PVC: Futures ended sideways and showed weakness, transactions showed open power, and the spot market weakened within a narrow range

PVC futures analysis: September 8 V2401 contract opening price: 6520, highest price: 6534, lowest price: 6424, position: 698097, settlement price: 6477, yesterday settlement: 6539, down: 62, daily trading volume: 1246399 lots, precipitated capital: 3.141 billion, capital outflow: 92.45 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 9.7 |

Price 9.8 |

Rise and fall |

Remarks |

|

North China |

6380-6420 |

6330-6370 |

-50/-50 |

Send to cash remittance |

|

East China |

6340-6440 |

6300-6410 |

-40/-30 |

Cash out of the warehouse |

|

South China |

6400-6550 |

6380-6500 |

-20/-50 |

Cash out of the warehouse |

|

Northeast China |

6200-6350 |

6200-6350 |

0/0 |

Send to cash remittance |

|

Central China |

6430-6480 |

6410-6480 |

-20/0 |

Send to cash remittance |

|

Southwest |

6200-6350 |

6200-6350 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices fell slightly, market sentiment has weakened. Compared with the valuation, it fell by 50 yuan / ton in North China, 30-40 yuan / ton in East China, 20-50 yuan / ton in South China, stable in Northeast China, 20 yuan / ton in Central China and stable in Southwest China. Most of the upstream PVC production enterprises'ex-factory prices remain stable, and when there are few contracts signed on Friday, the production enterprises are not willing to adjust the quotation, so they still maintain a high offer, while individual enterprises in the ethylene process are reduced by 50 yuan / ton. The offer mentality of traders in various regions is weak, the offer mentality of traders in various regions is weak, the price offer is relatively high and has no advantage, and there is a certain downward trend. After the futures price goes down, the supply advantage of the point price increases, and the basis is adjusted slightly. Among them, East China base offer 01 contract-(50-80-120), South China 01 contract-(0-60) good powder + 20, North 01 contract-(350-500), Southwest 01 contract-(250). On the whole, the purchasing enthusiasm of the downstream is low, and the trading atmosphere in the spot market is weak.

Futures point of view: PVC2401 contract night volatility slightly weaker, futures prices did not show another upward trend. After the start of morning trading, the futures price continued to run in a narrow range on the basis of late night trading, but it was weaker in the afternoon, and it was weak again around the low first line of shock in the afternoon. 2401 contracts range from 6424 to 6534 throughout the day, with a spread of 110. 01. The contract reduced its position by 10623 positions and has held 698097 positions so far. The 2405 contract closed at 6474, with 46625 positions.

PVC Future Forecast:

Futures: PVC2401 contract price operation did not continue to high horizontal trading above 6500 to continue to form an effective breakthrough, and even futures prices did not further stabilize the front line of 6500, coinciding with the profit settlement of some loose orders on Friday, coupled with the hedging of high prices under the weakening of commodity sentiment, and short opening forces began to appear in the market when the horizontal market did not rise. In terms of transaction, the opening of 21.7% more than the empty opening of 24.0%, the technical level shows that the three tracks of the Bollinger belt (13, 13, 2) are narrowing, the low point of the futures price begins to approach the position of the middle track, the daily-level KD line shows a dead-fork trend, and the distance between the two lines of the MACD is rapidly shortened. As a whole, the operation of the PVC main contract may show a further weakening trend in the short term, and observe the performance of the support position near the middle rail 6380.

Spot aspect: & the weakening price of nbsp; futures market affects the quotation mentality of merchants in the spot market. On the one hand, the current decline can not stimulate the activity of spot price transactions. Downstream products enterprises are still mainly wait-and-see, and do not reach the expected psychological procurement price. On the other hand, most of the new orders received by high-price traders consider hedging combined with spot prices for sales. For this market rise we also mentioned in the previous forecast, from the fundamentals of the variable support is less, relatively early active and substantial rise in categories, PVC fundamentals are relatively weak this is also the PVC period although the two markets have upward, but the scope and strength are insufficient fundamental reasons. The weakening of the two markets on Friday also dampened the bulls' confidence to some extent. International oil prices fell on the outer disk, with Brent oil prices falling below $90 a barrel as several signals hinted at weak oil demand in the coming months. In addition, market participants digested mixed data from China. On the whole, there may be some weakening risk in the PVC spot market in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

9.7 |

9.8 |

Rate of change |

|

V2401 collection |

6518 |

6428 |

-90 |

|

|

Average spot price in East China |

6390 |

6355 |

-35 |

|

|

Average spot price in South China |

6475 |

6440 |

-35 |

|

|

PVC2401 basis difference |

-128 |

-73 |

55 |

|

|

V2405 collection |

6554 |

6474 |

-80 |

|

|

V2401-2405 closed |

-36 |

-46 |

-10 |

|

|

PP2401 collection |

7894 |

7822 |

-72 |

|

|

Plastic L2401 collection |

8383 |

8317 |

-66 |

|

|

V--PP basis difference |

-1376 |

-1394 |

-18 |

|

|

Vmure-L basis difference of plastics |

-1865 |

-1889 |

-24 |

|

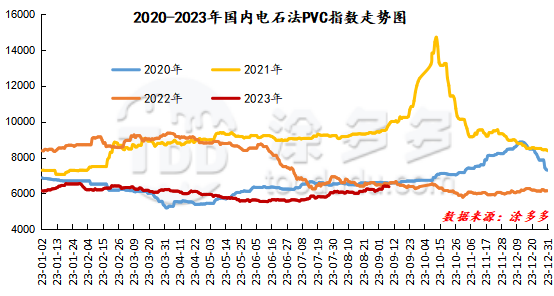

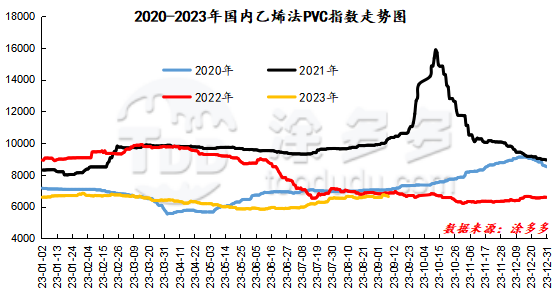

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC fell 29.74 or 0.465% to 6371.7 on Sept. 8. The ethylene PVC spot index was 6631.82, down 50, with a range of 0.748%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 260.12.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

9.7 warehouse orders |

9.8 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

501 |

801 |

300 |

|

|

Guangzhou materials |

141 |

441 |

300 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

280 |

280 |

0 |

|

|

Zhenjiang Middle and far Sea |

280 |

280 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,762 |

3,197 |

435 |

|

Polyvinyl chloride |

Peak supply chain |

940 |

1,340 |

400 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,205 |

1,205 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

7,771 |

8,639 |

868 |

|

Polyvinyl chloride |

Hangzhou port logistics |

0 |

33 |

33 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,531 |

1,591 |

60 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,240 |

2,240 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

170 |

170 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

892 |

450 |

-442 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang Jiahua |

30 |

30 |

0 |

|

PVC subtotal |

|

26,776 |

28,430 |

1,654 |

|

Total |

|

26,776 |

28,430 |

1,654 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.