PVC: Futures high and lateral pressure levels worked. There were many transactions but the futures price did not rise. The spot market range was sorted out.

PVC futures analysis: September 6th V2401 contract opening price: 6510, highest price: 6568, lowest price: 6463, position: 716178, settlement price: 6519, yesterday settlement: 6535, down: 16, daily trading volume: 1154770 lots, precipitated capital: 3.283 billion, capital inflow: 39.35 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 9.5 |

Price 9.6 |

Rise and fall |

Remarks |

|

North China |

6310-6390 |

6330-6420 |

20/30 |

Send to cash remittance |

|

East China |

6400-6470 |

6370-6440 |

-30/-30 |

Cash out of the warehouse |

|

South China |

6430-6550 |

6400-6520 |

-30/-30 |

Cash out of the warehouse |

|

Northeast China |

6200-6350 |

6200-6350 |

0/0 |

Send to cash remittance |

|

Central China |

6450-6480 |

6450-6480 |

0/0 |

Send to cash remittance |

|

Southwest |

6200-6350 |

6200-6350 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price range collation, regional merchants flexible small adjustment. Compared with the valuation, it rose 20-30 yuan / ton in North China, 30 yuan / ton in East China, 30 yuan / ton in South China, and stable in Northeast, Central China and Southwest China. Upstream PVC production enterprise factory price individual downward action, the range is concentrated in 50-100 yuan / ton, especially the previous higher quotation enterprise delivery is not smooth, reduce the factory price to promote the signing of the transaction. Futures prices still continue to run high sideways, and the price offers of traders in various regions have not changed much compared with yesterday, but relatively high prices are difficult to close, and some of them have only a small negotiation. The basis offer is slightly adjusted, and the point price supply part of some time periods has a slight advantage, including East China basis offer 01 contract-(50-80-120), South China 01 contract-(0-80) good powder + 20, North 01 contract-(450), Southwest 01 contract-(250). Overall, the trading atmosphere in the spot market today is still weak.

From the futures point of view: PVC2401 contracts opened lower and higher at night, but the upward range of futures prices was not enough. After the start of morning trading, the lowest intraday low of 6463 began to rebound slightly, and prices rose slightly again in the afternoon, but still showed slight weakness. 2401 contracts range from 6463 to 6568 throughout the day, with a spread of 105. 01 contracts with an increase of 7177 positions and 716178 positions so far. The 2405 contract closed at 6577, with 43406 positions.

PVC Future Forecast:

Futures: PVC2401 contract futures continue to adjust in a narrow range, the trend of futures prices shows a high horizontal trend for the third day in a row, and the market turnover is still dominated by relative long opening, of which 25.3% are more open than 22.4% short. Although the disk is more open and pressed, there is a trend that the price does not rise in the future. the technical level shows that the Bollinger belt (13, 13, 2) three-track opening turns, although the middle rail still opens upward, but the lower rail turns down. And the daily line-level KD line is not good, the overall technical level of the operation of futures prices or in the short term can maintain a high level to continue consolidation, but there is a weakening trend in the medium term. Therefore, if there is no additional event stimulus, it is expected that the futures price will still fluctuate around 6500 in the short term.

Spot aspect: commodity sentiment has also begun to enter a relatively stable high finishing stage, and the forced position behavior of 09 contracts of some active varieties in the early period has also come to an end, so each variety of the market lacks an overall trend guidance and starts the trend of interval operation. Although PVC runs strongly during the week, but the lag of time restricts the high point and rising range of prices in the two cities, as far as the spot market is concerned, production enterprises have recently significantly increased ex-factory prices, and sales pressure has been transferred to a generation of traders, while middlemen are currently slow in digestion and poor demand for a single unit, most tend to consider hedging with the spot, so the overall tone of PVC is laid. At present, there is no significant change in the level of supply and demand, calcium carbide enterprises start to increase supply and ease. On the whole, in the short term, the PVC spot market may still maintain a high level of consolidation, but the transaction is light.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

9.5 days |

9.6 |

Rate of change |

|

V2401 collection |

6535 |

6548 |

13 |

|

|

Average spot price in East China |

6435 |

6405 |

-30 |

|

|

Average spot price in South China |

6490 |

6460 |

-30 |

|

|

PVC2401 basis difference |

-100 |

-143 |

-43 |

|

|

V2405 collection |

6565 |

6577 |

12 |

|

|

V2401-2405 closed |

-30 |

-29 |

1 |

|

|

PP2401 collection |

7871 |

7962 |

91 |

|

|

Plastic L2401 collection |

8401 |

8459 |

58 |

|

|

V--PP basis difference |

-1336 |

-1414 |

-78 |

|

|

Vmure-L basis difference of plastics |

-1866 |

-1911 |

-45 |

|

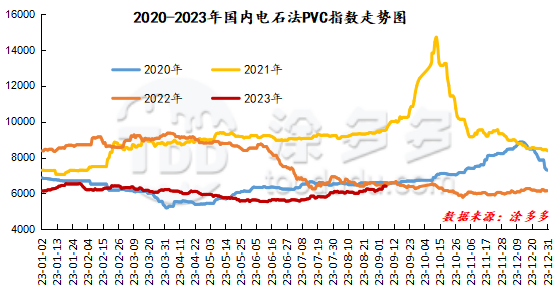

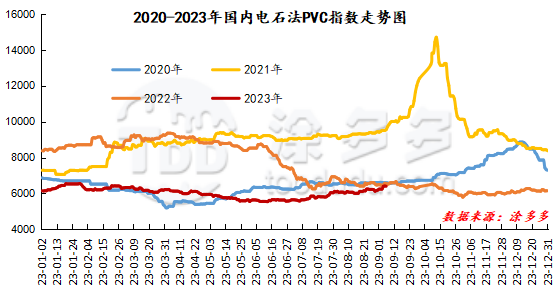

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC fell 10.39 or 0.162% to 6398.67 on Sept. 6. The ethylene method PVC spot index was 6690.74, down 45.07, or 0.669%. The calcium carbide method index decreased, the ethylene method index dropped, and the ethylene-calcium carbide index spread was 292.07.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

9.5 warehouse orders |

9.6 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

501 |

501 |

0 |

|

|

Guangzhou materials |

141 |

141 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

287 |

287 |

0 |

|

|

Zhenjiang Middle and far Sea |

287 |

287 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,762 |

2,762 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,205 |

1,205 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

7,297 |

7,297 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,531 |

1,531 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,240 |

2,240 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

170 |

170 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang Jiahua |

0 |

30 |

30 |

|

PVC subtotal |

|

26,047 |

26,077 |

30 |

|

Total |

|

26,047 |

26,077 |

30 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.