analysis:

Today, China's urea market prices stabilized and fell slightly. Most companies 'quotations remained stable. Some companies slightly lowered their ex-factory quotations. Overall, a small number of new orders were sold, and the market atmosphere was weak.

Specifically, prices in Northeast China have stabilized at 2,500 - 2,560 yuan/ton. Prices in North China fell to 2,400 - 2,550 yuan/ton. Prices in Northwest China fell to 2,510 - 2,520 yuan/ton. Prices in Southwest China fell to 2,450 - 2,800 yuan/ton. Prices in East China fell to 2,590 - 2,620 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,490 - 2,700 yuan/ton, and the price of large particles fell to 2,570 - 2,610 yuan/ton. Prices in South China fell to 2,600 - 2,720 yuan/ton.

Market outlook forecast:

On the supply side, urea is still in a state of low daily production, low inventory and high basis. In addition, early production units have been restored this week, and new units are planned to be put into production. Capacity utilization will increase slightly, and daily output will increase accordingly. In terms of demand, there is still a small amount of procurement demand in the downstream market. This month, the work of preparing fertilizer for agricultural needs has begun one after another, and the mentality of downstream dealers has gradually become apparent. However, affected by the current high urea prices, the market has replenished appropriate amounts of goods on dips, which has a certain impact on the current consumption of urea in China. The amount has formed certain support, but due to the low demand, the support is relatively limited.

Overall, output may increase in the next week. In addition, prices are still at a high level and downstream wait-and-see attitude is relatively strong. Therefore, it is expected that the spot price of urea will gradually fall slightly in the short term.